Read this email in French.

IN PARTNERSHIP WITH

Good morning ☀️

If you noticed our new logo and wondered what’s up, it’s because we’re turning 10 this month!

Ten years ago, the first TechCabal story went live. We could look in Google Analytics to know how many people read our first article the week it dropped—we’re guessing, not a lot. But we kept at it.

We had one job: to tell the world the most impactful stories about Africa’s tech ecosystem, and that we have done. We’ve gone to watering holes where founders are gathered and talked to them about what they are building; we’ve organised events of our own and asked founders to come document their stories with us, about how their innovations are changing lives around the continent; and, all this time, our daily reporting has stayed on top of pivotal events in the tech ecosystem in Africa.

Happy birth month to us! 🎉 To celebrate, we’ve put together a hamper of giveaways and delightful social content, which we’ll be rolling out for you throughout this month.

Are you still sitting down? 🥳

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$22,452 |

+ 0.48% |

|

Ether

|

$1,570 |

+ 0.35% |

|

BNB

|

$291 |

+ 0.13% |

|

Solana

|

$21.27 |

+ 1.26% |

|

|

Source: CoinMarketCap

|

|

* Data as of 18:00 PM WAT, March 5, 2023.

FLUTTERWAVE INVESTIGATES SECURITY CONCERNS

According to tech publication Techpoint Africa, fintech unicorn Flutterwave, in February, reportedly suffered a hack by culprits who transferred about ₦2.9 billion ($6.3 million) from the startup’s account.

Flutterwave, however, has promptly denied that a hack occurred, stating that it only noticed and reported an “unusual trend in transactions”. The fintech has also assured the public that all user funds and financial information are safe and secure.

“During a routine check of our transaction monitoring system, we identified an unusual trend of transactions on some users’ profiles. Our team immediately launched a review (in line with our standard operating procedure), which revealed that some users who had not activated some of our recommended security settings might have been susceptible,” the statement read.

Per TechPoint, the money was initially transferred to 28 accounts over 63 separate transactions. The fintech also allegedly filed a police complaint listing bank accounts the funds were disbursed.

Following the complaint, the fintech, via the Nigerian police, has filed a suit indicting 27 Nigerian banks and financial institutions—including PiggyVest, Nomba, Opay, PalmPay and Eyowo— who are allegedly complicit in helping disburse the funds.

So far, the courts have frozen 107 bank accounts in relation to the transfer. Several affected users, who claim to have no connection to Flutterwave, have taken to social media to complain about the freeze.

Zoom out: This news comes barely weeks after the fintech recovered Ksh7 billion ($59 million) which was frozen by the Kenya Revenue Agency (KRA) in 2022 in relation to financial impropriety accusations. It is unclear at this point what security settings left users’ accounts susceptible.

Receive money from family and friends living abroad in minutes this holiday season with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

NIGERIA RULES TO KEEP OLD NOTES

On Friday, the Supreme Court of Nigeria passed a ruling to keep the country’s old notes in circulation till December 31, 2023.

ICYMI: In October 2022, the Central Bank of Nigeria (CBN) announced redesigned currency notes for its old ₦200, ₦500 and ₦1,000 notes. Citizens originally had till January 31, 2023, to submit all old notes to commercial banks.

After numerous requests, the deadline was extended to February 10 due to a scarcity of new and old notes. Right before the extended deadline was up, the Supreme Court passed an injunction to temporarily halt the country’s pending ban on its old ₦200, ₦500 and ₦1,000 notes.

The CBN, and the federal government, however, ignored the ruling and continued to enforce the ban.

Days after the Supreme Court’s injunction, President Muhammadu Buhari, in a national broadcast, ordered the CBN to release only old ₦200 notes, disregarding the apex court’s injunction.

What’s stopping CBN from ignoring this order?

With the ignored February injunction, many argued that the Supreme Court had no jurisdiction over the CBN.

