Access Bank Plc, the pan-African bank present in 16 markets, reduced its stake in its Botswana subsidiary to comply with the listing requirements of the Botswana Stock Exchange (BSE). From 2019, the BSE has required listed companies to have a minimum of 30% of their shares available to the public for trading.

Between June 27 and 28, Access Bank Plc sold 59 million shares for P116 million ($8.6 million), reducing its stake from 78.15% to 70%.

“Through this sell down, we have now achieved a critical element of compliance expected by the BSE, which not only adheres to regulatory standards but also presents an opportunity for enhancing market dynamics and our shared value story by welcoming new shareholders,” said Access Bank Botswana managing director Sheperd Aisam in a statement to TechCabal.

The BSE free float was increased from 20% to 30% in January 2019 to increase trading and boost liquidity in the Botswana bourse. The move was controversial and led to the delisting of several companies including retail chain Funmart.

Access Bank was listed on the BSE in December 2018 after Access Bank Plc acquired a 78.15% stake in the Botswana subsidiary of ABC Holdings, which traded as BancABC, for P1.07 billion ($79 million).

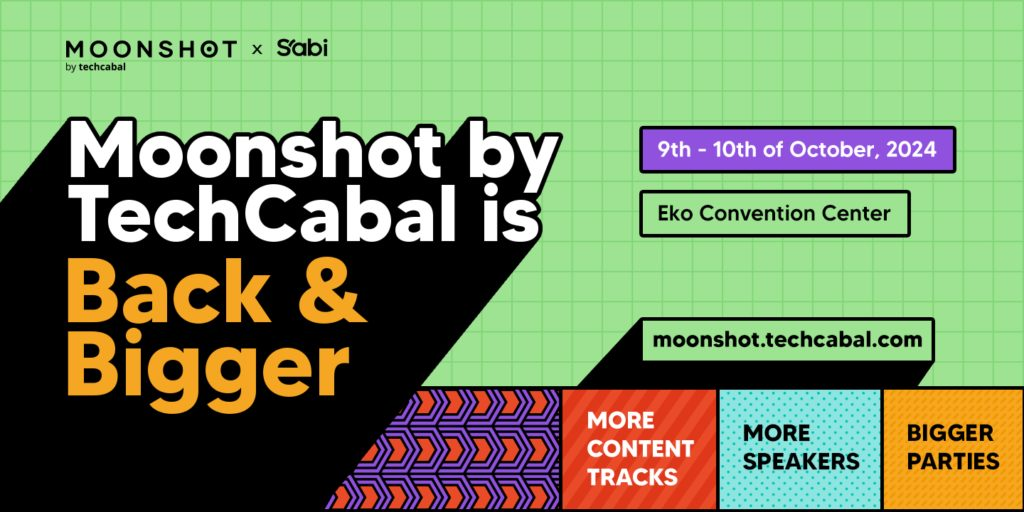

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!