TGIF ☀️

It’s still salary week, and to help you spend your hard-earned coins wisely, we’re currently running a salary week discount for Moonshot 2024!

From now until September 5, you can get Moonshot tickets 20% off with the code MSVIP. Share this with your friends and help them save some cash.

Features

Quick Fire 🔥 with Dolapo Omotoso

Dolapo Omotoso is a Revenue Growth Director and marketing strategist leading TransferGo’s African expansion. With expertise in creative storytelling and community-led growth, she drives impactful growth strategies, leveraging her experience from customer success intern to senior leader in the industry.

Explain your job to a 5-year-old

Think of me like Santa Claus, but instead of delivering gifts from the North Pole, I deliver money. I help people who live far away from their family and friends send money to them every day.

You started as a customer success intern and now you’re a director at an international company. How did this happen?

I became the go-to person for difficult tasks and delivered excellent results. I also love learning and implementing new ideas. Most importantly, I was resilient and focused on understanding how the business works and how all roles contribute to the big goal.

How have these skills translated to your current job?

Everything matters. From learning patience and empathy during my time at Piggyvest to understanding crisis management as a social media manager, engaging a community as a content marketer, and knowing how to view growth—all of it contributed. No knowledge was wasted.

What drew you to remittances?

My sister. I wanted to build something for her, to make it easy for her to hold currencies that mattered to her. At some point, my friends moved away, and now I guess I’m building for them too.

What’s the most challenging aspect of your job?

Ensuring everyone is happy. From satisfying customers with the rates, service, and product, to adapting to new environments rapidly, localising strategies, and balancing the need for rapid growth—it’s a lot to juggle. This requires a deep understanding of each market, strong collaboration with local teams, and the ability to make quick, informed decisions that drive growth without compromising on quality or customer satisfaction.

What advice would you give anyone trying to enter the fintech industry from a non-finance or engineering background?

You are only as good as your foundation, so make sure it’s solid and grounded. Leverage communities and networks—don’t be afraid to network and learn. Being taught by people who have gone through what you’re dealing with is the easiest way to gain valuable, rare insights.

What exciting things are you working on now?

Right now, I’m leading growth in Africa, for TransferGo which is incredibly exciting. We’re expanding into new markets, like East Africa, and working on localizing our services to fit the unique needs of these regions. As a director, I get to shape the entire strategy. I’m also exploring opportunities to build and lead local teams. It’s a dynamic role that allows me to make a significant impact on the future of TransferGo in Africa.

What do you do outside work?

Turns out I love to yap. I had a mentorship class I was running with the Empowerher community and I find it interesting doing speaking engagements. I am passionate about connecting with people and sharing my journey. I did a bit with communities like the Non-Tech in Tech Community and some universities.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Crypto

Busha and Quidax receive provisional VASP licences

Nigeria’s softening its stance towards crypto wasn’t on anybody’s 2024 bingo card after the country dragged Binance to court in February for allegedly being complicit in helping unscrupulous people steal $35 million.

About two years ago, it implicitly banned crypto and asked all financial institutions to freeze accounts that did as little as mention “crypto” or used crypto-related words in their transactions.

But the country has made a U-turn since.

On August 29, the country’s Securities and Exchange Commission (SEC) issued crypto licences in principle to two crypto companies; Busha and Quidax. It has also onboarded five others to its Regulatory Incubator (RI) programme to learn about how Nigerians use crypto. These Virtual Assets Service Provider (VASP) licences will help crypto companies offer crypto services to customers including buying, selling, storing, and trading cryptocurrencies.

While Nigeria is rightly adopting crypto fast; trading it, storing it, or doing whatever else with it, for the government, controlling crypto is likely more than just this “catch the thief” outlook it’s portraying.

There are more than 30 crypto and crypto-related companies in the country. All of them, unregulated. This meant they were untaxed—or there wasn’t a proper structure for taxing them.

But with new crypto laws and regulations coming, Nigeria can collect money from these companies while still keeping an eye out for people misusing crypto.

There just leaves two questions: how did crypto companies in Nigeria avoid scrutiny pre-2024? Did simply being facilitators rather than participators in crypto over-the-counter (OTC) trades help these companies survive long enough?

Either way, we’re witnessing a Nigerian masterclass.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Economy

Zambia’s inflation hits 32-month high

For most African countries, changes in food prices are a major driver of overall inflation. This is because food constitutes a significant portion of the consumer price index (CPI), a key metric used to measure inflation. When food prices rise due to factors like extreme droughts that threaten food production, the headline inflation rate tends to follow suit.

