What if interest wasn’t the only catch with your savings? Worldpay’s ‘Global Payments Report 2025 revealed that Nigeria remains a cash-heavy economy (40% of 2024 POS value), with credit facilities making up less than 2% of Nigeria’s digital payments. This leaves Nigerians in a financially unique position where they need to set money aside to make significant purchases.

ALLYCare by BAS is redefining how Nigerians save, offering interest rates of up to 20% per annum and access to premium hospitals at no extra cost. The Nigerian fintech company provides a platform that allows Nigerians to save money while having access to health coverage ranging from basic services like treatment of primary ailments to more premium services such as surgeries and antenatal care.

ALLYCare’s save-to-insure model

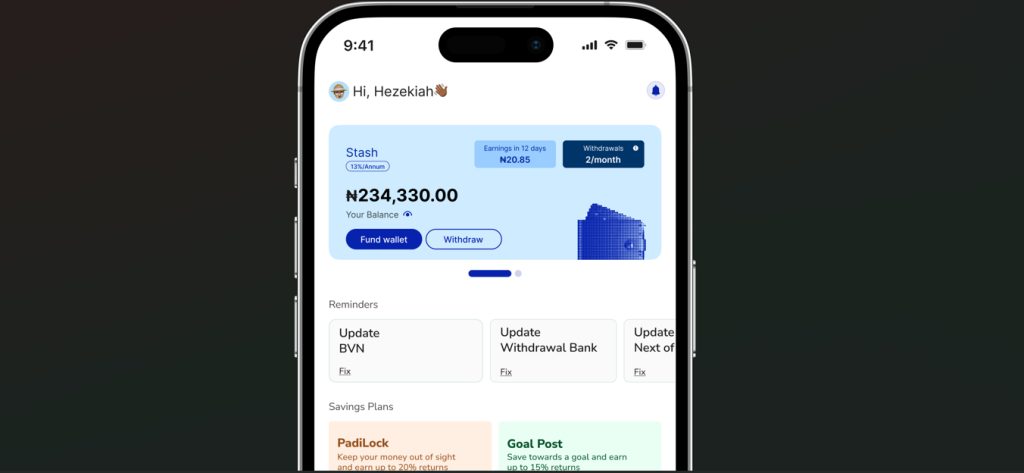

The savings mobile app offers a range of features to support users’ saving goals, such as Padilock, GoalPost, and Stash. With Padilock, users can save for as low as 30 days or as long as they wish, and get healthcare benefits as well. For instance, Martins, a 9–5 professional who sets aside money for his yearly house rent with the Padilock feature, automatically qualifies for healthcare access at no cost.

On the other hand, Goal Post users can save towards any specific goal, such as rent or fees. The fintech also allows users who save up to a specific amount and earn their interest instantly, at maturity, or in monthly instalments.

One feature called Total Care enables up to four users to save at once, allowing them to benefit from more premium healthcare coverage options. These include specialist consultations, surgeries, dental care, family planning, mental care, and gym access for up to four people. For more flexible saving options, ALLYCare offers Stash, which allows you to make occasional withdrawals while you save and earn interest daily.

CEO and Co-founder of ALLYCare, Iromara Victor says, ‘We started with a question: how can one of humanity’s oldest habits, saving money, be rebuilt for a world where health needs and financial shocks can come without warning? We created a growth engine that lets savings earn daily, build wealth for Nigerians, and hedge funds against inflation. Saving is no longer just setting cash aside; with ALLYCare, it becomes an active, protected system built to secure health and wealth for every Nigerian family and to serve an entire generation long into the future.”

The savings app, backed by BAS Group, a financial ecosystem and technology company based in Abuja, promises healthcare security built into your savings with a range of health coverages to meet your savings goals. ALLYCare is SEC-licensed and regulated by the National Information Technology Development Agency (NITDA), National Health Insurance Authority (NHIA), and the National Insurance Commission (NAICOM). To get double-protection with ALLYCare by BAS, download the mobile app on your App Store for iOS, or the Play Store for Android devices. For more information, visit ALLYCare.ng.