Good morning ☀️

We’re excited to announce our partnership with Wimbart on the second edition of their pioneering pan-African research publication, “Startup Performance Reporting in Africa”.

This report will shed light on the intricacies of investor relations within the African tech ecosystem. If you’re a founder, take a couple of minutes to share some key insights with us by filling out this survey.

Investment

Inside Renew Capital’s move to invest in West African startups

At the beginning of August, Ethiopia floated the birr, ending years of strict currency controls. As with many countries with currency controls, repatriating money could be impossible.

Here’s what that looks like if you’re a foreign investor: you could invest $1 million in that country, make 10x but struggle to get your profits out of the country. We’ve seen this play out in Nigeria in 2021, with companies using unorthodox ways to get money out of the country.

If you make money in a country but can’t get it out, it might as well be monopoly money, and if you’re an investor, when you get your money out, you want to move to a country or region where FX policy is market-determined and predictable.

It’s unclear if that was Renew Capital’s experience in Ethiopia, but CEO Matt Davis concedes the firm learned lessons.

After 10 years of investment, it figured it would look to other parts of Africa. The VC firm now invests in asset-light and tech-enabled businesses in West Africa and North Africa. It has started its investment in West Africa by investing in Affinity, a Ghanaian digital bank.

Renew Capital invests through two funds: a $6 million angel syndicate and a $15 million follow-on fund. It invests between $50,000–$500,000 in startups in its accelerator, and gives a follow-up of $1.5 million to startups that meet its metrics set during the accelerator.

The VC firm employs an unusual method of vetting founders including giving founders exercises to see how they perform. The VC firm believes in backing founders who are trustworthy, focused, and very disciplined.

While Davis has learned a lot of important lessons in investing, he believes the biggest lesson yet is continuous learning.

To learn more (pun intended) about Renew Capital and its investment thesis, read the full interview here.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Regulation

Bank of Ghana to issue new VASP licences

Ghana wants to regulate its crypto industry. In a recent draft framework, the Bank of Ghana (BoG) outlined the processes that VASPs and other crypto players operating in the country must take to avoid regulatory non-compliance.

BoG said that the high popularity of crypto has made it necessary to regulate digital assets—deviating from its earlier stance to ban all crypto transactions. In a similar fashion to other African countries that have made plans to regulate crypto, Ghana will soon issue VASP licences to crypto operators in the country.

The released framework emphasises that Virtual Assets Service Providers (VASPs) must provide financial trading accounts, carry out customer due diligence to ensure risk compliance with anti-money laundering (AML) policies, and operate physically in the country.

BoG also stated that VASPs must apply for their licences within a specified timeline once its regulatory framework is finalised. Companies that do not apply within this period will be chalked up as operating illegally in the country.

It’s not surprising that cryptocurrency adoption has grown rapidly in many countries—especially in Africa—despite attempts to suppress it. When governments fail to regulate a technology that attracts many users, it often flourishes underground.

The mistake made by many African countries, and others worldwide, is their failure to understand cryptocurrency. Instead of trying to comprehend and effectively regulate it, they opt for the simpler but less effective approach of attempting to suppress it entirely. The changes now suggest they’re adopting another approach.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Companies

MTN liquidates Visafone

For those who nostalgically recall the names Visafone, Multilinks, and Starcomms, you’re likely part of a select group who lived through Nigeria’s early mobile era. These pioneering networks, the last of the country’s CDMA breed, relied on technology that now seems quaint, dwarfed by the speed and efficiency of GSM and LTE networks.

Before the NCC phased out CDMA in 2019, Visafone, the country’s last CDMA operator, had an 800MHz LTE spectrum licence needed for 4G mobile network services. Although the company was struggling and neck-deep in debts, MTN acquired it for ₦43 billion ($26.9 million) to use its 800MHz spectrum to launch fourth-generation Long Term Evolution (4GLTE) services which it would use to compete with Glo.

Jim Ovia, CEO of Visafone at the time said that acquisition was necessary as the company didn’t have the ingredients needed to compete with other telecom companies.

That partnership may have well served its cause. MTN’s financials for the first half of 2024 showed that the telecom has liquidated Visafone after recording losses of ₦30.3 billion ($18 million) on the 2016 acquisition.

The move marks the final chapter in Visafone’s journey.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

Economy

Kenya turns to eco-taxes to raise $1.2 billion

When Kenya’s president, William Ruto, called off the controversial Finance Bill in June 2024, protesters who took to the streets opposing the bill felt a sense of relief. The bill was going to tax Kenyans on everyday consumer goods like sanitary pads and bread.

Yet, there was still a nagging sense that they were not in the clear yet: Kenya’s financial books were still a mess. It still owes over $80 billion in domestic and foreign debts. It made little money in production and exports against the cost of importing goods, and its debt servicing figures were reaching new highs.

As part of the scrapped Finance Bill, the government proposed an “eco levy” to tax products that polluted the environment, including cars and sanitary pads. Now, in a subtle move it hoped would appease Kenyans, the eco levy will only tax nylons and plastic pollutants that degrade the environment.

The newly-appointed finance minister, John Mbadi who previously opposed the levy, is now of the opinion that the reformed eco levy—expected to be in place by September—could make Kenya up to KES150 billion ($1.2 billion) as it plans to raise money. But Kenyans are not having it. They have rejected the recycled tax idea, viewing it as a rehash of the Finance Bill.

Kenya is rightly in a hard place. But the poser for today is whether more taxes against the backdrop of a lack of production and low export capacity is truly the way out for Kenya?

