TGIF ☀️

Later today, we’ll be having a conversation on embedded insurance in lending on TechCabal Live.

Join Turaco CEO Ted Pantone as we explore innovative solutions using case studies from One Acre Fund and Turaco, and barriers to the financial inclusion gap.

Nigeria is blocking access to crypto exchanges

It’s no news that the Naira has been steadily declining, recently trading at ₦1,600 to the dollar on Wednesday. However, what is rather surprising is the unorthodox effort the Nigerian government has been betting on to salvage the currency.

In 2015, Nigeria’s government cut down trees on the streets of Abuja to prevent the activities of black market BDC traders. In 2021, the Godwin Emefiele-led central bank shut down AbokiFX, a website providing currency exchange rates, accusing the platform of engaging in “illegal activities.”

And now, the government is trying out even more brow-raising methods to rein in its currency devaluation.

The news: Yesterday, the Nigerian Communications Commission (NCC) started restricting users’ access to the websites of cryptocurrency exchanges, including Binance, Kraken, and Coinbase, in the country. The move is seen as part of a broader effort to curb currency speculation as the price quoted on these exchanges often set the unofficial tone for foreign local currency exchange.

The move serves as the government’s latest attempt at applying a band-aid to its ailing currency. In recent times it has changed the method for setting its rate in the official foreign exchange market and loosened rules for Nigerians sending money from abroad to provide fixes to the naira.

A running trend: While the Nigerian government’s recent move to restrict access to crypto exchange websites seems drastic, it’s not the first time it has grappled with regulating this digital asset. In February 2021, the Central Bank of Nigeria (CBN) issued a circular prohibiting banks and financial institutions from facilitating crypto transactions, effectively banning Nigerians from using traditional channels to buy or sell cryptocurrencies. It recently lifted the restriction in December 2023.

However, this new restriction is different. It targets the websites of major international exchanges directly, aiming to curb speculation and prevent the unofficial exchange rates set on these platforms from influencing the Naira’s value. This broader approach signifies a shift in strategy compared to the previous ban, which primarily focused on traditional financial institutions and left peer-to-peer (P2P) trading largely unaffected.

The effectiveness and long-term implications of this new ban remain to be seen. Crypto has been making a comeback globally with bitcoin reaching $51,000 for the first time in two years; and on the continent withcrypto startups making a comeback. In Nigeria, crypto startups were already applying for licences from the capital markets regulator, indicating a strong interest in legitimising the industry and navigating the evolving regulatory landscape.

Access payments with Moniepoint

You don’t have to take our word for it. Give it a shot like he did Click here to experience fast and reliable personal banking with Moniepoint.

How Nigerian startups are navigating cloud costs

Cloud cost and overhead expenses are typically the biggest ticket price items for startups. “The biggest fight to come i Africa is getting access to all of that data at scale through low cost/free cloud services,” tweeted venture capitalist Victor Asemota way back in 2018.

It’s been six years since that tweet and nothing is closer to the truth.

In Twiga 2023, Kenyan e-commerce startup, Incentro sought help to pay its cloud service bill after Incentro, a Google partner, sued the company over a $2 million cloud service contract. Per the contract terms, Twiga could be paying as much as $84,000 per month for cloud services.

But for Nigerian startups who earn in Naira, the naira devaluation and FX volatility spells an even bigger price to pay. A $1,000 cloud service—the equivalent of ₦458,000 in early 2023—now costs ₦1.52 million, a 107% increase. Sources told us that startups can spend anywhere from $2,000 to $80,000 monthly in cloud computing costs.

How are Nigerian startups navigating these high-up-in-the-clouds bills?

Secure payment gateway for your business

Fincra’s payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through bank transfers, cards, virtual accounts and mobile money. Create a free account and start collecting NGN payments with Fincra.

SA regulators clampdown on spam calls

South Africans, get ready to silence those pesky “once-in-a-lifetime investment” calls!

The news: Yesterday, the Information regulator (IR) said it will begin cracking down on entities bombarding you with unwanted marketing calls.

According to Truecaller, a platform that flags potential spam calls, South Africans receive an average of 10 unwanted calls per month. The IR says enough is enough and will be dishing out fines of up to R10 million ($~522,000) or even jail time for offenders. No matter who’s dialing, the new rule applies to all public and private entities in South Africa.

Late to the party: This crackdown is a long-awaited victory for South Africans yearning for phone conversations that don’t involve dubious investment opportunities or free cruises to Atlantis. However, the crackdown is not a first on the continent.

In 2016, the Nigerian Communications Commission (NCC) issued a directive to MNOs to implement a “Do Not Disturb” (DND) code for SMS messages. Additionally, the NCC penalized MNOs for violating regulations regarding unsolicited marketing calls.

