Cardtonic is a leading fintech platform that primarily focuses on solving consumer-related financial issues in Nigeria. This involves helping Nigerians make global payments with virtual dollar cards and converting their international gift cards to cash.

However, the company noticed a gap that causes most businesses headaches: they struggle to find reliable cards that work for large payments.

Whether they are trying to pay for tools, software subscriptions, or running ads, they often face frustrating payment issues. They are either stuck with unreliable bank cards that fail when they want to make urgent payments, struggle to fund their cards, pay high transaction fees, or face unpredictable limits and restrictions. In fact, Cardtonic also struggled with the same payment issue for years.

Inspired by this problem, Cardtonic decided to create an entirely new, standalone product, Pil, to enable businesses to make large payments and track expenses with ease.

What is Pil by Cardtonic?

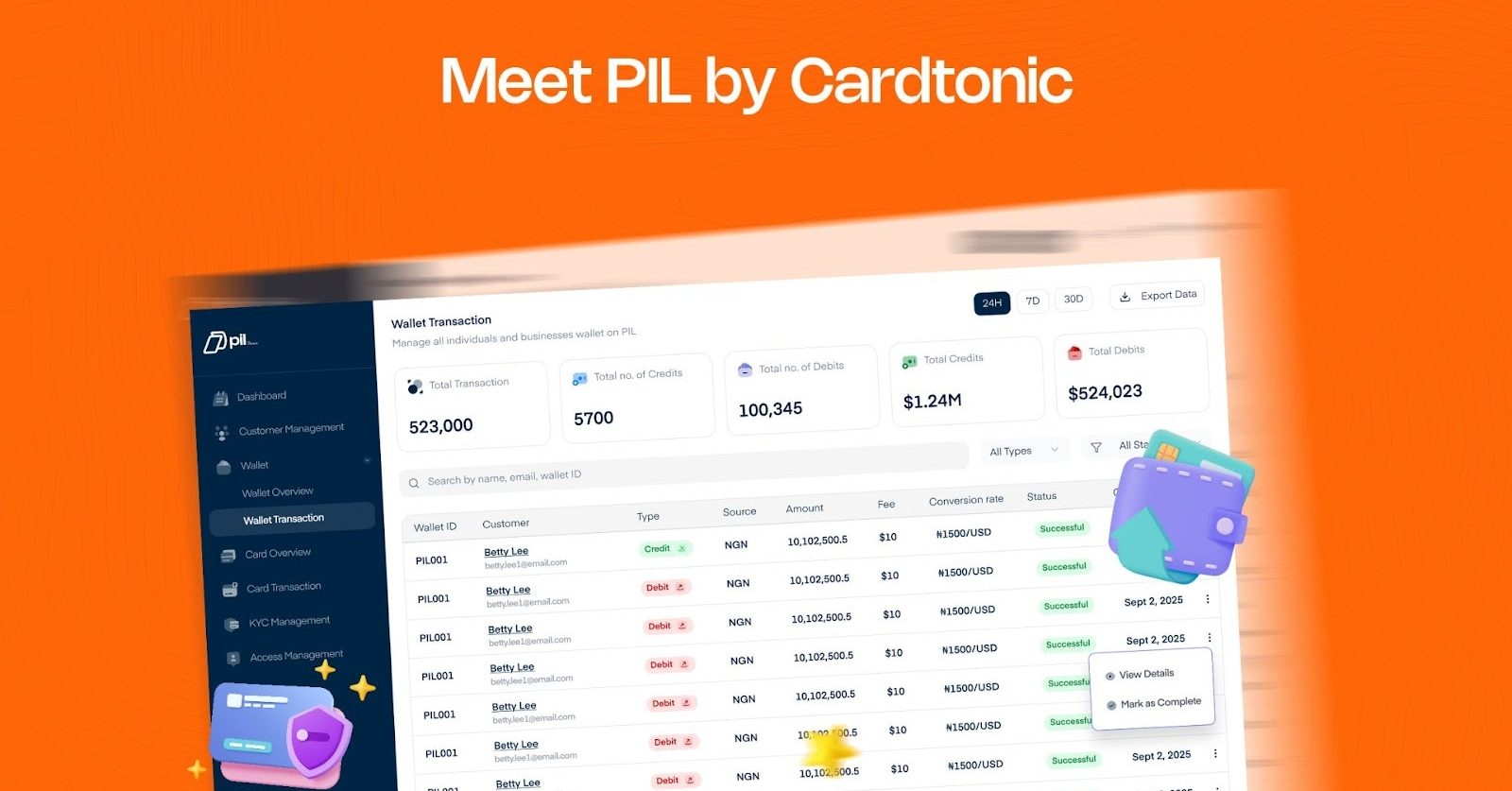

Pil by Cardtonic is a business-grade virtual dollar card platform that enables businesses and marketers to make global payments with ease and track expenses from a web-based dashboard.

It is designed to handle high-volume operations for businesses, allowing them to create and fund cards in local currencies (naira or cedi) or stablecoins such as USDC and make large payments without restrictions.

With Pil, marketers can run ads without any payment issues getting in the way, businesses can pay for software subscriptions, procurement teams can generate cards for specific vendor payments, and accounting teams can track expenses.

Pil by Cardtonic: The idea, source, and the structure

Pil by Cardtonic didn’t stem from a random urge to create a new product. Instead, it was built from a place of real pain points that Cardtonic has been struggling with for years.

Cardtonic spends heavily on running ads and paying for tools and software, yet making payments for these services often feels like a gamble. Most bank cards have unpredictable limits, are hard to fund, and often fail when you need to make urgent payments, even the ones with ridiculous fees.

After struggling with this same issue for years, Cardtonic decided to build an internal tool, which later expanded into a custom solution, Pil, for many other businesses facing the same issue when they make large payments.

However, for a global-scale solution like Pil to serve thousands of businesses, it needs to run on firm infrastructural systems, which come with a hefty price tag. Relying on founders’ capital and company revenue to fund Pil is impractical, even though Cardtonic has been running on it from the onset. To make Pil grow and scale quickly, Cardtonic raised $2.1 million from investors who are also interested in building this solution.

Pil is a B2B business model, whereas the current services Cardtonic offers are B2C, which means their structures and decision-making processes differ. Businesses need virtual cards with extensive and customisable controls, and primarily spend based on recurring expenses. However, individuals often require virtual cards for basic payments, and their decision-making process is based on personal needs.

For both products to grow and serve their target users, they need to exist under separate entities. Therefore, Cardtonic had to build Pil as a standalone product.

How Pil is revolutionising spend management for businesses

Most businesses don’t fail because they have bad products; they fail because they lack clear visibility into how cash flows. However, Pil is revolutionising this system for businesses, making it easy not just to make payments but also to have clear visibility into every expense.

With Pil, businesses can instantly create multiple cards for various departments or projects with appropriate limits and restrictions to monitor spending. For instance, they can create a SaaS subscription card to make payments related to SaaS subscriptions only.

Administrators can also allocate budgets to prevent overspending, receive instant, detailed transaction data, and track spending patterns.

Future outlook of Pil by Cardtonic

Pil is already built on a solid foundation: helping businesses with heavy expenses make payments with ease.

However, the future is much bigger with advanced tools and functionalities such as integration with automated expense flows and accounting software like Xero and Zoho. The team is also planning to create physical cards and an API that businesses can easily integrate into their systems.

With a solid foundation and clear roadmap, Pil is on track to become the operating system for businesses, marketing agencies, and startups with high-volume operations.