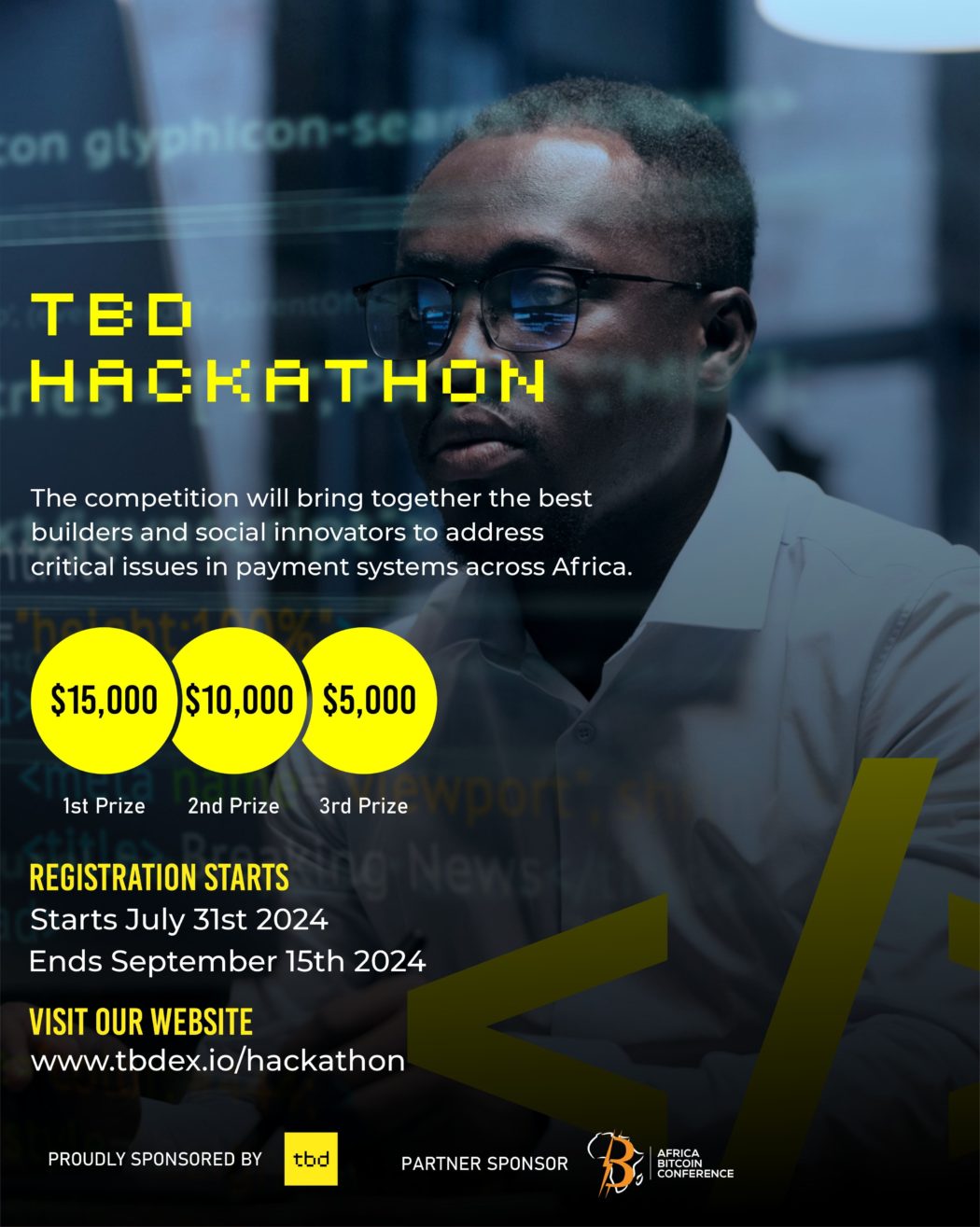

Win big in the TBD Hackathon

Calling all African innovators! Join the TBD Hackathon and revolutionise payment solutions in Africa. Do you have a passion for building solutions and shaping the future of finance? Build a payment app with tbDEX & win up to $15,000 in BTC! Apply by Sept 15

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $60,989 |

+ 4.03% |

– 9.19% |

|

| $2,665 |

+ 1.17% |

– 23.95% |

|

|

$1.73 |

+ 1.91% |

– 44.36% |

|

| $146.50 |

+ 2.54% |

– 15.57% |

* Data as of 05:55 AM WAT, August 20, 2024.

Events

- Difficulties within Africa’s economic landscape have raised questions about the feasibility of building successful startups on the continent. Iyin Aboyeji, a Nigerian entrepreneur who co-founded two companies valued at over $1 billion before the age of 30, is now a prominent startup investor. He is one of the featured speakers at Moonshot 2024, joining other innovators and industry leaders working on groundbreaking solutions to Africa’s most pressing challenges. Save your seat at Moonshot! Get tickets here.

- Step into the Future with AWS Community Day West Africa 2024! Are you ready to be part of the revolution shaping the next era of tech? Join the trailblazers, visionaries, and innovators who are pushing the boundaries of what’s possible. This is your chance to connect, learn, and ignite your passion alongside the brightest minds in the industry. Don’t just witness the future—be a part of it on September 27th & 28th. Register today.

- Kenyan Airways is profitable for the first time in a decade with $3.9 million in net profits from H1

- The Next Wave: Venture debt’s role in Africa’s startup ecosystem

- Swipe partners with Renmoney to provide instant loans through SwipeFlex

- Do we know enough about the health risks of new semiconductor factories?

Written by: Faith Omoniyi & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.