Good morning ☀️

We’ve identified a bug in your inbox settings that might be affecting how often you read TC Daily. Moving us from your Promotions folder to your Primary/Main folder ensures you won’t miss any critical African tech news (or hilarious puns).

Mono partners with Mastercard

Open banking, which permits banks to voluntarily share users’ data with fintechs, has been a long-battled phenomenon between Nigerian banks, regulators, and fintech startups.

Poised to be a game changer in Nigeria’s financial space, open banking allows convenience for users as sharing of users’ account data could allow them to manage their finances in one place, let digital lenders make informed decisions for borrowers, and make for a seamless experience for both businesses and users.

However, Nigeria’s central bank has delayed releasing guardrails to regulate the industry, thereby slowing the adoption of open banking. Yet, open banking startups like Okra and Mono have forged on in the industry, allowing startups to connect to user bank accounts, verify identities in real time, and initiate payments directly within their applications.

Now, Mono is taking things a notch higher.

A Mastercard marriage: Yesterday, Mono announced it was tying the knot with global payment giant Mastercard to enable payments directly into bank accounts without cards or USSD codes.

The bigger picture: Mono has been on a major drive to increase its revenue and inch toward profitability. Before the partnership with Mastercard, Mono partnered with Flutterwave, Nigeria’s payment behemoth, to allow merchants to receive payments via an account-to-account (A2A) option which it calls DirectPay. Mono claims to have made transactions worth over ₦5 billion ($3.8 million) through this payment since it launched in 2022.

The new partnership with Mastercard aims to increase that number. The partnership allows Mono to facilitate more transaction volumes through the Mastercard Payment Gateway System which is available to merchants across countries—Kenya, Ghana, South Africa, and Nigeria—where Mono currently operates.

What’s in it for Mastercard? Mastercard has been trying to diversify beyond non-card payment options on the continent in recent times. It has partnered with several payment providers to explore alternatives in mobile money wallets, contactless payments, and QR payments. The new partnership with Mono further aligns with this goal.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Triply is YC’s latest bet on the continent

Kenya’s tourism industry is one of its biggest cash cows for foreign income, earning about $2.13 billion from it in 2022. The East African country also expects an uptick in the number of tourists by 2026—with 2.4 million visitors up from 2.1 million in 2021. With a growing middle class and increasing disposable income, Kenyans are also increasingly exploring their own country.

Travel startups across the country are lining up to benefit from this. One of those startups is Triply, the latest member of the Y Combinator 2024 winter batch.

The news: Triply, a Kenyan fintech that helps travel businesses collect payments has been selected for Y Combinator’s winter 2024 batch. Triply is the latest African startup in the cohort after Cleva, the cross-border payment service, and Miden, the API startup.

Small businesses account for 90% of Africa’s travel industry. However, due to inadequate payment infrastructures, these businesses are unable to receive payments; as a result, they frequently have to use manual payment methods, which reduces the efficiency of their booking systems.

Launched in 2021 by Peter Wachira and Collins Muthinja, Triply helps travel businesses collect payments and automate their operations. The startup also advertises these businesses on its marketplace to help match the needs of Kenya’s local travel market which is projected to grow by $749,000 in 2027.

With Y Combinator’s backing and a booming domestic travel market, Triply is well-positioned to empower small travel businesses and become a key player in Kenya’s flourishing tourism industry.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

Facebook allegedly shared private DMs with Netflix for a decade

A new lawsuit is accusing Meta of giving Netflix special access to users’ private messages for nearly a decade. This alleged partnership, according to the class action lawsuit, helped Netflix tailor content for its viewers.

The lawsuit claims Facebook and Netflix had a close relationship, with Netflix receiving special access to user data through an “Inbox API” agreement. This would have allowed Netflix to see private messages related to what users were watching on its platform.

In exchange, Netflix would reportedly provide data on how users interacted with its service.

