Happy pre-Friday ☀️

Yesterday, WhatsApp was unavailable for two hours in a downtime that should have come to Slack…or Google Meet…or Microsoft Teams, if your company is into that kind of freaky stuff.

The downtime affected all Meta products were affected by the glitch, but the company is yet to reveal what is up.

This is the first major WhatsApp outage since 2022, but is Meta’s second largest outage in five weeks after another glitch, on March 5, took down Facebook, Threads, and Instagram but left WhatsApp untouched.

Nigeria increases electricity tariff prices

Nigeria is bringing putting more passion in its energy sector.

The country has a long history of poor electricity supply. This lack of power supply has affected the nation’s economy and small businesses alike, with most SMEs resorting to alternatives like gasoline-generating sets and solar generators to power their daily activities. Yet, the Nigerian government spends a huge amount of money—about ₦2.8 trillion ($2.1 billion) from 2015–2022—on subsidising electricity prices for its people, eating into allocations for building roads, and healthcare among others.

A recharged thinking: The government is now having a rethink and has removed subsidies for 15% of the population who consume 40% of the nation’s electricity. Only users on Band A—those who receive up to 20 hours of electricity per day—will be affected. At this stage, it is unknown if there are any planned upticks for the other bands.

This change also comes as the country battles its ailing national grid which has already collapsed twice this year, and plunged the nation into darkness. In 2023, the grid collapsed over 13 times, and the only solution is to invest more in the sector.

What that means is that it will now cost almost three times as much to get electricity as the new electricity tariff has been raised from about ₦66 ($0.050) To ₦225 ($0.17) kilowatt per hour. This also represents a significant shift for small businesses on this band as they may have to raise prices to cope with the new change.

A win for DisCos: While Nigerians may face the brunt of the new tariff hike, electricity distribution companies are in for a win. Since the Nigerian government broke its power firm into eleven distribution companies and six generations firms, these power companies have been hurting from losses incurred during their operations. The new move by the government to raise power tariffs has been long expected by the electricity distribution companies as they have clamoured in recent times for a need to increase their fees to help bolster their balance sheet.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Binance wants Nigeria to release the detained executive

The tussle between the Nigerian government and Binance is still on.

Five weeks after Nigeria detained Tigran Gambaryan, a former US Agent and executive of Binance, the crypto behemoth has asked the Nigerian government for his release.

ICYMI: Gambaryan was detained alongside Nadeem Anjarwalla, Binance’s Kenya-based regional manager for Africa. Both executives had flown into the country to resolve the company’s restricted website access. Anjarwalla fled the country with a smuggled passport, according to the office of Nigeria’s national security adviser (NSA).

In a new statement released yesterday, Binance said Gambaryan, a former US Agent, “has no decision-making power in the company and should not be held responsible while discussions are ongoing between Binance and the Nigerian government”.

Human rights violations? Last week, both executives filed a human rights violation suit in Nigeria’s Federal High Court, asking the office of the NSA and Nigeria’s anti-graft agency, the Economic and Financial Crimes Commission (EFCC) to release them, return their passports, and issue a public apology.

Binance claims that Gambaryan—who leads Binance’s Financial Crime Compliance (FCC) team and was hired in 2021 to help fix the crypto giant’s complaint issue—has worked with Nigerian law enforcement in the past, providing information that helped tackle fraud and money laundering activities up to the tune of $400,000. The company said Gambaryan’s team facilitated multiple training sessions for Nigerian law enforcement on the role of exchanges in the digital asset ecosystem.

As Gambaryan approaches his sixth week in detention, it remains to be seen how the scuffle between Binance and the Nigerian government unfolds.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

LemFi gets approval to operate in Kenya

In the past two years, startups in Kenya have faced the heat as the country’s apex bank shut them down left, right, and centre for lack of regulatory approval.

Flutterwave and Chipper Cash, for example, went through a rough patch after the Central Bank of Kenya (CBK) directed all banks to stop dealing with the company for being unlicensed. Other digital lenders also faced the same problem. In defence, the startups argued that the apex bank’s licensing procedures were sluggish, with some processes extending beyond three years.

It seems LemFi might have broken the spell, as the startup, yesterday, announced that it had received regulatory approval from the Central Bank of Kenya less than a year after entering the Kenyan market.

In June 2023, the fintech entered the Kenyan market via a partnership with PesaSwap that allowed users send Kenyan shillings to other currencies. The fintech, at the time, also noted that Kenyans using its services would not have to pay any transfer fees.

Now, with the announcement of its regulatory approval, the startup says it will work with another Kenyan startup, Wapi Pay, to reach its goal of providing “seamless remittance services to 500,000 Kenyans in the diaspora.”

A Ghanaian re-entry: The news also comes two months after the fintech resumed activities in Ghana following a three-month suspension of its activities in the country. In November, the Central Bank of Ghana named LemFi as one of the startups operating without regulatory approval in the country. The fintech promptly engaged the Ghanaian government and restored it FX services in the country.

