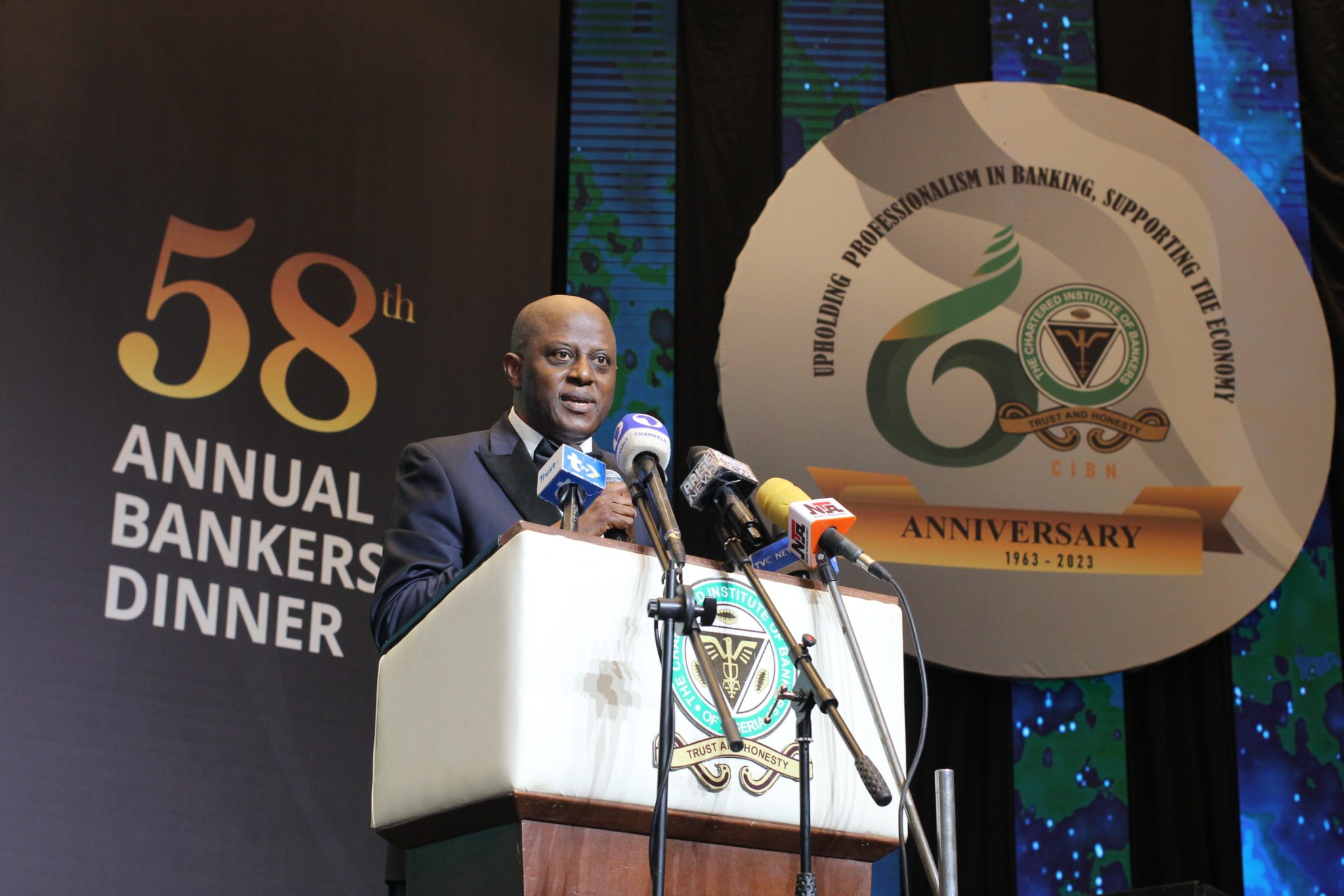

The Central Bank of Nigeria (CBN) has consecutively raised the benchmark lending rate by 200 basis points to 24.75%, from 22.75%, in another aggressive push to contain inflation. Olayemi Cardoso, the CBN governor, announced this today after the bank’s Monetary Policy Committee (MPC) meeting that began on Monday, March 25, making it the tenth consecutive hike since May 2022.

The rate hike was expected as the body language in the last meeting signalled a reluctance to reduce borrowing costs until inflation moderates below 30%. Authorities have devalued the naira twice since June and closed the gap with the unofficial market rate, as part of reforms to attract investors. Last week, the bank claimed to have cleared a backlog of unmet foreign exchange obligations.

[ad]

At least four policy experts who spoke to TechCabal expected a 100 basis point hike today. Cardoso hopes that consecutive rate hikes will address Nigeria’s inflation issues at nearly a three-decade high. However, analysts are unsure whether more hikes are needed.

Explaining the motive for the hawkish stance, Cardoso said MPC members needed to control inflation to ensure that ordinary Nigerians’ purchasing power is restored in the short to medium term.

“Members noted the continued rise in headline inflation was driven largely by food prices because of supply shortages and high cost of logistics distribution,” Cardoso said. According to him, addressing food insecurity is key to containing current inflationary pressures.

Experts told TechCabal that the CBN should hold the rates in the coming months, instead of further tightening interest rates. “The full effect of the last MPC meeting is yet to be felt on the economy. The practice is not to meet monthly, but once every two months. They need to weigh and measure,” said Johnson Chukwu, the CEO of Cowry Asset Management.

The CBN must find a balance amid the massive expectations ahead of the meeting. The bank has to be wary of the impact of too-high interest rates on the economy and the sustainability of the banking sector, Samuel Oyekanmi, another financial analyst warned.

[ad]

Cardoso said it was a tough decision to make but there was a consensus by the committee to progress with the tightening circle. “Key drivers of inflation remain the strong exchange rate pass through to domestic prices, rising costs of transportation, high costs of energy and other production inputs, lingering insecurity and legacy infrastructure deficit,” he added.

President Bola Tinubu’s reforms, while painful for consumers, have led the currency to gain in recent days and improved investment flows. Foreign inflows rose to $2.3 billion in February, driven by renewed interest from foreign investors and a rise in overseas remittances. This figure in the first quarter of 2024 outperformed the $3.9 billion received for 2023. While foreign-investor portfolio trade on the Nigerian bourse increased by 18% in February 2024 from roughly half of that figure at the beginning of the year.