Meta says no: Meta, of course, denied the claims, stating the agreement only allowed users to message their Facebook friends about what they were watching on Netflix within the Netflix app.

If you think this might violate privacy agreements, you’re wrong.

The second time’s the charm: This isn’t the first time Meta’s been accused of giving other platforms access to users’ DMs. In 2018, a New York Times investigation revealed that Meta—then Facebook—had given several companies including Amazon, Netflix, Spotify and Sony, the ability to read and even delete Facebook users’ DMs.

At the time, Meta also denied the claims, stating, “None of these partnerships or features gave companies access to information without people’s permission.”

The company was not fined for this as it did in fact, not violate user agreements. It has however faced over $1 billion in fines over the past five years for data privacy violations across the world.

At this time, it remains unclear whether the latest class action lawsuit will result to more fines for the big tech company.

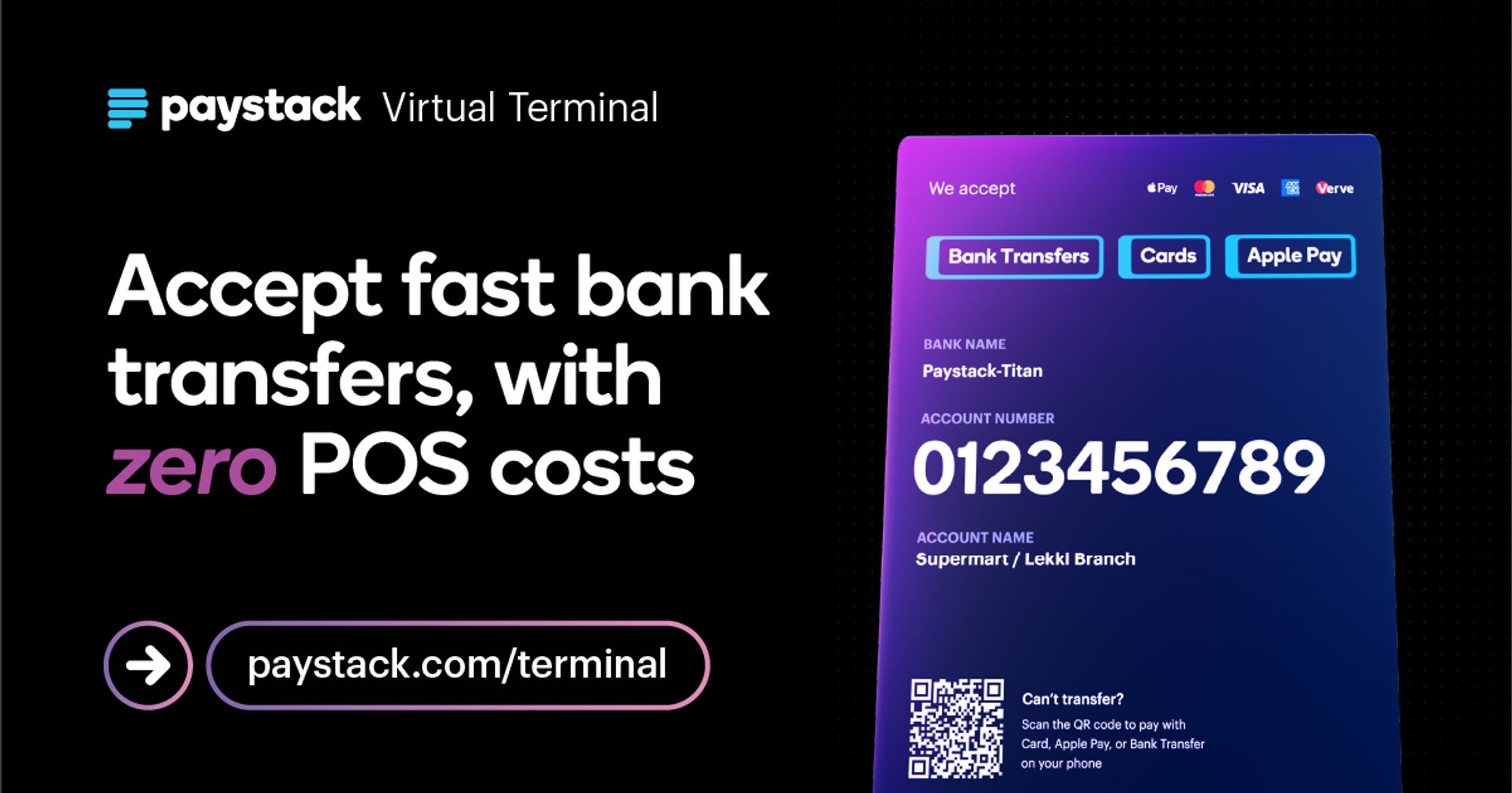

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

How fintechs can adapt to FX reforms

In recent years, African countries have embarked on foreign exchange reforms aimed at fixing inefficiencies within their FX markets and stemming the decline in foreign currency reserves. The Nigerian government, for instance, announced significant changes to its FX market structure, dislodging a multi-market system that had been in existence for over six years. One of the changes involved consolidating various FX windows into the Investors & Exporters (I&E) platform, enabling market forces to determine unified exchange rates between buyers and sellers.

Before the reform, the FX market had been characterised by disparities between official and parallel market rates. Between 2019 and January 2023, the rate in Nigeria surged from ₦362 to ₦1,455, marking more than a 300% increase.

However, as the FX space gradually transformed, it also had a ripple effect on the cross-border fintech sector. Startups that facilitated FX trading and cross-border payments found themselves at a crossroads as the changes had earlier prompted local banks to halt international payments conducted on naira cards. This has left consumers and businesses turning to alternative means of making payments for services across streaming platforms, online courses, tuition fees, and so on.

