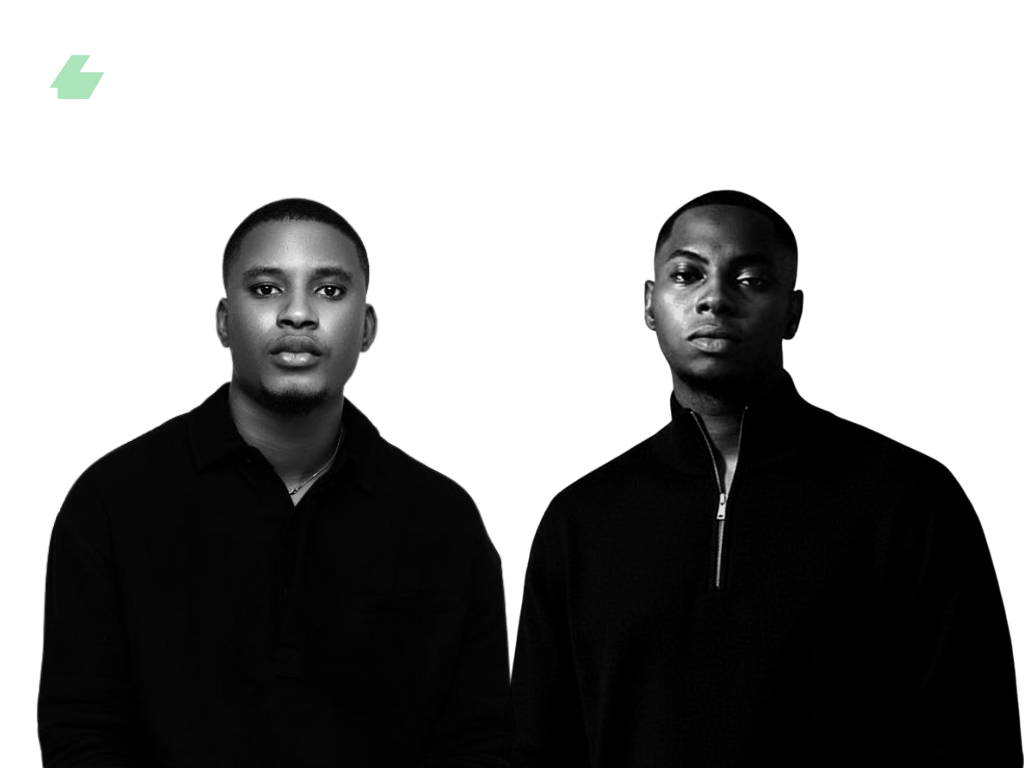

Chatbramp is the type of bold and radical innovation that should be encouraged in the Nigerian tech industry. The small startup is the brainchild of two Computer Engineering graduates from Nnamdi Azikiwe University, Awka, Anambra State of Nigeria. The CEO and Co-founder, Chibuike Nwogbo, is the former head of marketing for the rapidly expanding crypto exchange Obiex. Backed by his former boss, Chibuike resigned from his role at Obiex to build a different startup than Chatbramp. He initially reached out to Victor Lamja, who was running his own IT firm fresh out of university at the time, about building an AI accounting tool for African crypto traders. After building for some months, the team realized that their available runway wasn’t sufficient to build this type of complex product, but instead of trying to raise more money, they took a different but bold approach: they chose to pivot.

Chibuike remembers it to be a long and dry period- “It was almost like we were in a desert with no compass and our water was running dry.” The team is grateful for this period as it pushed them to a level that only births innovation. Until now, people have referred to the Nigerian fintech space as a copy-and-paste industry with everyone doing the same thing. While this isn’t 100% true, the world is changing and Chatbramp wants to reinvent how people interact with products. Part of the team’s doctrines for new employees is a depth of expression that can be channeled into their work in making finance more interactive and truly personal.

The company focuses on making crypto payments possible in African retail stores by acting as a bridge between crypto and fiat in the region. It’s worth noting that many other startups have tried to enable crypto, especially stablecoin payments, in retail stores across Africa, but the problem with this method is that it creates friction with regulators, and seeks to change a system that has taken so long to adopt and trust. Chatbramp wants to do it differently: by facilitating crypto payments in a way that guarantees the merchant receives naira and the Chatbramp user only spends their crypto, they are bridging the on-chain and off-chain economy.

Chatbramp aims to tap into the over $205 billion sub-Saharan crypto market and the $1.68 trillion payments market in Nigeria that is presently dominated by the likes of Opay and Moniepoint. By enabling seamless buying and selling of major cryptocurrencies including BTC, ETH, SOL, USDC and USDT, Chatbramp is positioning itself as a reliable option for people who prefer to remain on-chain

The presence of AI in Chatbramp is new and refreshing. It integrates new technology into products in ways that are useful to the average user, but have never been seen before in the ecosystem. Chibuike has said that the team is working hard at improving the capabilities of the assistant in the coming months. “We are the first, what you might call, AI Crypto exchange, so the path is not exactly paved for us, but we are working on sensible integration of AI tools into the product to facilitate crypto payments in Africa.”

With so much chatter about AI in recent months, the Bramp team remains adamant about building around the new technology. “It’s the future, and luckily for our users, they get to experience what the future of finance looks like when they use Chatbramp” Lamja said when asked about the AI integrations in the product.

It remains to be seen what next this young startup will roll out, but so far the features on Chatbramp feel different but useful.