Good morning ☀️

You can now use ChatGPT without signing up or signing in.

Yesterday, OpenAI opened up its generative chatbot service to users across the world who can now access the service without having an account. There’s a catch though: OpenAI says users who dont sign in will experience “slightly more restrictive content policies” which could mean anything from being stopped from asking ChatGPT how to make $100 million in 24 hours, to getting a version of the service that’s as reliable as telecoms on a rainy day.

Cheers!

Thepeer closes shop

Thepeer, a Nigerian API startup that aimed to connect wallets across African fintechs, has shut down after failing to gain traction.

In a blog post published yesterday, the company announced its shutdown citing compliance issues and an overall unacceptance of wallets as a viable payment option as key hurdles they faced.

The company, which raised $2.1 million in its first formal venture capital financing, shared it needed to make a key decision either to do a hard pivot, an M&A or return capital to investors. “After carefully weighing our options, we decided that returning the remaining capital to investors was the best decision,” co-founders Chika Ononye and Trojan Okoh wrote.

What does this mean for customers? In the statement, the company hopes to explore future possibilities for Thepeer and the platform will be in maintenance mode in the interim. The company stated it will prioritise keeping it functional for as long as possible while they identify a new and exciting home for Thepeer.

Experience fast and reliable personal banking with Moniepoint

Give it a shot like she did 🚀. Click here to experience fast and reliable personal banking with Moniepoint.

Access Bank lost $4.6 million to fraud in 2023

Nigeria’s financial system has experienced an uptick in fraud since 2020. Financial institutions in Nigeria have revealed that since 2020, fraud has cost them ₦159 billion ($201.5 million).

BusinessDay revealed in September of last year that Fidelity Bank suffered three attacks that cost them ₦2 billion ($2.5 million). Access Bank, Nigeria’s biggest bank based on customer deposits, filed a lawsuit in June to collect ₦3 billion ($3.8 million) that had been fraudulently withdrawn, according to court documents that were posted on social media and independently verified by TechCabal. The bank filed a second lawsuit in July to recoup an additional ₦5 billion ($6.3 million) that scammers had taken illicitly from its coffers.

Now, Nigeria’s largest commercial bank is counting its losses in full.

A ₦6.15 billion fraud: Per TechpointAfrica, Access Bank, Nigeria’s largest commercial bank by assets lost about ₦6.15 billion ($4.6 million) to fraud and forgery in 2023. This accounts for a 327% uptick of monies lost—₦1.44 billion—in the previous year.

Per the bank’s financial report, fraudulent transfers and withdrawals were the biggest driver of losses, accounting for 70%. Embezzlement—cash theft, suppression, pilferage, dry posting, electronic fraud, and USSD—contributed to the remaining portion of losses.

Access Bank’s findings reveal that 6,771 electronic fraud attempts were made worth ₦2.69 billion. The bank only lost about ₦92.2 million in those attempts. Last year, TechCabal reported on how several Nigerian banks were having internal conversations to rein in fraud. These banks often struggle with information sharing and lack of coordination on financial fraud investigations by local law enforcement agencies.

Deloitte secures Ethiopia’s first securities investment advisor licence

Global audit and consultancy firm Deloitte has become the first company to secure a securities investment advisor licence in Ethiopia.

This new development is a result of Ethiopia launching its own Securities Exchange slated for the third quarter of this year

Side-bar: A well-regulated stock exchange acts like a growth engine. It fuels savings by offering a secure and potentially profitable avenue for investment. This pool of savings then flows towards the most productive companies, propelling their growth and job creation.

Why Ethiopia? The Securities Exchange boosts transparency by requiring companies like Deloitte to provide audit and consulting services. These companies will regularly publish audited financial information that will be made accessible to all. This empowers even smaller investors with the same level of insight previously enjoyed only by large players.

Additionally, a thriving stock market attracts professional analysts who dissect and interpret this information, providing even more informed decision-making for investors.

Brook Taye, the director-general of the Ethiopian Capital Markets Authority, believes that having Deloitte licensed as an investment adviser will help speed up the process of growing Ethiopia’s stock exchange market and that with the company’s expertise, they can make things happen faster and better.

Deloitte will be able to help businesses get ready to sell shares on the exchange. The first company to sell shares will likely be Ethio Telecom, a state-owned phone company. Ethiopia expects more Kenyan companies to get involved in their stock exchange as well.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

Google Podcast to shut down soon

Last September, Google sent out an email to users announcing plans to shutter its podcasting service, Google Podcast. The news particularly came as a shock to many users and to this writer who found the app very easy to use. Google accompanied the email with tools on how users can migrate their current subscriptions on the app to YouTube Music or export a file that can be uploaded to other apps.

Google announced yesterday that users in the US would not be able to use the Google Podcast app after today, April 2nd, 2024, per TechCrunch. Additionally, Google announced that after June, users of the app will not be able to export or relocate their subscriptions.

Why is Google podcast shutting down? Google’s shutdown of a vertical is not new—remember Google’s inbox that was morphed into Gmail or Google’s play services that was moved into Youtube Music.

While the shutdown of Google Podcasts, with over 500 million downloads, might surprise some, it signals a strategic shift for creators globally. Google is doubling down on its video-first approach by integrating audio and video podcasts directly into YouTube Music.

This move aligns with the ever-increasing consumer demand for video content. People are spending more time watching videos online, and Google is positioning YouTube Music as a one-stop shop for both audio and video experiences.

