Good morning ☀️

You may have heard rumours on social media that Ghana, like Nigeria, is planning to implement a 1% cybersecurity levy on digital transactions in the country.

It’s fake news. The Bank of Ghana (BoG), Ghana’s apex bank, yesterday, dismissed the news as false stating that it has not enacted any such levy. Nigeria’s 0.5% cybersecurity levy still stands though, and Nigerians can expect to see changes from May 20.

Amazon finally launches in South Africa

Amazon is finally open for business in South Africa!

Yesterday, after two years of waiting and wading, the American e-commerce finally opened up its second African marketplace with 3,000 pickup points and free deliveries for South Africans who are making their first purchase.

The long haul: News of Amazon’s launch in South Africa started spreading in 2022 after the company started constructing a headquarters in the country. Amazon, however, didn’t make it official until October 2023 when it revealed the amazon.co.za URL.

The launch should have happened earlier, but the e-commerce behemoth, since January 2022, was landlocked in a court battle with South Africa’s First Nations group which argued that the site where Amazon’s HQ now sits belongs to indigenous people and should be protected. The case went all the way to the Court of Appeal which ruled in favour of Amazon. The platform’s launch in South Africa was also stalled because it needed to comply with local regulations.

Amazon’s big deal in South Africa: The US e-commerce giant is entering a market where it will face stiff competition from Naspers-owned Takealot, which accounts for 48% of South African online sales. The retail giant will also face South Africa’s strict competition regulations, which have already forced established players to make significant changes to their business models.

Reactions to the launch: For some South Africans, the launch is a bit of a letdown. While there’s a marketplace with competitive prices and delivery options, none of the popular Amazon products Kindle, Fire devices, Ring doorbell or services Prime Music are available. This stands in contrast to their biggest competitor, Takealot, which already sells these Amazon products.

Amazon now has two African locations: Contrary to popular belief, this isn’t Amazon’s first rodeo in Africa. In 2021, four years after Amazon acquired Souq.com—the largest e-commerce company in MENA—the platform launched in Egypt using Souq’s platform and existing subscribers. Since then, the platform has employed over 2,500 staff and has reportedly helped local Egyptian businesses grow their businesses by 40% Y-o-Y. Last year, it also announced expansion plans in Egypt which include tripling its fulfillment capacity.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Forex traders in Nigeria sent into hiding again

If you were unable to reach your favourite bureau de change trader yesterday, it’s because they went into hiding.

Why? Yesterday and the day before, Nigeria’s anti-graft agency, the Economic and Financial Crimes Commission (EFCC), conducted fresh raids on foreign exchange traders who trade on the street across major Nigerian cities.

Yesterday’s raid was the second in two months. In February, the EFCC arrested over 100 currency traders in Lagos. One month later, the Central Bank revoked the operating licences of more than 4,000 Bureau de Change operators (BDCs) and banned street trading.

Why the clampdown? In May, the federal government unified its exchange rate in a bid to find stability for the value of the naira. Since then, the currency has lost about 70% of its value. The naira briefly rebounded to become the world’s best-performing currency in March after experiencing huge gains, which were shortlived against the dollar and other currencies.

The government believes currency speculators—like foreign exchange traders—drive up the prices of the naira, but some experts cite a lack of liquidity as the real issue. Since the start of the year, the government has maintained this belief and implemented a raft of decisions—including the ban of the global crypto exchange platform, Binance, over suspicion that crypto traders use peer-to-peer trading to manipulate the price of the naira via a pump-and-dump strategy—to rein in FX volatility.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

Nigerian officials ask $150 million bribe from Binance executives

Welcome to another instalment of the Nigeria-Binance saga.

The arrest of Tigran Gambrayan and Nadeem Anjarwallar by the Nigerian government is probably not news to you anymore. What’s new is that one month before the arrest, Nigerian officials allegedly asked for bribes worth $150 million from Gambrayan.

A $150 million bribe: According to reports from The New York Times and Bloomberg, Nigerian officials gave Gambrayan and his colleague Nadeem Anjarwallar a 48-hour ultimatum to make deposits of $150 million in crypto as bribe payments.