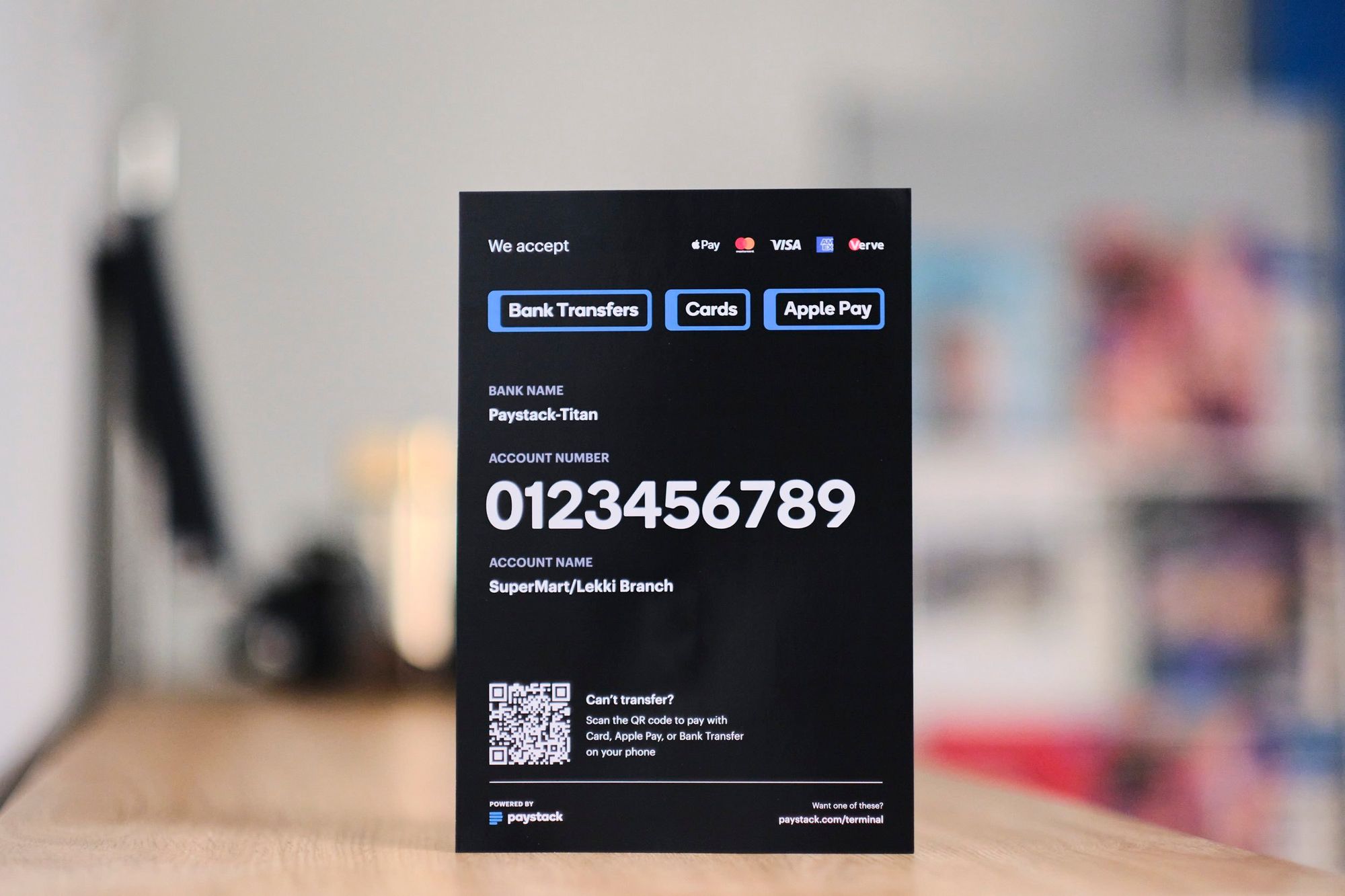

Accept fast in-person payments, at scale

Delight your customers by allowing frontline staff and sales agents confirm bank transfers, instantly. Learn more →

Funding tracker

This week, Hohm Energy, a South African climate startup, raised $8 million in seed funding. E3 Capital and 4DX Ventures led the round with participation from Breega, E4E Africa, TO.org, Tekton Ventures, Sunu Capital, Musha Ventures, and Climate Capital Ventures.

Here are other deals for the week:

- d.light, a Nigerian-based solar-powered solutions provider, secured $7.4 million in securitized financing from Chapel Hill Denham’s Nigeria Infrastructure Debt Fund, which was structured and sponsored by African Frontier Capital.

- Arnergy, a Nigerian clean tech startup, raised $3 million in funding from All On, an off-grid energy impact investment company

- Mamamoni, a Nigerian fintech social enterprise, received $270,000 in funding from the Challenge For Youth Employment (CFYE).

Before you go, our much anticipated State Of Tech In Africa Report for Q4 2023 is now out. Click this link to download it.

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $51,467 |

– 0.82% |

+ 28.72% |

|

| $2,956 |

+ 0.52% |

+ 26.10% |

|

|

$7.14 |

+ 1.92% |

+ 54.00% |

|

| $8.17 |

+ 10.40% |

+ 268.10% |

* Data as of 06:30 AM WAT, Febraury 23, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- Big Cabal Media – Social Media Intern, Senior Events Associate – Lagos, Nigeria

- Adeo – Marketing Personnel – Ghana (Remote)

- Flutterwave – Frontend Engineer – Nigeria

- Credpal – Mobile App Developer – Lagos, Nigeria

- Vodacom – Executive Head: Cybersecurity – South Africa (On-site)

- MRI Software – Data Analyst – South Africa (Hybrid)

- Fairmoney – Lead Product Designer – Lagos, Nigeria

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

What else is happening in tech?

- South Africa eyes Nomad goldrush, targets wealthy remote workers in new draft regulations

- Inside the Board fight over Michael Moritz at Klarna

- BuzzFeed sells Complex for $108 million, announces job cuts

- Avatar: The Last Airbender is everything that’s disappointing about Netflix’s live-action cartoon shows

Written by: Stephen Agwaibor & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.