And when an extreme drought threatens food production, prices of food go up, pushing inflation up a notch. This has been the case for Zambia where food makes up more than half of the inflation basket.

The inflation figure for August was 15.5% up from 15.4% in July. The country has been experiencing a severe drought that has blighted crops, leading to a 17.6% increase in food prices up from 17.4% in the previous month. The drought has also dampened hydropower generation, and hurt the nation’s currency due to increased costs of food importation.

To keep inflation under control, the Bank of Zambia held the interest rate at a seven-year high of 13.5%. The Bank now has its work cut out to get inflation to its 6-8% target.

Zambia’s situation is eerily similar to Zimbabwe’s where drought has increased food prices leading to the country’s first inflation increase since it changed currency in April.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

Insights

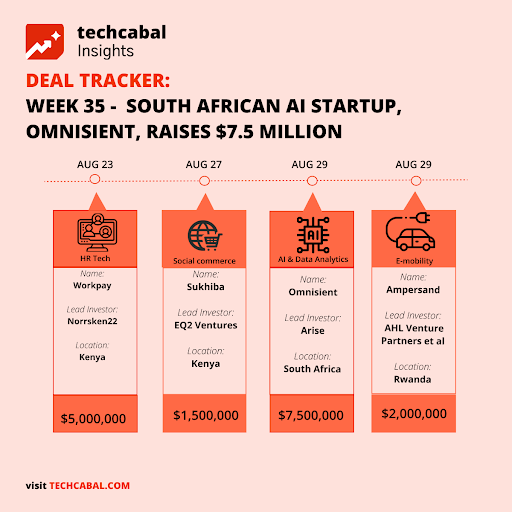

Funding tracker

This week, South African AI & Data-analytics start-up Omnisient raised $7.5 million in Series A from Arise. (August 29)

Here are other deals for the week:

- Rwanda-based e-mobility startup Ampersand received $2 million in new equity investments from AHL Venture Partners and Everstrong Capital and reinvestment from Beyond Capital Ventures. (August 29)

- Kenyan social commerce startup Sukhiba raised $1.5 million in a seed extension round led by EQ2 Ventures. Other investors, such as Accion Venture Lab, Musha Ventures, Quona Capital, and existing investor CRE Ventures, participated in the round. (August 27)

- Kenya-based HR Tech Workpay announced that it secured $5 million of Series A investment in a round led by Norrsken22. Participation came from Visa, Y Combinator, Acadian Ventures, Saviu Ventures, Axian, Plug n Play, and Verod-Kepple Africa Ventures. (August 23)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, our State of Tech in Africa H1 2024 Report is out. Click this link to download it.

Dive In Festival 2024: A Global Call for Change

Join the Dive In Festival 2024 on Sept 24 in Nigeria and Namibia! This global event features industry leaders, discussions on sustainability, and opportunities to connect with a community driving change. Register Now to join the conversation!

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $59,024 |

– 0.31% |

– 10.01% |

|

| $2,519 |

– 0.27% |

– 22.8% |

|

|

$5.45 |

– 2.11% |

– 19.11% |

|

| $139.27 |

– 3.08% |

– 22.14% |

* Data as of 06:05 AM WAT, August 30, 2024.

Events

- Resilience17 (R17) is launching an AI Accelerator to help ambitious globally focused teams build and launch AI products. The Go Time AI Accelerator is open to Nigeria-based companies. The accelerator offers up to $200k total investment with an initial $25k upfront (via SAFES with a $2.5m valuation cap), expert mentorship from industry veterans and technical gurus, technical and business growth support, access to API & Cloud credits, housing credits, delicious team meals, and a vibrant workspace in Victoria Island, Lagos. Apply by September 13.

- The Africa Prize for Engineering Innovation is open to African innovators creating engineering solutions to local challenges. Innovators from sub-Saharan Africa should pitch viable engineering products or services that will have social or environmental benefits to the continent. Apply for the chance to get up to $25,000 in funding.

- The Future of Capitalism Tech Startup Competition is offering $1 million to one lucky tech startup that can transform how businesses today operate. If your tech can save costs, boost efficiency, increase productivity or customer satisfaction, then apply by September 30 for a chance to win.

Written by: Faith Omoniyi, Stephen Agwaibor & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.