Good morning ☀️

Before we get to today’s edition, here’s a reminder that we launched The Big Daily last week, it’s TC Daily but for Nigerian news.

If you’re looking for a daily newsletter that breaks down the most critical Nigerian news, sign up for The Big Daily and get updates by 7 AM every weekday.

In today’s edition

OPay nears $3 billion valuation

Nigerian fintech behemoth, OPay, has scored big wins in Nigeria’s fintech space. The startup was one of the beneficiaries of Nigeria’s ill-timed currency redesign which led to cash scarcity for multiple weeks. In that time, the fintech witnessed increased cash transactions. According to its financials, the company “quadrupled its user base through 2023 and grew revenue by over 60% on a constant currency”.

While OPay currently boasts over 30 million users and 500,000 agents, it had humble beginnings. The fintech—formerly Paycom, a mobile money operator—was acquired by Opera, an asset management company in 2018.

Since the acquisition, the fintech has raised more than half a billion dollars. In its last $400 million fundraise in 2021 led by SoftBank, the company was valued at about $2 billion. But recent filing from Opera’s financial result shows that OPay’s valuation inches close to $3 billion. Want to find out more?

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Nigeria blocks four fintechs from frontloading fresh faces

If you’ve tried opening a new account with Kuda Bank, Moniepoint, Opay, or Palmpay, you likely received a message stating “Thank you for downloading this app. Sign-up is currently unavailable. Please check back later.”

This isn’ta network issue though.

At least four banks, including those mentioned above, are following a directive by the Central Bank of Nigeria (CBN) to temporarily halt opening new accounts. This won’t affect other deposits or existing banking activities.

Why: Per reports by TechCabal, an unnamed fintech executive claims the pause is linked to an ongoing audit of the fintechs’ Know Your Customer (KYC) processes; the sources also describe the situation as temporary.

This isn’t the first time fintechs have faced regulatory scrutiny in Nigeria. Concerns about Know Your Customer (KYC) processes led to Fidelity Bank and Standard Chartered Bank restricting transfers to Opay, Kuda, Moniepoint and Palmpay in October 2023. “The issues are due diligence and KYC, until they get their house in order, they will continue to experience issues like being blocked by banks,” a source said to TechCabal at the time.

This shift is driven by a rise in fraud, prompting traditional banks to request verification of KYC procedures performed by neobanks. In some cases, traditional banks may even want to conduct their own KYC checks on neobank customers.

This directive also comes days after the Nigerian Federal High Court granted the Economic and Financial Crimes Commission (EFCC), the authority to freeze over 1,146 bank accounts linked to illegal foreign exchange dealings, money laundering and terrorism financing. However, the National Security Agency (NSA) has denied a link between the restriction to opening new accounts and the bank accounts that were frozen.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

Uganda requires verification for digital transactions exceeding $260

The Bank of Uganda has implemented a new directive requiring ID verification for digital transactions exceeding UGX 1 million ($260).

Why? The directive was made to address the increase in fraudulent activities linked to mobile money systems, which have been susceptible to deceptive agents and criminals

“Mobile money systems have occasionally been the target of cybercrime carried out by agents working with criminals,” the X post reads.

The BoU stressed that these measures align with Section 55 (1)(b) of the National Payments Systems Act, 2020, and Regulation 7 (h) of the National Payment Systems (Agents) Regulations, 2021 which prohibit over-the-counter transactions without full identification of the consumer, and mandate compliance with all financial regulations.

Ugandan citizens must use a valid national ID card or passport for this process, while foreign residents, including refugees and other aliens in Uganda, will need a refugee ID/attestation letter or an alien ID.

Ugandans cry out: The implementation of this directive has not been without criticism. Stakeholders have particularly noted that this measure will slow down transactions for Ugandans who don’t have ID cards. Of its 19 million adult citizens, just 78%—about 15 million Ugandans—are estimated to have a valid means of ID per a 2021 report.