Upon receiving the request, Gambrayan upped and left the country and drafted a three-page document describing his ordeal to Binance lawyers and the company’s contacts in the Nigerian government.

Is Nigeria punishing the executives? Gambrayan would return to the country a month later with Nadeem Anjarwalla, Binance’s regional manager for Africa. What followed was the arrest of both men for “tax evasion” and money laundering charges. Although Anjarwalla fled custody in March, Gambrayan has appeared in court twice and is awaiting his next trial. Per TechCabal, Nigerian officials also threatened to arrest Richard Teng, the CEO of Binance.

Since the arrest, Binance has stopped trading the naira pair on its platform and has left the country after the government restricted access to its website.

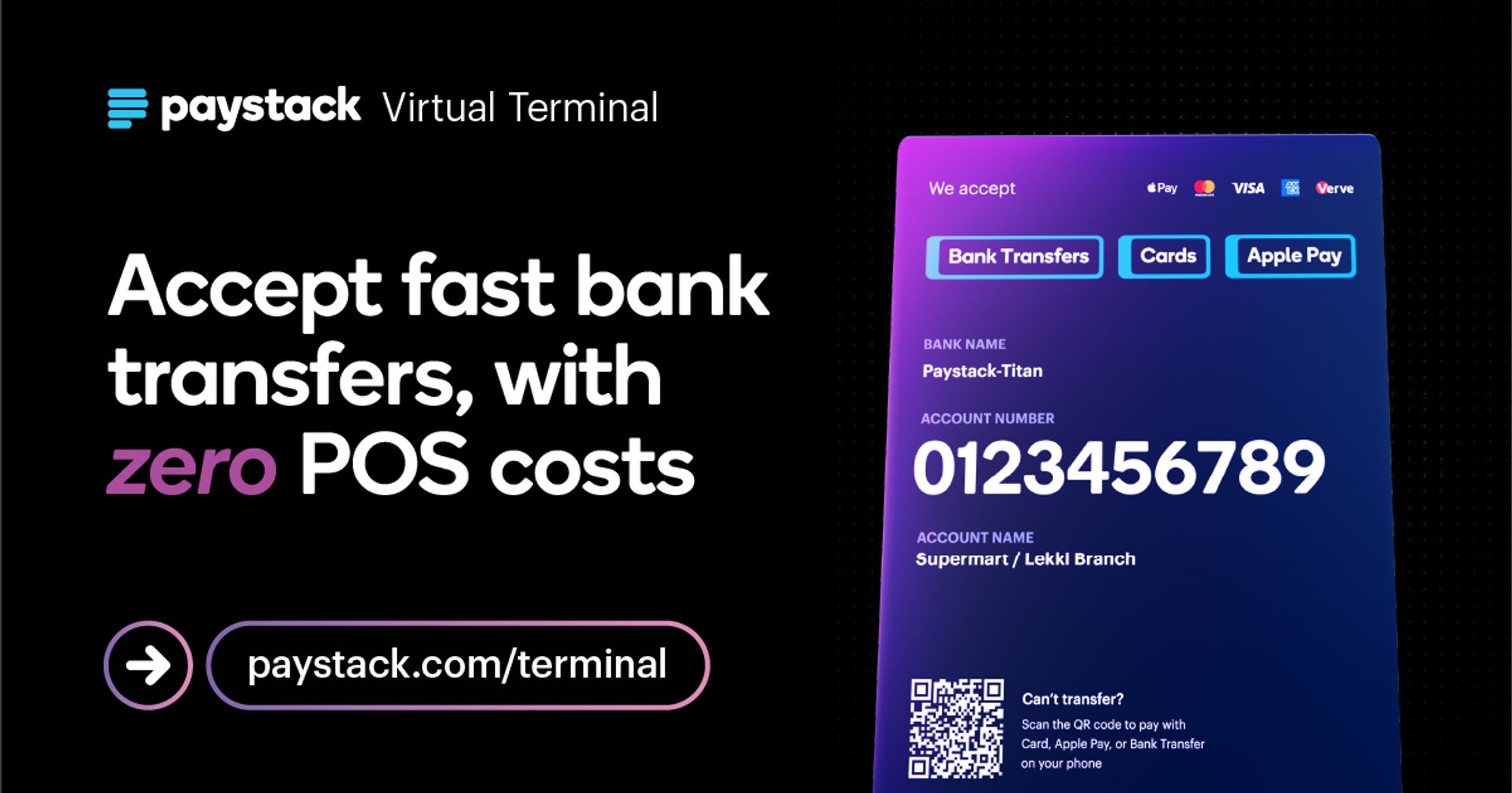

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

SEC meeting fails to quell Nigeria’s P2P ban fears

Nigeria’s cryptocurrency industry is facing a period of uncertainty. and a ban might be imminent.

What’s happening? A meeting took place on Monday between the Securities and Exchange Commission (SEC) and industry participants to discuss regulations. However, instead of clarifying matters, it sparked concerns about the possibility of banning peer-to-peer (P2P) trading.

The SEC is worried that P2P is affecting the value of the naira in the foreign exchange market. This concern mirrors arguments used for past attempts to ban crypto trading entirely. Sources close to the case say the agency urged crypto exchanges to stop offering naira on their P2P platforms. Some exchanges already took this step after Binance came under scrutiny.

Cooperation in exchange for involvement: The agency also called for industry cooperation and a promise to involve them in regulation development. Director general Emotimi Agama also sought input from the 300 attendees on proposals and concerns regarding Nigerian crypto market regulations. “We have an open door policy towards all that mean well for this country, especially in the fintech community”, he said.

The meeting did little to quell fears of a P2P ban. Crypto traders remain on edge, although they were granted a month to prepare proposals for the SEC’s consideration.

