Prospa, the Y Combinator-backed business banking startup, is the subject of complaints and social media callouts after persistent delays in processing customer withdrawals. Four customers said their withdrawals had not been processed since May 2024 amid the company’s claims of service downtime.

It is not the first time customers have experienced such delays. In February 2024, the company also claimed a service downtime impacted transaction speeds, with customers needing to wait weeks to access withdrawals.

Prospa did not immediately respond to a request for comments.

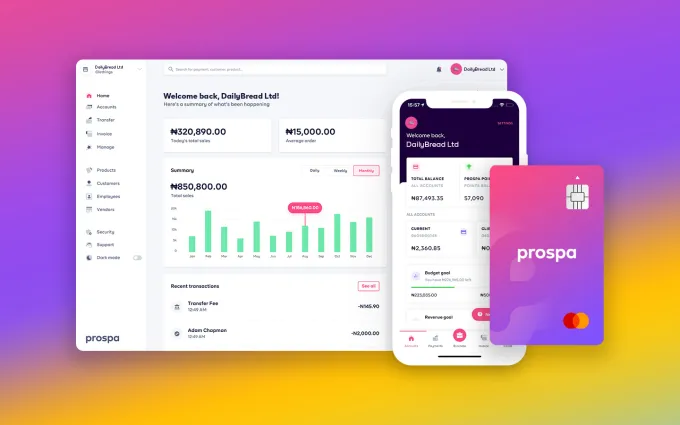

These delays are worrying for business owners who use Propsa to hold deposits and access other services like company registration, virtual storefronts, invoicing, bookkeeping, sub-accounts, and working loans.

“Either their [customer care] phone lines were switched off or they responded saying they have NIP server issues,” one person who had ₦800,000 in his Prospa account told TechCabal in March. “I called my friend who works at NIBSS [the country’s payment aggregator] and they said Prospa had no such issues.”

The delays were resolved in mid-March, according to affected users, some of whom visiting the company’s Yaba office. Others formed virtual support groups to share updates.

In May, customers began experiencing delays again, with some withdrawals taking up to three weeks to process. “At this point, the customer care reps are just engaging complaints because they have to, and not to actually help,” an affected user told TechCabal.

Like the last time, many are visiting Prospa’s office to demand a resolution.

“When they come round, we get our account managers to attend to them and resolve their complaints,” an employee told TechCabal.

An ex-employee rejected comparisons to Brass, a business banking startup that struggled with working capital before it was acquired by new investors.

“Prospa has never had capital issues. They only had technical issues,” a former Prospa employee who worked in Credit told TechCabal. “They are partnering with commercial banks so most times, [the engineering team] say issues are from them.”

The bank has previously partnered with Wema Bank, and Parkway ready cash. Per its website, it partners with Good News Microfinance Bank.