Platnova is a fintech platform that facilitates payments to any continent in the world. The fintech’s goal is to become the only money app customers ever need and it is doing this by providing multi-currency accounts to customers and facilitating local and global money payments in one app. From international tuition payments to international money transfers, savings, and more, Platnova has something for everyone.

Platnova has something for everyone

With Platnova you can;

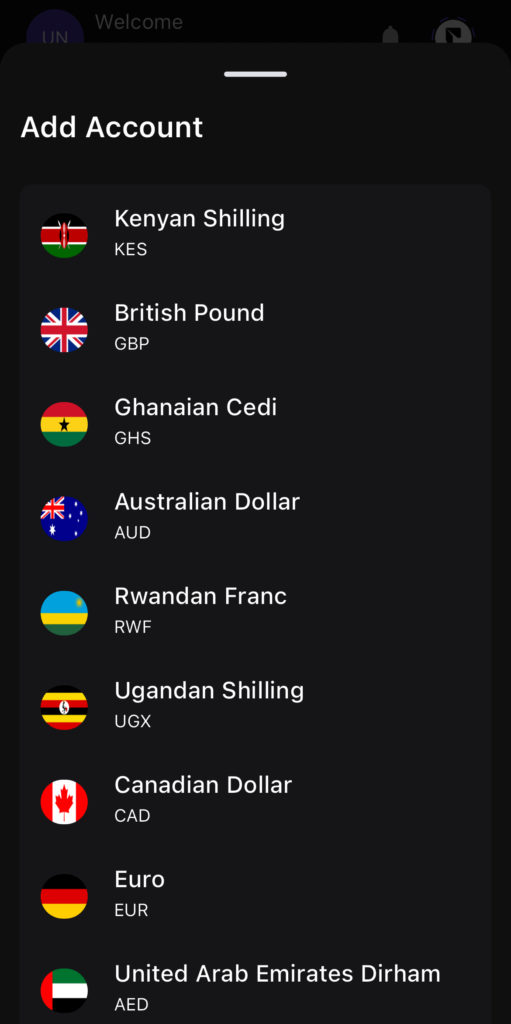

- Own multi-currency wallets with instant currency conversion: When you register, you automatically get a local bank account number. To get another wallet in a different currency, all you need to do is click the flag that shows up on the local account in your profile and a list of foreign accounts will pop out. You can then choose the currency wallet you want to add.

International money transfers through Platnova are instant. To receive international transfers, directly in your account, the sender has to open a Platnova account too. All the money recipient needs to do is send their Nova tag to the sender and then the sender can credit the recipient’s account using the Nova tag to find them. For this review, we made a transfer from a Platnova account in China to a Platnova account in Nigeria and got credited in a dollar wallet in less than a minute (This process cost $25).

