Two years after crypto excitement hit Africa, there has been a painful return to earth. Prices and trust are low, and the promise that crypto would help Africans escape poverty now needs re-examination.

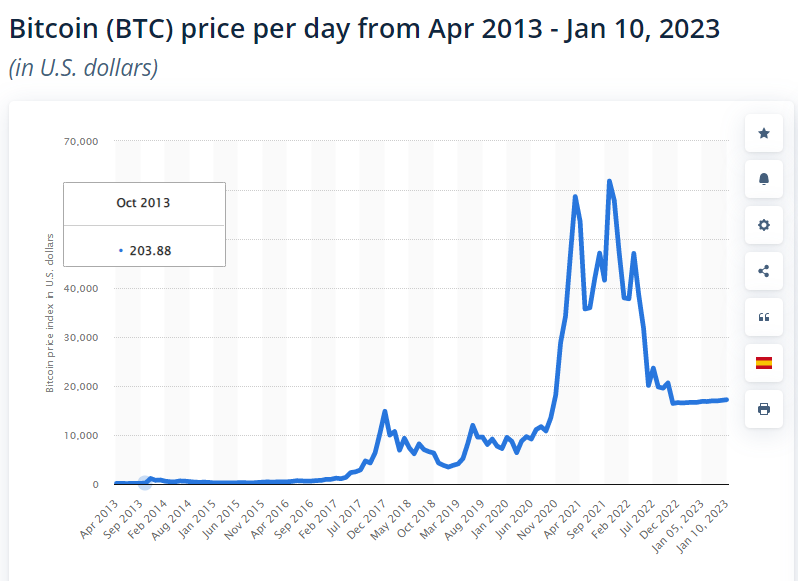

In November 2021, bitcoin (BTC) hit an all-time high value of $65,000, while ethereum (ETH) also hit an ATH of $4,815. The prices reflected the market’s optimism, driven partly by news in early 2021 that Tesla would accept payments in bitcoin and convert part of its balance sheet to crypto. Africa was not left out of the excitement. A big part of the crypto promise for Africa was that it would bring prosperity to the continent. That promise took hold. The peer-to-peer lending platform, Paxful, claimed its data showed in 2021 that Africa was leading the “global cryptocurrency adoption.”

Africa welcomes crypto with open arms

In 2018, articles like this predicted that crypto would find acceptance in Africa, citing hyperinflation in many African countries and the difficulty of sending money to the continent. Those predictions panned out, and in 2020, a two-year bull run followed, validating crypto’s promise of prosperity. Speculative trading, holding USDT as a hedge against local currency inflation and, later, stake-to-earn and high-yield crypto products, became popular among Africa’s crypto-conscious. The consensus was that those were the early days, and prices could only go up.

Beyond cryptocurrencies, non-fungible tokens (NFT) also captured the imagination of African creators who, before then, had not enjoyed easy access to global markets. In March 2021, TechCabal published this article about a Nigerian artist who sold $750k worth of NFT art that he made on Microsoft Word. In March 2022, TechCabal’s Damilare Dosunmu argued that NFTs had found their biggest mainstream proponents in Africa. Here’s an excerpt from his article:

“The past few days have been good for NFT in Africa—Nigeria and Ghana, to be precise. From a group of Ghanaian pallbearers who just became millionaires to the old Nigerian street drummer who now has thousands of naira in the bank, everybody can see the manifestation of cryptocurrency’s promises: decentralised economy and borderless accessibility of wealth.”

Crypto winter cools excitement

Despite the promises of long-term wealth, crypto proved that it is not immune to global economic pressures. As the excitement of 2020 and 2021 waned, crypto prices started to slide, and like we’ve all learned in the past year, it’s easy to be a genius in a bull market. As inflation rose globally, bitcoin prices fell, and crypto startups struggled. Crypto lenders, Celsius and Voyager, were the first to fall, and the implosion of FTX remains high drama. This week, a Forbes report claimed that Binance is bleeding assets, with $12 billion gone in under 60 days.

At the start of the year, Coinbase announced another round of layoffs this week, firing 950 employees. It’s similar to the situation in Nigeria, with crypto exchange Quidax laying off 25% of its workforce in November 2022, citing difficult global conditions. A few weeks later, the crypto payments startup, Lazerpay, also laid off employees after failing to raise funding. But the biggest shock came from Nestcoin, a startup that received $6.45 million funding to “accelerate crypto and Web3 adoption in Africa and frontier markets”. The startup laid off employees after it lost an estimated $4 million in FTX’s collapse.

How will Nigerian startups weather crypto winter?

Emmanuel Njoku, Lazerpay’s CEO, believes that the narrative that crypto would provide wealth for Africans is misinterpreted. “People interpret crypto’s promise of wealth to mean an increase in the price of ETH or BTC. What crypto will do for Africans is give us the freedom to earn money. Thanks to crypto, we have access to a global economy; the argument is that you can build for the world.”

Yet he admits the hurdles crypto startups now face in Africa with a loss of trust because of incidents like the FTX implosion. “Today’s market conditions are a wake-up call for people in crypto to think about building actual use cases. We’re past the phase of hype. Building utilities and use cases are the stage we are at.”

Where does this leave creators?

Seni Oremodu, a growth marketer who works with crypto startups, agrees that the speculation in the NFT space in 2021 was problematic. “A lot of speculators in the space were in it to spike prices and got quick profits. It meant that it wasn’t always easy for projects with real value to stand out. Today, most of those speculative elements are gone, and we’re seeing more honesty from creators. I think real artists will always make money.”

Bolarinwa Oladimeji, an artist from Nigeria who admits that creators made money and names for themselves during the NFT boom. She told TechCabal that the “NFT space isn’t as vibrant as before, and sales are harder to come by.” For her, the loss of interest in the space is because people burnt their fingers investing in “bad projects.” Those losses have led to more scrutiny and paranoia; no one wants to lose money again.

According to Bolarinwa, “What you’ll get from a sale of 0.5 ETH in January 2022 isn’t what you’ll get now. It’s more difficult to make sales now. People aren’t FOMO-driven anymore, and you need to put in a lot of work or have clout in the space to sell your project these days.”