Additionally, there were concerns over a possible rise in ID card forgeries spurred by the new requirements. This is a concern that aligns with the findings of a 2024Smile ID report, which indicates that fraudsters seeking access to financial services usually try to bypass onboarding protocols using compromised government-issued IDs which are the cornerstone of ID verification in most digital transactions.

Uganda is planning to begin mass citizen enrollment for new-generation biometric national ID cards starting in June.

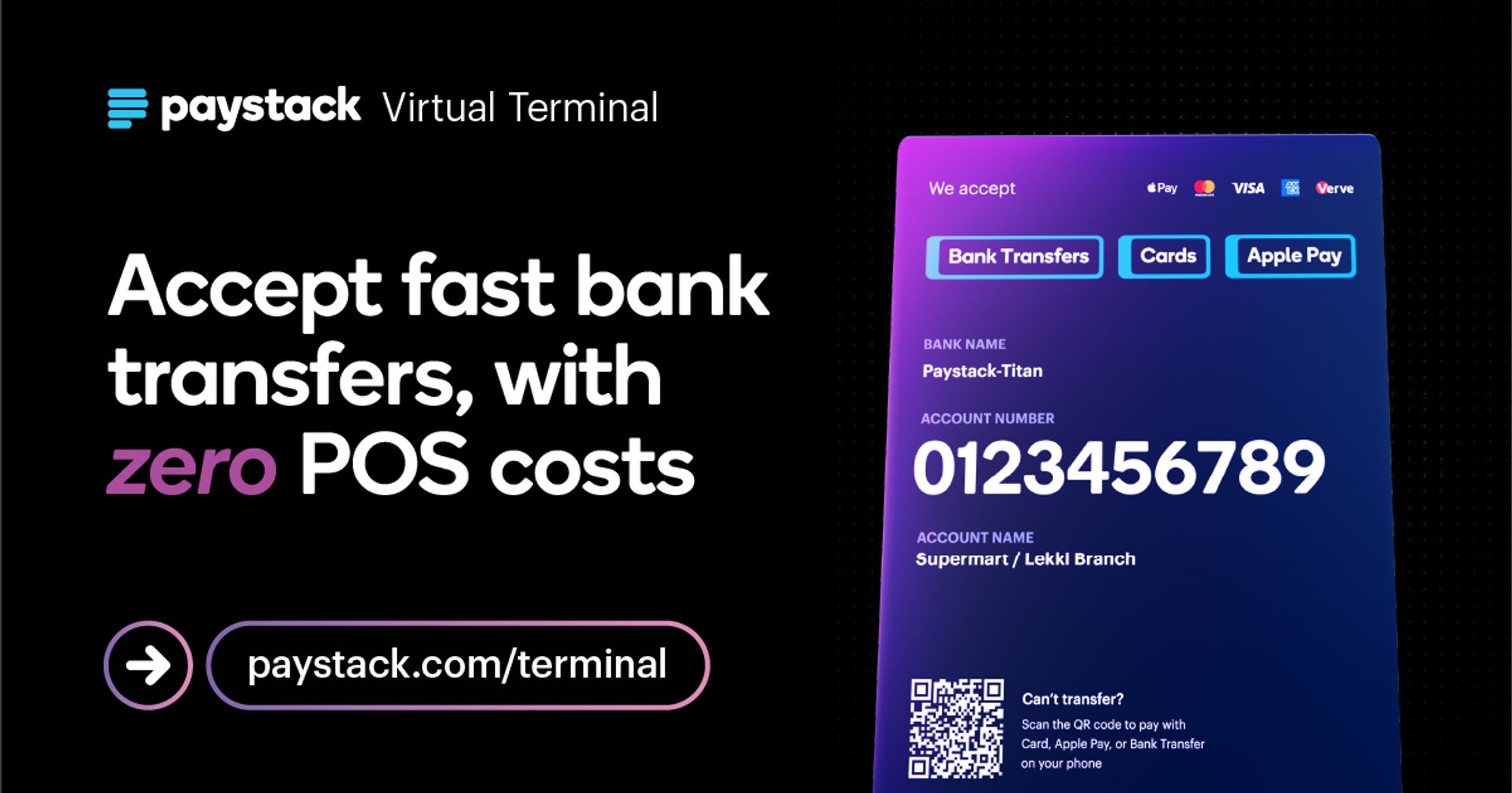

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

OpenAI licensed to use FT content in ChatGPT

OpenAI is finding love (and data) in the media.

