There are about 25 ATM terminals within Badore, Langbasa and Addo, three major roads of less than 5km located within the Ajah community in Eti Osa local government area in Lagos state, which is more ATMs than over 20 local governments in Kano state have. The three roads also account for more bank presence (nine bank branches) than the entire stretch from Abraham Adesanya, Ibeju Lekki, Lekki Free Trade Zone, to Epe, a distance covering 135.9km.

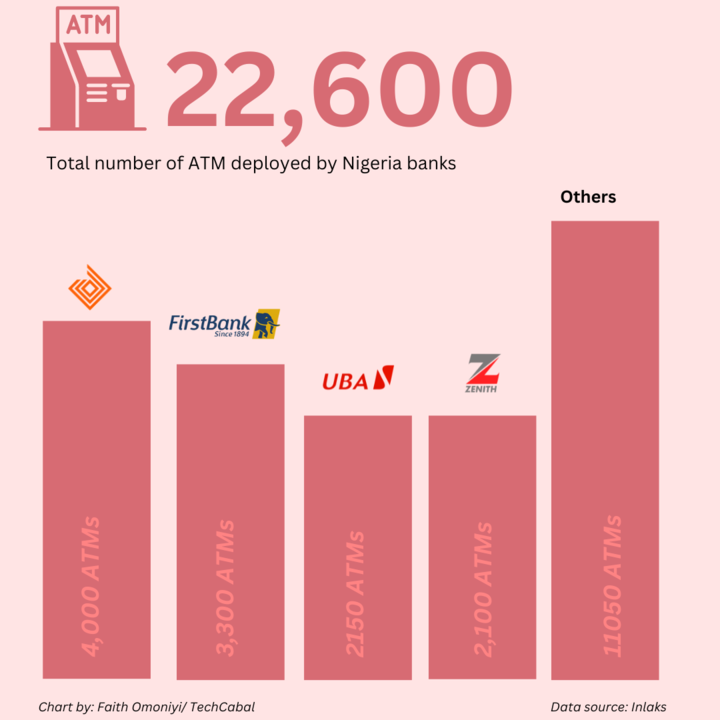

Five days out of seven a week, most of the over 25 ATM locations are empty because the machines are out of service, out of network, or out of cash. It is the same experience many bank customers face with about 22,600 ATM locations, as Inlaks data show, spread across the country.

Nigeria requires about 60,000 ATMs to meet up with its growing population of 216 million people and a banking population of 106 million adults, according to Tope Dare, executive director of Inlaks, the largest ATM operator in the country, which controls over 50% of the market.

In 2010, Nigeria had roughly about 7,100 ATMs and the number grew to over 11,000 in 2011 because the CBN mandated the removal of the offsite deployment by banks. This meant that banks would no longer invest in ATMs outside their branches. The CBN seeded the deployment to independent ATM deployers which couldn’t run the project due to the cost. The ban was eventually lifted, allowing banks to invest more in ATMs. The number of ATMs then grew from 11,000 in 2011 to 16,000 around 2016 and 21,000 in 2019. It grew to 22,600 in 2021, where it has remained as of December 2023, an indication that investment in the market has reduced.

Seventy-six per cent of the total ATMs in Nigeria are deployed by eight banks. Access Bank has over 4,000 ATMs, First Bank has about 3,300, UBA has 2,150 ATMs, Zenith has 2,100 ATMs, GTBank has 1800 ATMs, FCMB has 1,350, Polaris has 1300, and Union has 1,200. A total of 17,200 are owned by these eight banks.

Consequently, there needs to be more ATMs in Nigeria to serve the needs of the banking population, and this has always been the case with Nigerian banking services.

The estimated branch count of the 24 commercial banks is about 4,500, which is not enough for an estimated 106 million banking population reported by EFInA. The BVN accounts are currently at 60.1 million and active bank account holders are about 135 million. The annual growth rate of ATMs in Nigeria is about 3%-4%, but this has dropped to below %1 in the past two years, as the Inlaks data show.