This time, however, the Supreme Court has reportedly proven its authority. The apex court has proven that the tight deadline contradicts CBN’s own regulatory act; Section 20 of the CBN Act of 2007 states that reasonable notice should be given in times of currency redesigns, and two months, according to the Supreme Court, is not reasonable notice enough for a country with over 200 million inhabitants.

KENYA LAUNCHES NEW TAX-MONITORING SOFTWARE

Under the new Ruto administration, Kenya is planning to generate Ksh3 trillion ($24.1 million) in taxes in the 2023/24 financial year, and Ksh4 trillion ($32.3 million) over the medium term.

To achieve this, its tax regulatory agency, the Kenya Revenue Authority (KRA), has launched a new tax-monitoring software: the electronic Tax Invoice Management System (eTIMS).

In January, the government hinted at the new software which it said would help curb the country’s high tax evasion rate by monitoring mobile money transactions which over 90% of Kenyans use for trading.

eTIMS, however, will do more than just monitor mobile money transactions. Per The Standard Business, Kenya’s ETR is an invoicing and reporting tool that will allow the KRA make tax assessments even before taxpayers file their taxes. All transactions subject to value-added tax (VAT) will be tracked by the KRA in real time.

“The new system will improve compliance with VAT law through transparency and visibility of transactions subject to VAT,” said KRA deputy commissioner George Obel in an interview with The Standard Business. “This system will also narrow the field for fictitious input VAT claims.”

While a full rollout is expected to take place in April 2023, the KRA has urged all taxpayers and businesses to onboard themselves on the eTIMS platform or risk paying a fine of up to Ksh1 million ($7,800).

eTIMS currently has Windows and Android apps, as well as online and lite versions so users can file taxes on various devices.

Curacel Grow helps you easily embed insurance with your products and on your platforms to build trust, increase customer loyalty and grow revenue.

Visit Curacel.co to learn more and get started.

This is partner content.

MFS AFRICA PARTNERS WITH WESTERN UNION

Africa’s largest digital payments network MFS Africa has announced a partnership with Western Union.

Per the partnership, users of the MFS Africa platform will be able to receive money from over 200 countries in their mobile wallets. MFS Africa reportedly connects over 400 million mobile money wallets and 200 million bank accounts across 35 African countries.

Western Union, on the other hand, has a presence in over 200 countries and territories, with 150 million customers. It is also one of the preferred and accessible payment methods for sending money from other countries to Africa.

The partnership will launch its service first in Madagascar before expanding to other African regions.

“Our efforts to drive global financial inclusion mean delivering on customer needs today and into the future. Through our partnership with MFS Africa, we are excited to come together and deliver on our joint commitment to bring innovative solutions for customers as they support their families and accelerate their momentum up the economic ladder,” said Hassan Chatila, the global head of account payout network at Western Union.

For MFS Africa, the partnership brings it closer to its vision of having a presence in all 54 African countries, and serving 500 million people and millions of MSMEs. The partnership also comes eight months after it announced the close of a $200 million Series C round.

TC INSIGHTS: GATEKEEPNG DIGITAL LENDING IN AFRICA

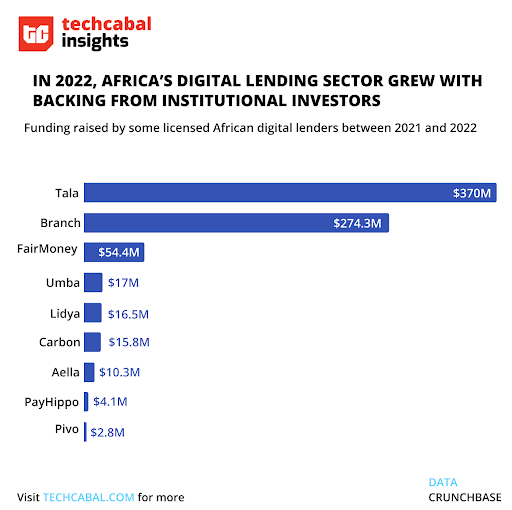

With a fast-growing digital finance consumer market in Africa, digital lending offers alternative funding options to Africans with flexibility and speed. This sector has also attracted large sums of investment to become a key growth driver in revolutionising the continent’s overall consumer credit market. According to surveys by the Commonwealth Chamber of Commerce, 40% of Africans prefer online financial platforms, contextualising the 102% increase in online alternative financing from $104 million in 2017 to $563.8 million in 2022.