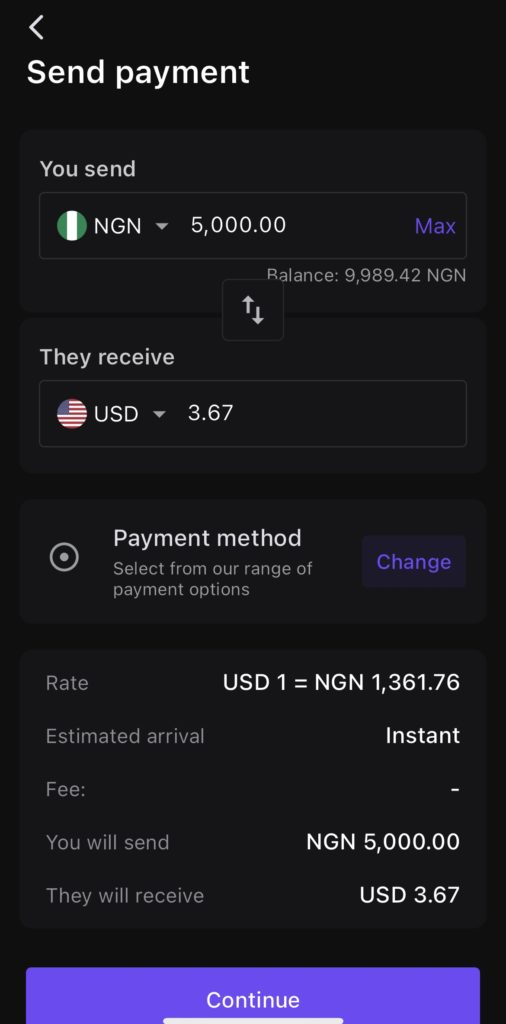

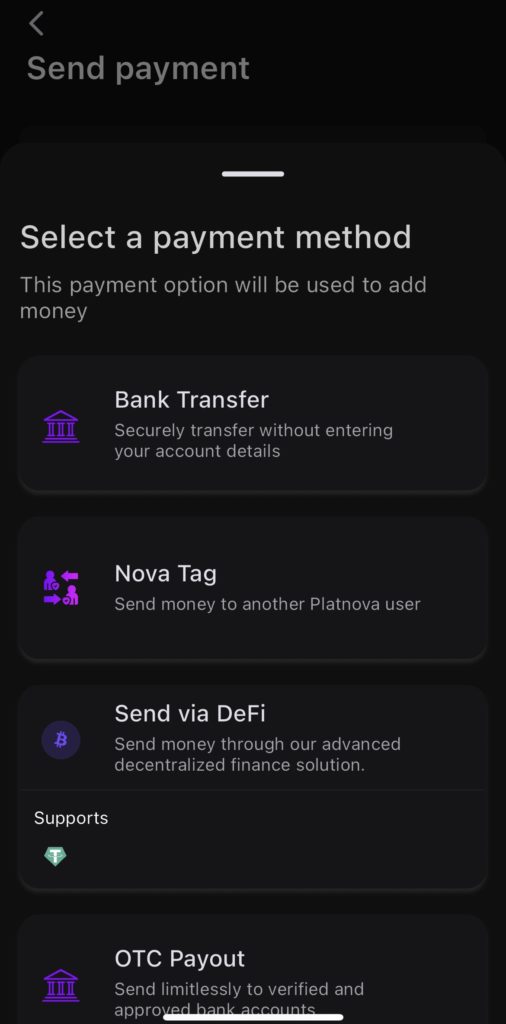

To send money locally and internationally, just click “send” on the wallet you want to transfer from. A conversion page will pop up and you can decide to send naira and the recipient will get it in dollars or any other currency directly into their bank account, Nova wallet, or crypto wallet instantly.

