Moody’s, a credit rating agency, has cut Kenya’s sovereign rating into junk, citing the country’s diminished capacity to pay its debts after recent protests forced President William Ruto to withdraw a controversial tax bill that would have raised billions in revenue.

On Monday, the credit agency downgraded Kenya’s credit ratings by one level to Caa1 from B1 for local and foreign currency long-term issuer ratings and foreign-currency unsecured debt.

After two weeks of protests, Kenya withdrew the controversial tax measures to de-escalate tensions. President Ruto proposed a 9% spending cut to the 2024/2025 budget which Moody’s said will narrow the fiscal deficit.

Moody’s does not expect the East African nation to come up with new revenue-raising measures following the recent protests that turned deadly on June 25, leaving at least 41 people dead. The scrapped 2024 Finance Bill contained measures to raise an extra $2.7 billion to help the country manage ballooning debt and fund development programmes.

“The downgrade of Kenya’s rating reflects significantly diminished capacity to implement revenue-based fiscal consolidation that would improve debt affordability and place debt on a downward trend,” Moody’s said in a statement.

“In particular, the government’s decision not to pursue planned tax increases and instead rely on expenditure cuts to reduce the fiscal deficit represents a significant policy shift with material implications for Kenya’s fiscal trajectory and financing needs.”

While the cuts announced by Ruto are expected to improve the country’s liquidity, the credit assessor maintains that Kenya’s fiscal deficit will reduce gradually than previously projected. It expects East Africa’s largest economy’s debt affordability to be weaker for longer.

“As a result, we now expect the fiscal deficit to narrow more slowly, with Kenya’s debt affordability remaining weaker for longer. In turn, larger financing needs stemming from a wider deficit increase liquidity risk against more uncertain external funding options,” Moody’s said.

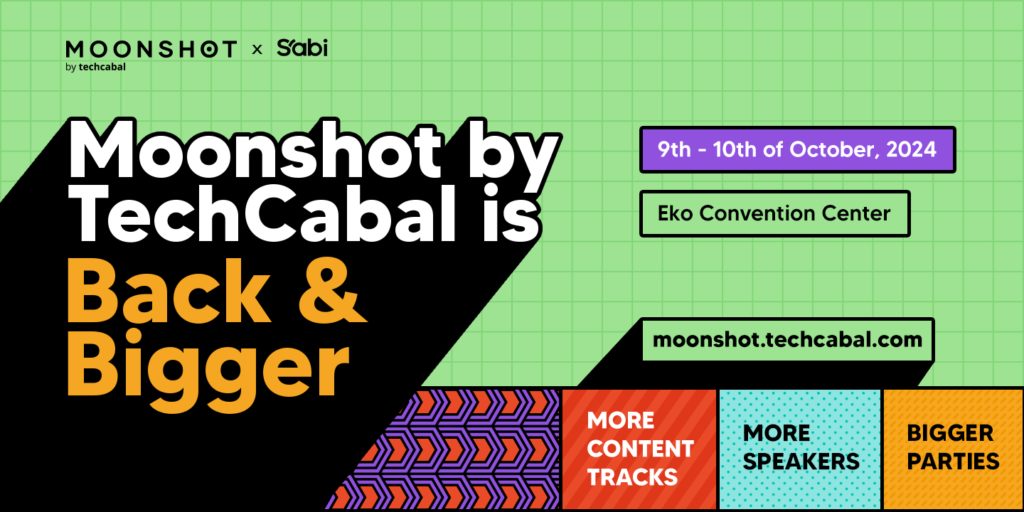

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!