How much does a P2P ban mean to Nigeria? A 2023 report by leading cryptocurrency firm Chainalysis reveals Nigeria’s dominance in global P2P trading. Ranked number one worldwide, Nigeria surpasses established markets. This leadership extends to Africa’s largest crypto economy. However, a P2P ban could cripple this growth. While sub-Saharan Africa, where Nigeria resides, holds the lowest global transaction volume, a ban would significantly impact Nigeria’s position and potentially hinder widespread crypto adoption within the country.

Expand your business to new markets with the Sabi Market app

Set up your online store, reach new buyers, make and receive payments and manage your inventory in a few steps. Click here to download the app.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $62,329 |

– 1.66% |

– 10.17% |

|

| $3,012 |

– 2.06% |

– 12.30% |

|

|

$0.22 |

– 2.65% |

– 36.72% |

|

| $149.07 |

– 2.86% |

– 17.06% |

* Data as of 00:30 AM WAT, May 8, 2024.

- Applications are open for the 5th edition of Wema Bank’s startup-focused tech competition, Hackaholics, themed “Meta-Idea: DigiTech Solutions for Africa’s Prosperity”. The edition will be executed over six months, touring 10 universities across Africa and challenging the youths to pitch unique, innovative, and practical Digi-Tech solutions to positively impact the acceleration of progress, development, and prosperity in Nigeria and across the African continent. The best innovators in Africa will be awarded ₦70 million. Apply here.

- Applications are now open for the DAAD Leadership for Africa Master’s Scholarship Programme. The programme aims to support the academic qualification and advancement of young refugees and national scholars from Burundi, Kenya, Rwanda, South Sudan, and Uganda at higher education institutions in Germany. Applicants will get a chance to learn a German language course for 6 months before study begins, and a Tuition-free M.A. or M.Sc. degree programme at a public or state-recognized university in Germany starting September/October 2025. Apply by June 7, 2024.

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs. Apply by May 19.

Here’s what you should be looking at

- Jumia lowers operating losses 70% in Q1 2024 even as profit remains elusive

- Identity company, Seamfix, raises $4.5 million in first funding round to expand outside Nigeria

- Chipper Cash resumes US operations two months after pausing services

- Nigeria raises levy on e-transfers by 900%, analysts call for a transaction cap

Written by: Faith Omoniyi & Towobola Bamgbose

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.