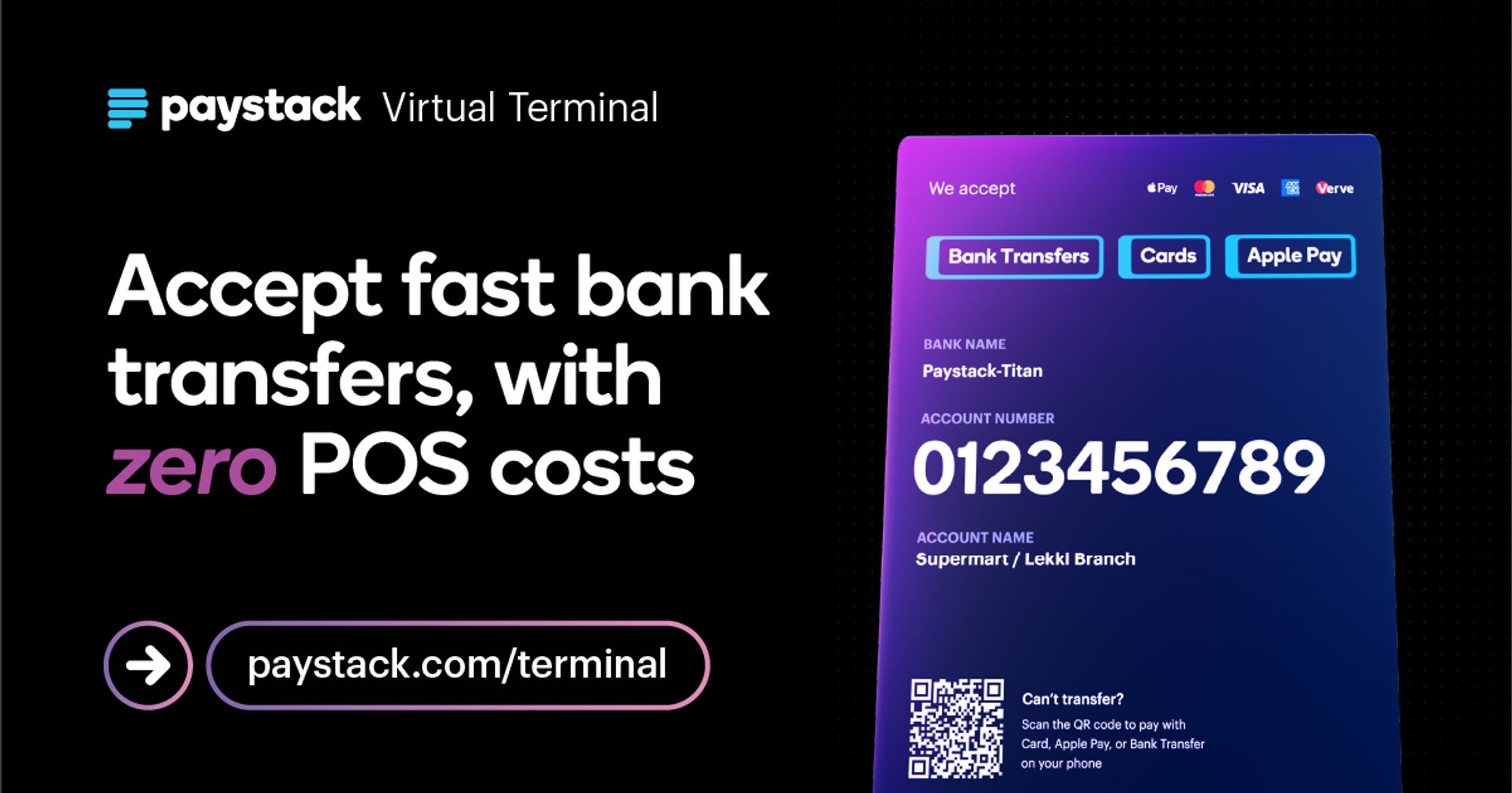

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Adenia Partners closes $470 million fund

In news about funding, private equity firm Adenia Partners has announced the close of its latest—and largest—Africa-focused fund.

Per TechpointAfrica, the Adenia Africa Fund closed at $470 million led by investors like the European Investment Bank and the World Bank’s International Finance Corp which contributed $300 million to the pool.

The fund will target growth opportunities in high-potential sectors across the continent, including fintech, telecom, and healthcare.

Investment strategy shift: The firm also announced an increase in the average investment size per company. Alexis Caude, Managing Director at Adenia, said the firm will now deploy an average equity cheque of $40 million per target. This shift in strategy reflects Adenia’s focus on acquiring controlling stakes (51% to 100%) in its portfolio companies.

In its previous funds, the company has invested in healthcare and agritech businesses across the continent including Kenya’s Quick Mart, South Africa’s The Courier Guy and Ghana’s Cresta.

It also recently expanded its offices to Nigeria where it hopes to tap into the investment opportunities available. So far, Adenia has raised over $800 million across five funds since its founding in 2002.

This is a reprint. This article was originnaly published in July 2023.

Win with MarkHack

GDM Group & Eko Innovation Centre announce MarkHack 3.0! Calling startups in AI, blockchain, VR to shape Africa’s media future. Network & win accelerator access. Apply now.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $65,542 |

– 0.75% |

+ 3.47% |

|

| $3,293 |

– 0.10% |

– 4.94% |

|

|

$1.16 |

– 15.24% |

– 15.99% |

|

| $182.82 |

– 2.70% |

+ 39.21% |

* Data as of 06:52 AM WAT, April 4, 2024.

- Ride-hailing platform, Bolt has launched an Accelerator Programme for its drivers and riders in Kenya. The program will see the company invest €20,000 (about KES 2.92million) in seed funds to support business plans developed by Bolt drivers and couriers or their family members that link to sustainable transport. Apply by April 4.

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs . Apply by May 19.

Here’s what you should be looking at

- Central Bank of Kenya maintains interest rates at 13% as inflation eases

- US blames corruption for slowing investments in Nigeria and Kenya in trade report

- South Africa passes digital nomad visa law amid public concerns

- Benjamin Oyemonlan is creating a protean payment platform at Platnova

- MTN sees decline in internet subscription over NIN-SIM compliance

Written by: Towobola Bamgbose & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.