When Mira, a Nigerian fintech that helps restaurants receive payments, launched its QR code payment system in January 2024, it wanted to change how people make restaurant orders.

By allowing anyone to scan a QR code, check out a list of meals, and pay through bank transfer, Apple Pay, or a card, it eliminated the need for repeated interactions with the restaurant’s wait staff.

Mira soon learned restaurants wanted something slightly different but familiar: a point-of-sale management system tied to hardware. It led to the launch of the Mira register.

Priced at ₦360,000 ($226), Mira register has two displays, a receipt printer, a barcode scanner, Bluetooth and Wi-Fi. It tracks customer orders and internal business processes. The device comes with a Budpay or VFD embedded account to receive payments. Food delivery apps like Chowdeck and Glovo are also integrated with the hardware device for order fulfillment.

Mira charges a monthly subscription fee ranging from $5 per restaurant location for its basic plan to $500 for larger restaurants in its enterprise plan. It charges $30 for its pro plan and a 1% transaction fee on payments made on Mira Register.

“We started with the simplest form (order management system) to get us into the hospitality space,” said Ted Oladele, Mira’s CEO.

Mira initially offered restaurants a plan to pay for the device in 12-month installments, but most restaurants preferred to pay full price upfront. These businesses already pay upfront for Orda, Louverse, Workman, and Omega POS, Mira’s competitors.

While those competitor devices need internet access to run smoothly, Mira claims it uses a hybrid approach that allows restaurants to operate the product with minimal internet connection.

“There is a reputation deficit for local players. We are trying to enter the market with a reputable product,” said Oladele.

Feranmi Adejumobi, co-founder at Ni Fries, claims Mira’s most valuable feature is its dashboard’s detailed inventory tracking data.

“The Mira dashboard allows us to track inventory levels and calculate the amount of food we can produce efficiently,” said Adejumobi. He claims the dashboard allows businesses to collect data points that can inform their pricing strategies and overall profitability.

Despite its claim to a better product, Mira faces an uphill climb in overcoming the switching costs for businesses who may already use its competitors’ devices.

The startup serves a mix of SMEs—restaurants and retail stores—and counts Olaiya Foods, Grey Matter, The Vault, NiFries, OTP Kitchen, and Ashluxe as customers. Mira currently serves about 200 businesses across Nigeria.

Since its launch, Mira has processed over $500,000 in transactions since launch, earning most of its revenue from businesses on its enterprise plan.

“We are more expensive than the average local competitor. We don’t fight on pricing,” said Oladele.

The startup raised $200,000 in a family and friends round and is in the middle of a seed round.

While some customers who spoke to TechCabal experienced occasional glitches on the device, they are typical for startups in the early stages of development. Oladele claims the startup constantly seeks customers’ feedback and occasionally gets requests to build custom features. ‘

While Oladele agrees that building custom solutions for users on request might be a slow approach for a venture-backed startup, he thinks it is a necessary step to building a superior product.

As Mira expands its service offering and looks for product differentiation, Oladele’s goal is to attract a 10% market share which will make the business profitable.

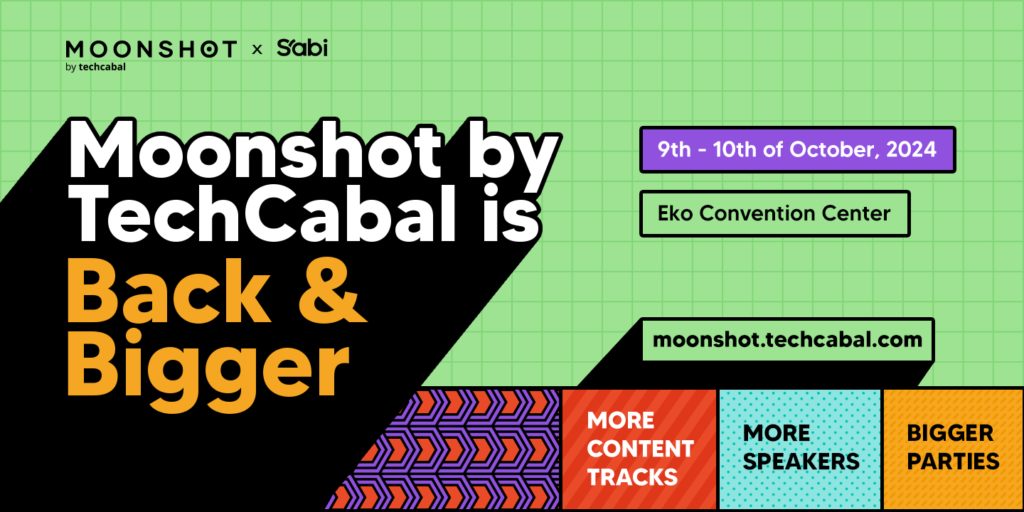

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!