For years, owning a new smartphone in Nigeria has meant one of two things — paying the full cost upfront or settling for an older model. But the growing fusion of fintech and consumer electronics is changing that story.

This month, Credit Direct Checkout and VIVO unveiled a first-of-its-kind partnership that allows Nigerians to own the new VIVO Y21d with just a 20% down payment — the most flexible smartphone financing offer yet from a regulated credit provider.

It’s a major leap for smartphone financing in Nigeria, and an early sign that digital credit innovation is becoming central to how Nigerians shop for tech.

VIVO Y21d: Designed for Everyday Power

The VIVO Y21d brings premium specs to the mid-range market — proof that performance and affordability can coexist.

The device features a 6.68-inch 120Hz display, dual stereo speakers, and a 50MP Ultra HD AI camera for crisp, intelligent photography. Powering it all is a 6500mAh battery supported by 44W FlashCharge, giving users a full day of productivity and entertainment with minimal downtime.

Available in Coral Red and Jade Green, the Y21d offers three variants to suit every budget:

- Y21d (4GB RAM + 128GB) – ₦199,800

- Y21d (6GB RAM + 128GB) – ₦219,800

- Y21d (6GB RAM + 256GB) – ₦239,800

It’s sleek, powerful, and surprisingly affordable — but the real innovation isn’t in the hardware. It’s in how Nigerians can now buy it smarter.

How the Credit Direct Checkout Model Works

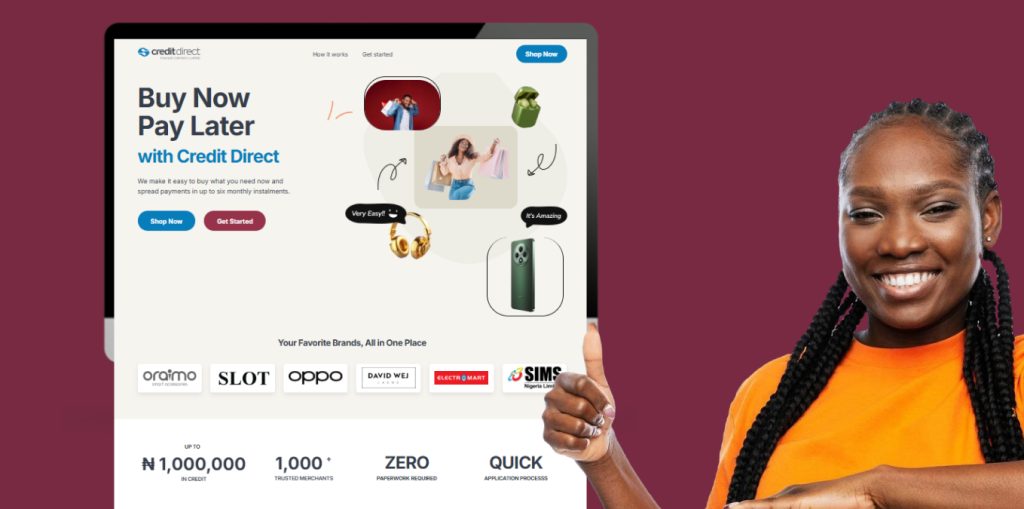

Credit Direct Checkout is a buy now, pay later (BNPL) solution built for Nigeria’s retail market, connecting customers to flexible financing directly at the point of purchase.

In this VIVO partnership, shoppers can pay only 20% upfront, down from the usual 30%, and spread the balance across 1 to 6 months. There’s no collateral required, and approvals are almost instant through the Credit Direct system.

Credit Direct Checkout gives customers multiple ways to complete their smartphone purchase — online, in-store, or through verified social media channels — all with the same convenience and flexible payment plan.

Here’s how it works in simple steps:

- Check Your Credit Limit: Visit the Credit Direct Checkout website to see how much financing you qualify for.

- Shop Your Way: You can either

- Visit an authorized store such as SLOT, POINTEK, FINET, or 3C HUB, or

- Go directly to a partner vendor’s website and select Credit Direct Checkout as your payment option at checkout.

- Choose Your Device: Pick your preferred VIVO Y21d model and color.

- Complete Your Payment:

- In stores or via social media pages, you’ll receive a secure payment link to pay your 20 percent downpayment and select your repayment plan.

- On partner websites, you simply choose Credit Direct at checkout and pay directly — no link required.

- Get Your Phone: Take home your brand-new device and pay the balance in convenient monthly installments.

For instance, the most affordable model, priced at ₦199,800, can be yours with just ₦39,960 down payment, with the balance of ₦159,840 spread over flexible repayment periods.

This approach gives users financial breathing room while unlocking access to premium technology — a win-win for both consumers and the ecosystem.

Why This Matters for Nigeria’s Digital Economy

Nigeria’s smartphone penetration continues to grow, but affordability remains a major bottleneck. By leveraging BNPL infrastructure and digital credit scoring, Credit Direct Checkout is addressing one of the biggest barriers to tech access, which is upfront cost.

This partnership signals a shift toward embedded finance in retail, where credit, payment, and purchase happen seamlessly in one customer journey. For a country with over 120 million smartphone users, initiatives like this can accelerate digital adoption and inclusion.

Moreover, by working with established OEMs like VIVO, Credit Direct is proving that responsible BNPL models can thrive when backed by credible credit institutions rather than unregulated third parties.

The Bigger Picture: Making Digital Credit Work for Consumers

Beyond convenience, Credit Direct’s BNPL model demonstrates what customer-first fintech innovation looks like. It’s about access and financial empowerment.

By offering lower down payments, clear repayment structures, and transparent terms, the company is positioning itself as a leader in responsible digital lending. This aligns with Nigeria’s broader push toward ethical credit systems that help consumers build trust and long-term credit value.

As digital finance matures, partnerships like VIVO × Credit Direct Checkout could redefine how Nigerians interact with both credit and technology — merging financial inclusion with consumer lifestyle.

Final Thoughts

The ability to buy the latest tech with a 20% downpayment is more than a retail perk — it’s a glimpse into the future of Nigeria’s digital credit ecosystem.

By merging consumer electronics with fintech infrastructure, Credit Direct Checkout isn’t just making smartphone ownership easier; it’s reshaping access, affordability, and trust in Nigeria’s digital economy.