Nigeria’s ATM per capita (number of ATMs per 100,000 adults) has also dropped from 16.92 ATMs in 2018 to about 16.15 in 2021. The global standard should be 1,000 ATMs per 100,000 bankable adults. Hence, Nigeria should have about 60,000 ATMs when it is measured against the unique bank customers at 60.1 million. Given the 22,600 active ATMs, there is a deficit of about 37,400 ATMs. As the number of bankable adults keeps increasing and more cards are issued, it is expected that ATMs will decrease in number over time, since the banks are not deploying more ATMs.

Growth factors for ATMs

In the past, some of the factors that have contributed to the growth of ATM deployment in the country include banks’ profitability. When banks are profitable, they undertake branch expansion and capital expenditure. Banks also deploy more ATMs when their customer base is growing because this means that more cards will be issued, and there will be a need to provide cash and additional ATMs for the customers. Banks that undertake digitalisation initiatives often need to deploy more ATMs. Financial inclusion initiatives also impact the growth of ATMs positively. Banks will also deploy ATMs in areas with improved power generation, this is because the cost of electricity is a major burden for ATM deployment.

Why investors are looking away from ATMs

Dare says the ATM business in Nigeria is facing its most difficult times due to the high cost of maintenance, growing adoption of other banking channels, foreign exchange crisis, galloping inflation, insecurity, and uncertainty in the ATM policy environment, all of which are driving investors far away from the market.

In 2016, the exchange rate for the dollar was ₦250. It rose to ₦325 in 2017 and stabilised between ₦330 and ₦360 by 2019. Dare says buying at a rate of ₦380 in 2020 and ₦455 before the Muhammadu Buhari administration left office, impacted the unit cost of ATMs significantly. However, it went from bad to worse when the new government under Bola Ahmed Tinubu dramatically announced the unification of the FX rate, which pushed the official rate to ₦750. The black market price for the dollar is currently above ₦1,500.

“A machine that we were selling at ‘x’ million naira this time last year, by today we are selling at 3.5x today. This is affecting the hire purchasing cost due to FX. The FX is also dependent on the customs duty and the OPEX. The cost of maintaining ATMs has gone up due to inflation, the cost of transportation, and the cost of spare parts because you have to import spare parts from abroad,” Dare said.

ATMs are also seeing fewer investments because most investors are paying more attention to other growing electronic channels such as PoS terminals, mobile app transfers, USSD, and other alternative channels consumers use to make payments faster and more convenient.

“The rapid adoption of digital payment methods is influencing consumer behaviour, leading to a shift away from traditional ATMs in favour of more convenient digital alternatives,” said Olaoluwa Awoojodu, CEO of E-Settlement Limited.

The non-profitability of ATMs is also a big factor for investors. The interchange fee also known as the surcharge fee, is one of the lowest in the world. Today, when a customer visits an ATM he/she is charged N35 after the third transaction. The fee is fixed by the CBN; hence banks cannot change it without approval from the regulator. For investors, fixing the fee does not make sense given that the unit cost for processing ATM notes in Nigeria is one of the highest in the world. Today, it takes a minimum of 150 notes to process the equivalent of $100, said a bank CEO who wanted to remain anonymous.

According to Dare, to revive the ATM business, the government should consider offering a tax concession. Presently the customs duty on ATMs is over 25%, whereas the duty on solar products is 5%. ATM policymakers also need to de-emphasise cash availability in ATMs and champion the upgrade of the machines to provide cardless payment innovations such as Near Field Communication (NFC). NFC is a short-range wireless communication technology that allows devices to exchange data without a physical connection. Users can initiate a transaction by tapping their NFC-enabled smartphones in front of the contactless reader on the ATM. This connection facilitates secure data transfer between the user’s mobile banking app and the ATM, eliminating the need for a physical card.

“You can also have a convergence of your mobile to the ATM where you can initiate a transaction in your phone, and you can go to the ATM to consummate it. ATMs should go beyond the regular functions of cash dispensing to more advanced and innovative solutions and contactless payment at minimal costs. ATMs will not die in any country as long as cash is king,” said Dare.