Mano, a grocery delivery startup that serves high-end areas in Lagos and Abuja, is expanding to Nigeria’s ultra-competitive food delivery segment. Founded in 2020 by Moe Nesr, Mano expanded to Nigeria in 2021 and delivers groceries and household appliances from its dark stores—physical stores that do not allow walk-ins—within a 10km radius.

The African startup has dark stores in Lekki, Victoria Island, Ikeja, and Wuse 2, offering deliveries in 40 minutes.

With its expansion to food delivery, the self-described underdog wants to win a sizeable market share in the $936.5 million segment dominated by Chowdeck, Food Court, Glovo, and HeyFood. Bolt and Jumia exited the segment in late 2023.

Mano is taking a different approach in a market where existing players are spending big on marketing, and facing pressure to reduce their commissions.

Mano charges a flat delivery fee of ₦1,400 on all orders. While that’s more expensive than all other players, its focus on high-brow areas and the fact that it already charges similar fees for grocery deliveries means this is not a big risk.

“We want to cater to the various palates of customers—the food enthusiasts who want to try a variety of food [no matter the price], and the aspirational customer who wants quality food at a moderate price,” said Fadekemi Adefemi, Mano’s marketing manager.

The company also believes there are still many unsolved pain points in the food delivery business. “Delayed delivery, damaged food, cumbersome refund processes, are growing pain points of food delivery customers.”

To solve these problems, it will take a different approach from its current operational model. While it owns the inventory for its grocery delivery business, its food delivery business will use an aggregation model similar to Chowdeck and Glovo.

It will give Mano less control over food quality and preparation time. In their dark stores, Mano’s staff (pickers) can ensure quality by directly inspecting fresh produce and other items. This isn’t possible with an aggregation model that relies on partner restaurants.

Mano’s solution is to allow customers to track their orders in real-time—a feature many competitors offer. It will also only deliver within a 10km radius of its restaurant partners (at least one other food delivery service offers this option) and at the moment, it isn’t looking to add restaurants at breakneck speed. This is not a startup trying to blitzscale.

“Mano seems to be slowly building a model that is not after scale but efficiency,” said a former food delivery executive.

“[Mano] is not looking to serve everybody,” Adefemi added. “If we have 1000 customers, we want to nurture them and ensure they have all they need.

Adefemi clarifies that this “tactical approach” is not an absence of ambition.

“We are revenue-focused, but we are a very data-driven team.” The company’s projections reportedly show revenue will grow steadily if it remains obsessed with consistently delivering quality at a steady pace.

The company declined to share specific numbers about its number of users or active users, and the gross merchandise value that its grocery delivery arm has made so far. “The business is doing well, and even our investors [whom the company has raised over $4 million from] agree that the food delivery vertical is right and timely.”

“We say among ourselves, ‘Mano is the underdog. You won’t see us everywhere, but we are moving and even so steadily.’”

Editor’s note: This article has been updated to reflect that Mano’s delivery fee is ₦1,400, not ₦1,200 as was previously stated. It has also been updated to reflect that Mano has raised $12 million to date.

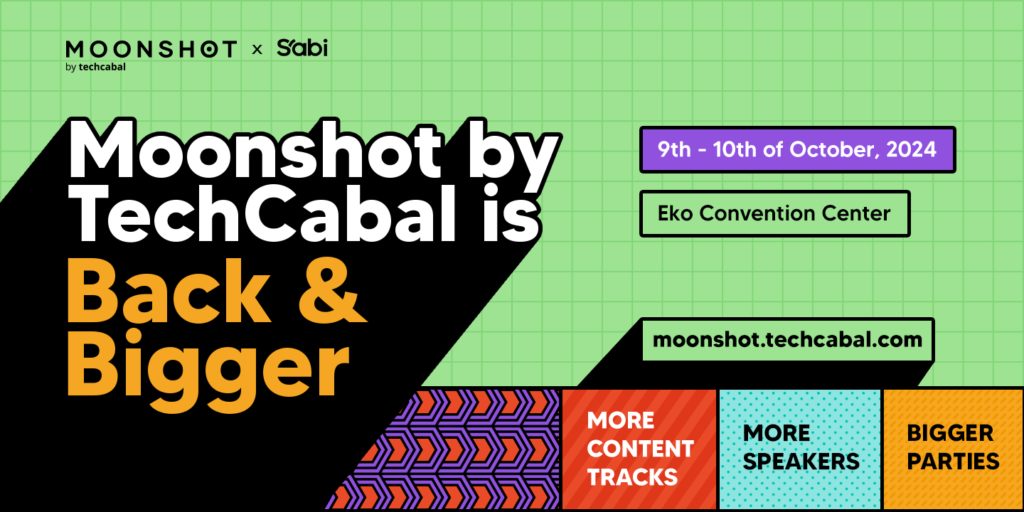

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!