Five Nigerian cloud companies are in talks with the government to become their preferred choice for hosting sensitive government data, two people with direct knowledge of the matter told TechCabal. The lobbying efforts are based on a 2019 National Cloud Computing Policy that makes a case for local cloud service providers as “a first choice consideration.”

If successful, the talks would be a good starting point for increased adoption of local cloud options amid rising costs due to the naira devaluation—some government agencies spend up to $500,000 monthly on cloud services, one person with direct knowledge of the matter said.

A few local cloud companies are also considering creating a consortium having begun talks in April 2024, one person with direct knowledge of the matter said, declining to share names.

For these companies, getting the government’s buy-in will help encourage private companies to host their data locally.

Over 70% of government ministries, departments, and agencies (MDAs) host their data on cloud providers like AWS and Microsoft Azure, according to one 2021 report.

Another group of local cloud providers has also held talks to lobby Mobile Virtual Network Operators (MVNOs) and pension fund administrators (PFAs) to host data locally, two people familiar with the matter said.

The push for patronage for homegrown cloud providers comes as cloud costs have more than doubled in the past year thanks to the naira devaluation. Most Nigerian companies host their data on AWS, Microsoft Azure, and Google Cloud, and the costs are charged in dollars. Local providers aren’t just positioning themselves as cheaper alternatives, but also argue that patronising them will reduce the country’s forex burdens.

“If data is hosted locally, you generate more revenue locally and the money stays within the economy,” one industry insider said.

These local cloud providers are considering offering discounts to incentivise companies to host their data locally.

Local providers are positioning themselves for a boom in Nigeria’s data center market projected to reach $578.1 million by 2029.

The lobbying efforts coincide with rising investments in data centers in Nigeria driven by the demand for data storage solutions following the arrival of eight subsea cables. Airtel is building five hyper-scale data centers across Africa—the first in Lagos. Kasi Cloud Limited, a local cloud provider, began construction of a $250 million Tier IV data center in 2022. Last week, MTN Nigeria said it will complete work on a second data center in Lagos by December 2024.

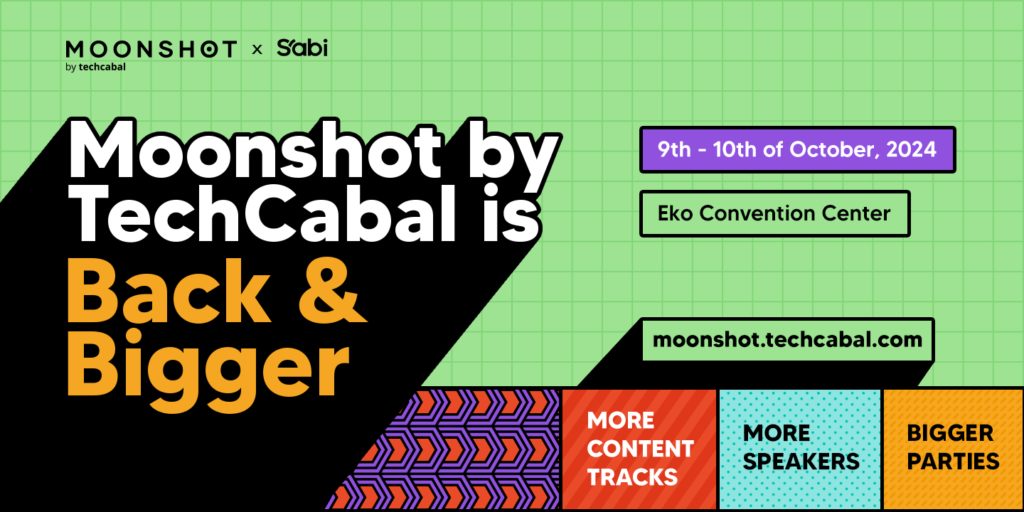

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!