|  |

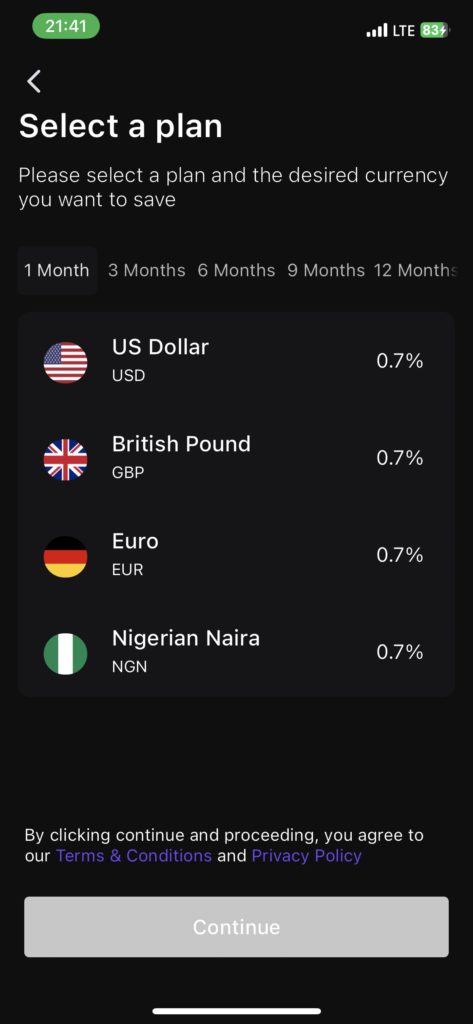

- Save in multiple currencies: on the app there’s a vault to help you save in multiple currencies from 1 month to a year (12 months). This vault allows users to easily save in US Dollars, Euros, Pounds, or Naira and earn up to 11.5% in interest.

Users can also convert the money in their wallets to another currency to save and hedge against inflation. For example, if a user has money in their Nigerian wallet, they can choose to save in a US Dollar vault by simply selecting a dollar wallet as the “Saving currency”. The app will calculate the interest you’ll get so you can see how much you’re getting in interest upfront.

- Make tuition fee payments: Without needing to travel or ask for assistance from an agent, you can make school payments directly to institutions very quickly and seamlessly. The process of finding one’s institution takes 5 seconds. From Cardiff University in the UK to the University of Alberta in Canada, or the University of Port Harcourt in Nigeria, you’ll find them all listed and you can pay tuition, feeding, registration, accommodation fees, and more with a simple transfer. To use this feature, users simply need an invoice with the school’s bank information and to input the payment instructions (What the payment is for and who is making it; student, guardian, parent, etc.)

This feature is great for people with wards schooling either locally or abroad. This feature cuts out middlemen and makes it easy to pay for school from the comfort of your home in any country.

Other features on the Platnova app include;

- Global gift card payments: Purchase gift cards for Apple, Amazon, Asos, eBay, Netflix and more in multiple currencies

- Bill payment: Buy airtime, electricity tokens, pay cable subscriptions, and more.

- Buy, sell, and exchange crypto

- Get a Platnova debit card (Verve) delivered to your doorstep.

How it works

To use Platnova download the mobile app from Google Play store or the IOS App Store.

Step 1: Register. Users need an email to receive an OTP from the platform so they can register. Input your email details, receive the OTP, input that, and get started.

Step 2: Set a password, pick your country of residence, and input your mobile number and address.

Step 3: Verify your identity. To enjoy the wide range of payment options Platnova has, users need to verify their identity. You need either a National ID number (card, slip, or virtual NIN), Voter’s ID, Driver’s licence, or international passport. For security purposes you’ll need picture evidence of your ID and also perform a liveness check (This is basically taking multi-angle selfies in a well-lit environment.)

After step 3, you now have an account to start making and receiving payments.

[ad]

With Platnova, no matter what country you’re in or where you go, all you need is one app and you can instantly start receiving and making payments. If you’d like to use Platnova, here are some quick pros and cons.

Pros:

Reliability: These features work. Most international money transfer platforms restrict African countries like Nigeria but Platnova makes it very easy to make and receive payments from anywhere. We tested some of these features and spoke to one of the co-founders about how Platnova operates.

Excellent customer service: The platform has 24/7 customer support with a response time of less than a minute.

Top-notch security: According to the company, they meet all the regulatory measures in the countries they operate.

Also, the app requires a PIN and face unlock/password to operate. Every time your phone screen goes off, the app locks you out and every time you switch to another app on your phone it also locks you out, even if the Platnova app is still running in the background. Other apps give you a few minutes after you switch to other apps before they ask for a password again but Platnova makes it impossible for someone using your phone to get access to your account. Turning on face unlock with this feature makes the app easier to use.

Cons:

Saving vault limits: The minimum you can save in your vault is ₦100,000 or $100.

Transfer restrictions: Some transfers only work from Platnova account to Platnova account. The dollar account you get in Nigeria has no account number attached so users can only receive money in that wallet from another Platnova account holder. Hopefully, this will change in the future.

To find out more about Platnova go here.