By deploying credit-worthiness models based on borrowers’ data, digital lending startups have become attractive to small businesses and individuals looking for quick loans. These startups have grown with strong investors’ backing.

There is not enough legislation on the regulatory framework for companies offering digital lending services in most African countries. Kenya and Nigeria are two of the most prominent African markets for digital lending, where most loan apps belong to unregistered and unlicensed tech companies making users susceptible to privacy abuse.

However, efforts to crack down on the illegal operations of unlicensed digital lenders have not brought the desired outcomes. But Nigeria’s regulator had fully or conditionally authorised the operations of 106 digital lenders as of January 2023. Also, the Central Bank of Kenya (CBK) has approved only 22 in its country, while nearly 300 startups await the apex bank’s approval.

Babatunde Akin-Moses, co-founder and CEO of Sycamore, a peer-to-peer lending platform, says while the regulation of Africa’s digital lending sector is experiencing a state of awakening, the sector is currently receiving attention. “Thanks to a wave of alleged consumer complaint claims in the form of abusive follow-up messages to borrowers who default on loans. This is a big part of what has led to the recently increased oversight by regulators, but there is also the slow pace and high cost of regulatory compliance.”

He however believes there are several products and services that the digital lending market needs that the licensed entities are not able to deliver based on regulatory constraints. “When you have such unmet demand in a big market, some will likely step in to plug this gap in ways that may blur the lines between being fully regulated or otherwise,” Babatunde told TechCabal via email.

Meanwhile, the app marketplaces like Google PlayStore and Apple AppStore wield significant powers with their market share to impose regulatory standards on African digital lenders and remove unlicensed apps. For instance, Google PlayStore is the biggest platform for discovering digital services in Africa. And since January 31, 2023, Google has strengthened its screening process to mandate digital lenders to obtain approval from local regulators.

While it is necessary to tackle the illegal operations of digital credit providers, an attempt to create excessively stringent laws will not only stifle the market but also limit the funding to small businesses and individual consumers in a tough economic environment. Regulators and digital lenders must work together to accelerate the transformation of Africa’s financial lending markets towards equitable and fair digital lending.

IN OTHER NEWS FROM TECHCABAL

Africa’s edtech startups remain bullish despite funding decline.

With alternative energy solutions in high demand, can SA’s greentech startups seize the opportunity?

Centre Stage: Feyikemi Akin-Bankole and Simi Badiru, recent grantees of Spotify Africa’s Podcast Fund.

JOB OPPORTUNITIES

- TechCabal – Senior Reporter, Reporter – Africa

- Zikoko – Managing Editor – Lagos, Nigeria (Remote possible)

- Big Cabal Media – Commercial Director – Africa

- Big Cabal Media – Software Developer, Senior Product Manager, Sales Associate, Senior Sales Manager, Senior Editor (Citizen) – Lagos, Nigeria (Hybrid)

- PayDay – Chief Financial Officer, Finance Lead – Africa (Remote)

- ICF – Communications and Engagement Lead, Multicultural Comms Specialist – Kitui County, Kenya

- Fido – Customer Support Team Lead, Content Creative Manager, Marketing Manager, IOS Developer, Financial Analyst – Ghana, South Africa

- Brass – Sales Manager, Product Specialist, Brand Designer, Motion Designer, Product Designer, Business Operations Associate, Head of Business Banking – Lagos, Nigeria.

- AfricaCheck – Copy Editor – Johannesburg, South Africa

- Nomba – Frontend Engineer, Senior Backend Engineer, Senior Financial Analyst – Lagos, Nigeria

- Vendease – Product Owner, Technical Product Manager – Lagos, Nigeria

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.