How do I migrate my subscriptions? Simply open the Google Podcasts app, head to the Home tab, and look for the Google Podcasts app shutdown notification. Click on it to initiate the export process. Under “Export Subscriptions,” choose “Export to YouTube Music.” You’ll be directed to the YouTube Music app, where you can select your Gmail account. Once confirmed, your subscriptions will start transferring – sit back and relax, as it may take a few minutes for everything to move over from Google Podcasts to YouTube Music.

If, like this writer, you prefer audio-only podcasts, here are some alternative platforms to consider: Pocket Casts, Castbox, Spotify, Podbean, and Anchor.

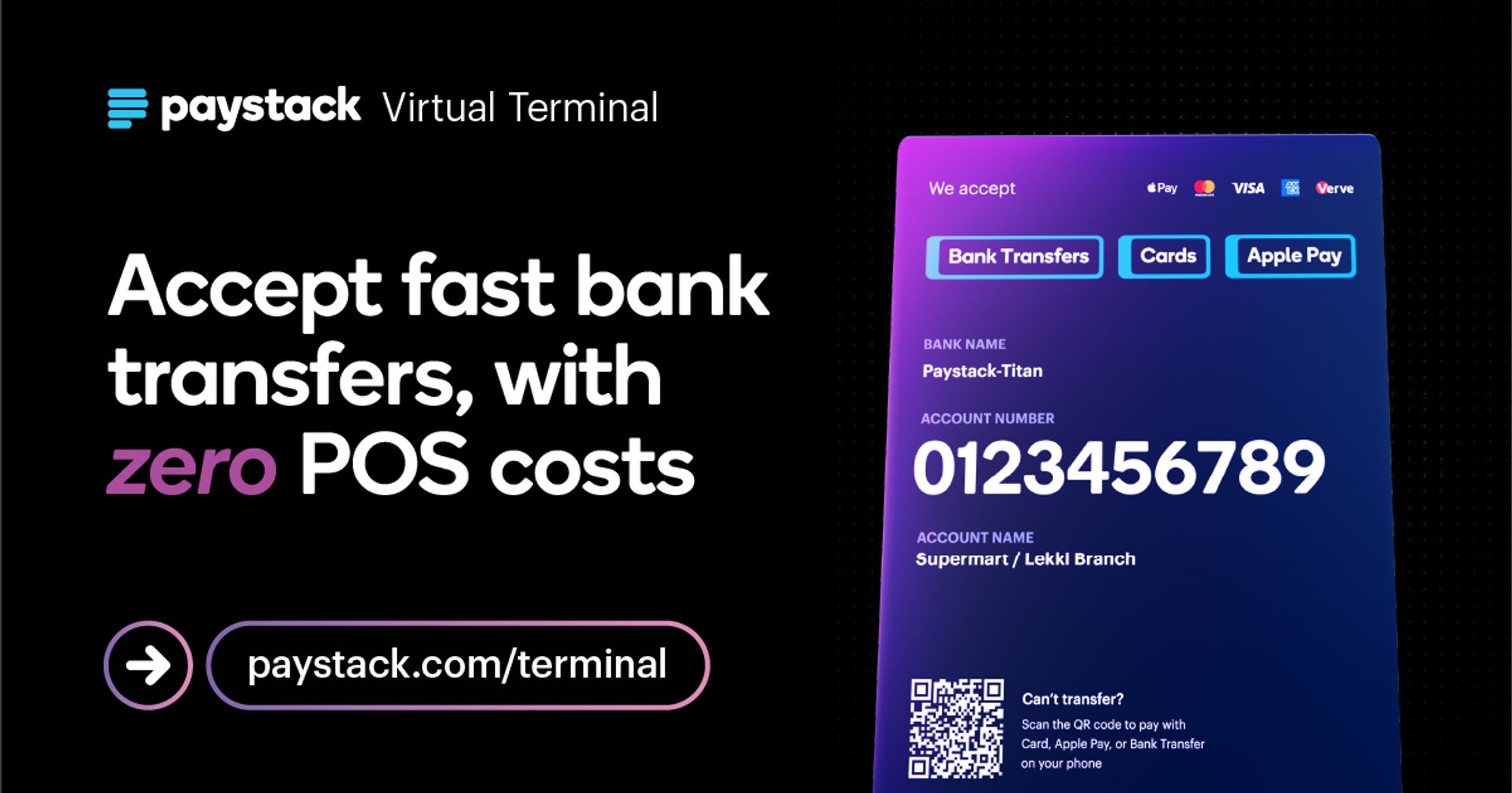

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $69,229 |

– 2.29% |

+ 12.20% |

|

| $3,367 |

– 6.65% |

– 2.05% |

|

|

$3.91 |

– 12.81% |

+ 133.28% |

|

| $184.23 |

– 9.24% |

+ 41.40% |

* Data as of 05:52 AM WAT, April 2, 2024.

- Ride-hailing platform, Bolt has launched an Accelerator Programme for its drivers and riders in Kenya. The program will see the company invest €20,000 (about KES 2.92million) in seed funds to support business plans developed by Bolt drivers and couriers or their family members that link to sustainable transport. Apply by April 4.

- The Corporate Social Responsibility arm of MTN Nigeria, MTN Foundation has opened applications for phase two of its “Yellopreneur” initiative, through which it intends to offer 150 female entrepreneurs with ₦3 million ($1,900) each as loans to boost their businesses. Apply by March .

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs . Apply by May 19.

Here’s what you should be looking at

Written by: Towobola Bamgbose & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.