Since the inception of ChatGPT, OpenAI has explored different partnerships to source data to train its models. The company has recently been on a media matchmaking spree, pursuing bouts of media partnerships to incorporate content from prominent media outlets into its AI system.

While it enjoyed plain sailing with certain media houses, it has struggled with others. Last year, the ChatGPT maker approached the New York Times for a potential partnership for the use of its content. However, the love affair went south. The deal spawned into a legal tussle, after the New York Times accused OpenAI of copyright infringement. OpenAI, however, refuted such claims. OpenAI suffered a similar fate with The Intercept, Raw Story, and AlterNet who sued the company in February.

A win-win with the Financial Times: As OpenAI navigates the legal tussle, it has made headway, inking a partnership with the Financial Times to use summaries, quotes, and links to its articles in ChatGPT prompts results. Both companies did not disclose the financial terms of the deal. However, OpenAI reportedly pays between $1 million and $5 million to license content from publications.

Beyond the licensing agreement, OpenAI will work with the FT to develop new AI features specifically for the news organisation’s readers. Last month, the publication released a generative AI search function on beta powered by Anthropic’s Claude large language model.

Zoom out: The Financial Times partnership is the latest in the stack of OpenAI’s media partnerships. Axel Springer—the owner of Business Insider, Politico, Bild, and Welt—and the Associated Press have both struck deals with OpenAI. These agreements allow OpenAI to train its models on the vast amount of data from their articles.

$446 mllion: That’s how much African startups raised from January to March 2024. It’s a 45.62% decline compared to Q1 2023.

Source: “State of Tech in Africa (SOTIA)” Report, TechCabal Insights.

Attend GITEX Africa

GITEX Africa returns a second time on May 29–31, 2024, to Marrakech, Morocco, discussing ways to accelerate the continent’s digital health revolution. GITEX is the continent’s largest all-inclusive tech event renowned for uniting the brightest minds in the technology industry.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $66,360 |

– 0.17% |

– 9.27% |

|

| $3,189 |

– 3.51% |

– 9.31% |

|

|

$0.25 |

– 6.19% |

– 34.95% |

|

| $137.10 |

– 1.67% |

– 30.05% |

* Data as of 23:45 PM WAT, April 29, 2024.

- The fourth edition of Pitch2Win is open for applications. Pitch2Win aims to connect visionary founders with potential investors, fostering growth, collaboration, and investment opportunities. The 3 Finalists will win a prize pot of $20,000. They will also receive an all-expense paid trip to the IVS2024 Kyoto Event, Japan’s largest startup conference. Apply by May 5, 2024.

- Norrsken is accepting applications from startups at their early (pre-seed) stage for its 2024 cohort. Selected startups will receive up to $125k in funding and pitch to an audience of hundreds of investors, potential partners and clients at Norrsken Investor Day. Apply by April 30.

- Applications are now open for the DAAD Leadership for Africa Master’s Scholarship Programme. The programme aims to support the academic qualification and advancement of young refugees and national scholars from Burundi, Kenya, Rwanda, South Sudan, and Uganda at higher education institutions in Germany. Applicants will get a chance to learn a German language course for 6 months before study begins, and a Tuition-free M.A. or M.Sc. degree programme at a public or state-recognized university in Germany starting September/October 2025.Apply by June 7, 2024.

Here’s what you should be looking at

Written by: Faith Omoniyi & Towobola Bamgbose

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.