Amidst the constraints with traditional banks, fintech innovation is redefining product offerings with virtual bank accounts and dollar cards. This affords consumers seamless means of making international payments by streamlining the process and eliminating the need to source dollars from the black market.

Nevertheless, the attraction of cross-border payment convenience does not come without trade-offs. The exchange rates offered by these platforms often surpass those presented by official channels like the I&E window, primarily attributable to the limited accessibility fintechs have to official FX sources. In a bid to counterbalance this limitation, they resort to using parallel market rates, which further widens the discrepancy.

But can cross-border fintechs still sustain their appeal if banks embark on a trajectory of offering lower exchange rates and more accessible FX options? More than ever, fintech companies must continue to recalibrate their strategies, ensuring that their value proposition remains attractive even in periods when traditional banks will begin to level the playing field.

This is a reprint. This article was originnaly published in July 2023.

Win with MarkHack

GDM Group & Eko Innovation Centre announce MarkHack 3.0! Calling startups in AI, blockchain, VR to shape Africa’s media future. Network & win accelerator access. Apply now.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $66,267 |

– 0.71% |

+ 6.89% |

|

| $3,312 |

– 1.52% |

– 3.60% |

|

|

$0.80 |

+ 16.77% |

+ 16.77% |

|

| $187.99 |

+ 2.32% |

+ 44.82% |

* Data as of 06:10 AM WAT, April 3, 2024.

- Ride-hailing platform, Bolt has launched an Accelerator Programme for its drivers and riders in Kenya. The program will see the company invest €20,000 (about KES 2.92million) in seed funds to support business plans developed by Bolt drivers and couriers or their family members that link to sustainable transport. Apply by April 4.

- The Corporate Social Responsibility arm of MTN Nigeria, MTN Foundation has opened applications for phase two of its “Yellopreneur” initiative, through which it intends to offer 150 female entrepreneurs with ₦3 million ($1,900) each as loans to boost their businesses. Apply by March .

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs . Apply by May 19.

Here’s what you should be looking at

Written by: Towobola Bamgbose & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.