2023 was a tough year for the private capital space in Africa, as factors like inflation and currency depreciation, among others, made business incredibly difficult across the continent. Local currencies like the Kenyan shilling and naira sunk to historic lows, while a depletion in foreign exchange reserves increased the cost of doing business in Egypt.

This had a significant impact on private capital activity on the continent in 2023, as the economic uncertainty pushed fund managers into being more wary and prudent with their investment strategies.

In April 2024, The African Private Capital Association (AVCA) released its 2023 African Private Capital Activity Report which provides insight into dealmaking, fundraising, exits and the key trends shaping Africa’s private capital landscape. For over two decades, AVCA has been focused on enabling and championing private investment in Africa.

Here are five interesting things we learned from the report:

1. The African market was more resilient than expected

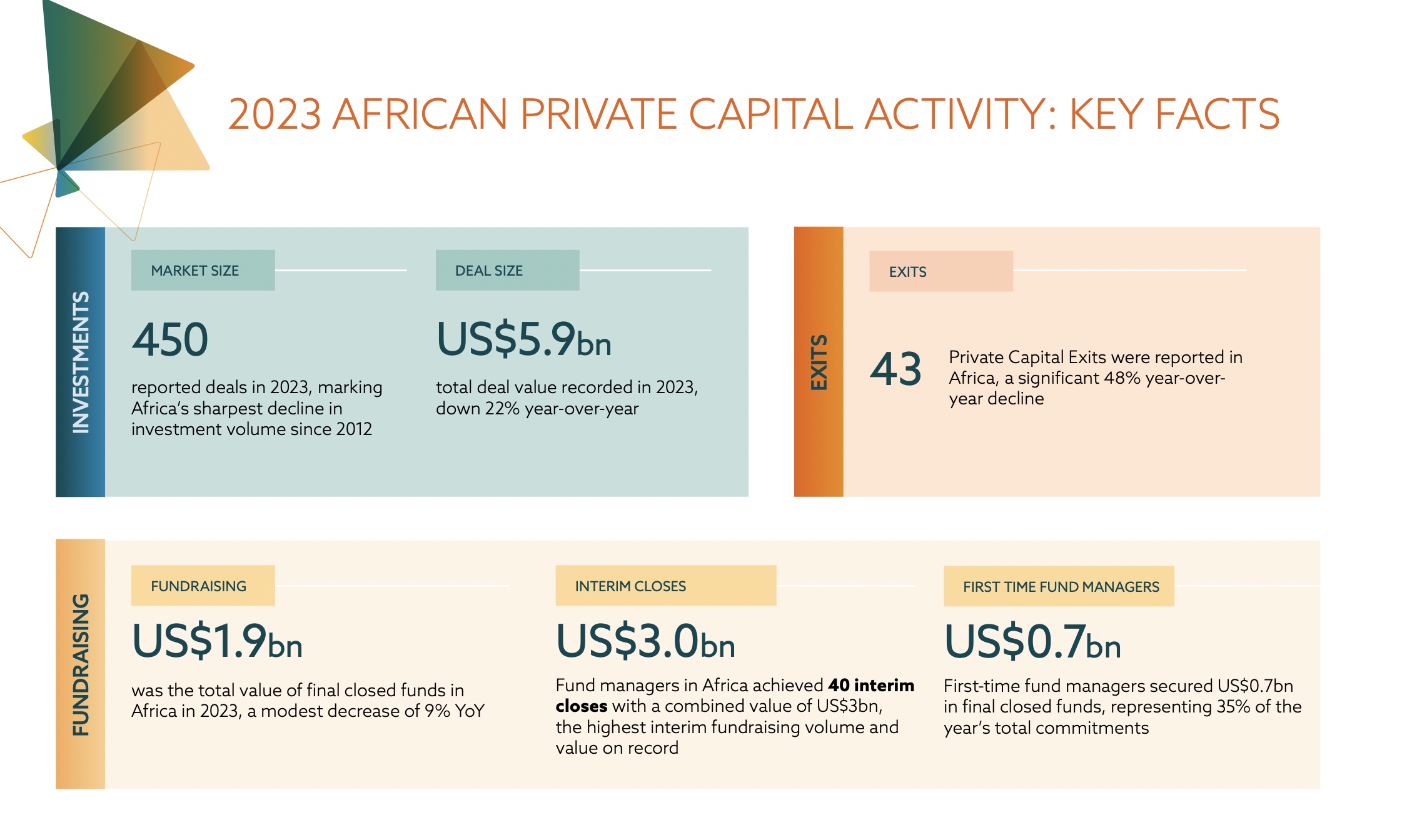

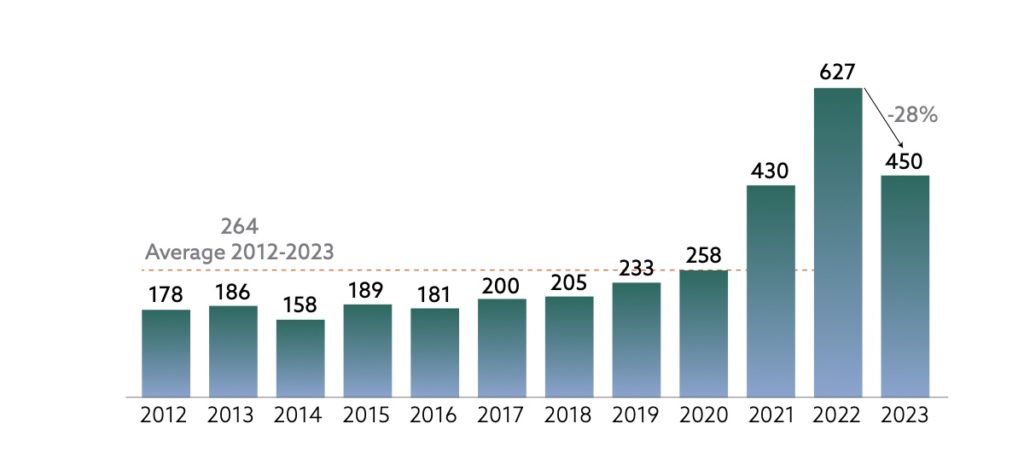

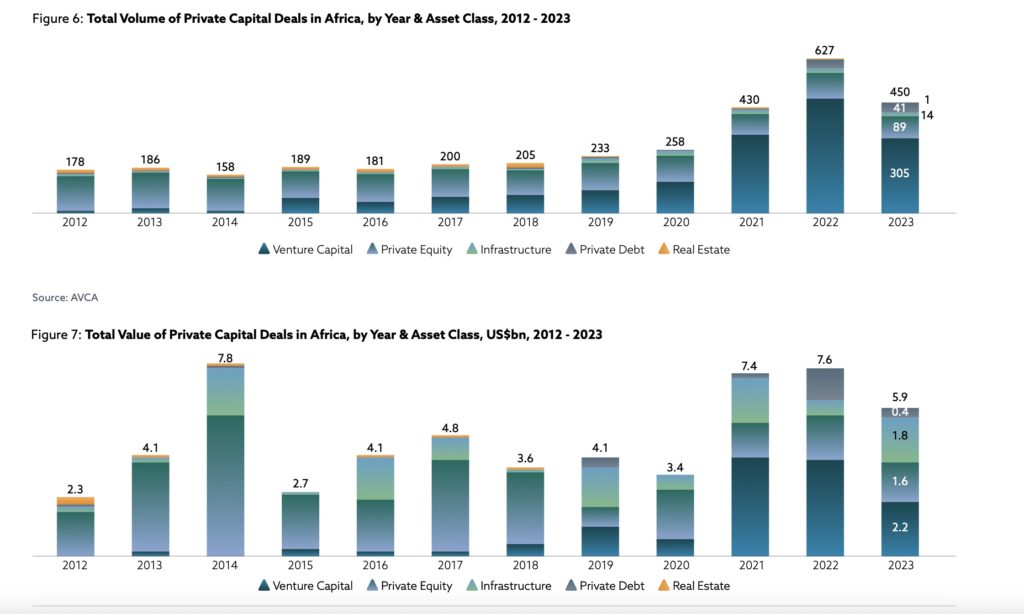

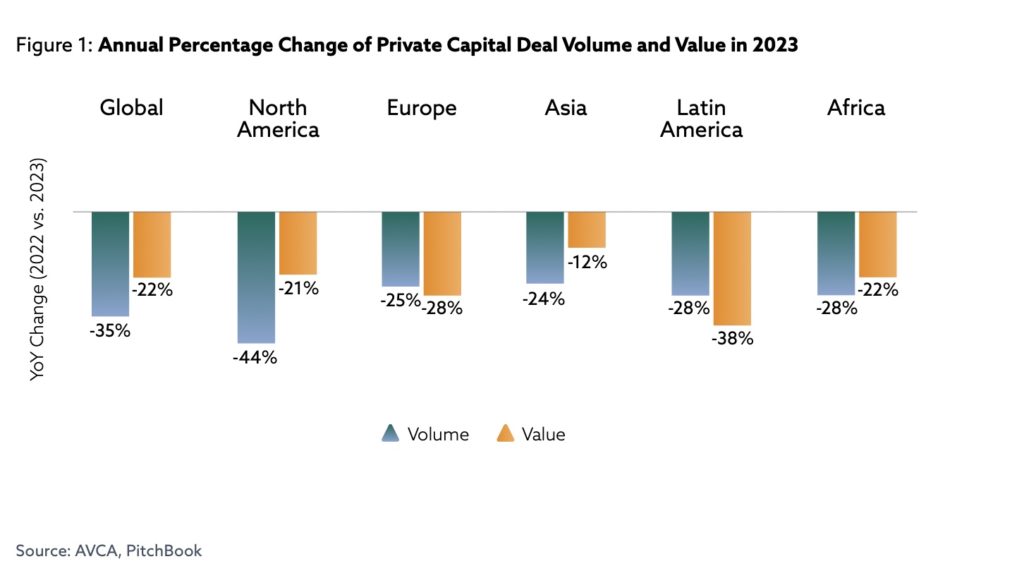

According to the report, there was a notable decrease of 28% in Africa’s total private capital deal volume, bringing the total number of deals to 450. Despite this downturn, Africa displayed surprising resilience, performing better than other developing regions and still managing to achieve $5.9 billion deal value —the second-strongest year on record for deal volume in Africa. This surpassed both the decade-long average and recent years’ averages, and was primarily driven by two large infrastructure investments in the South African renewable energy sector of above $250 million each.

2. Tech and clean energy received the most attention

Venture capital (VC) remained the star of the show, attracting 68% of all private capital investment in Africa. This trend reflects the continued interest of investors in backing tech-driven businesses across the continent’s rapidly growing markets since 2015. After VC, infrastructure also saw a significant surge in investment values which tripled to $1.8 billion, and was largely driven by renewable energy projects. According to the report, investors and experts are convinced of the continent’s potential to become a leader in clean energy transition in the coming years.

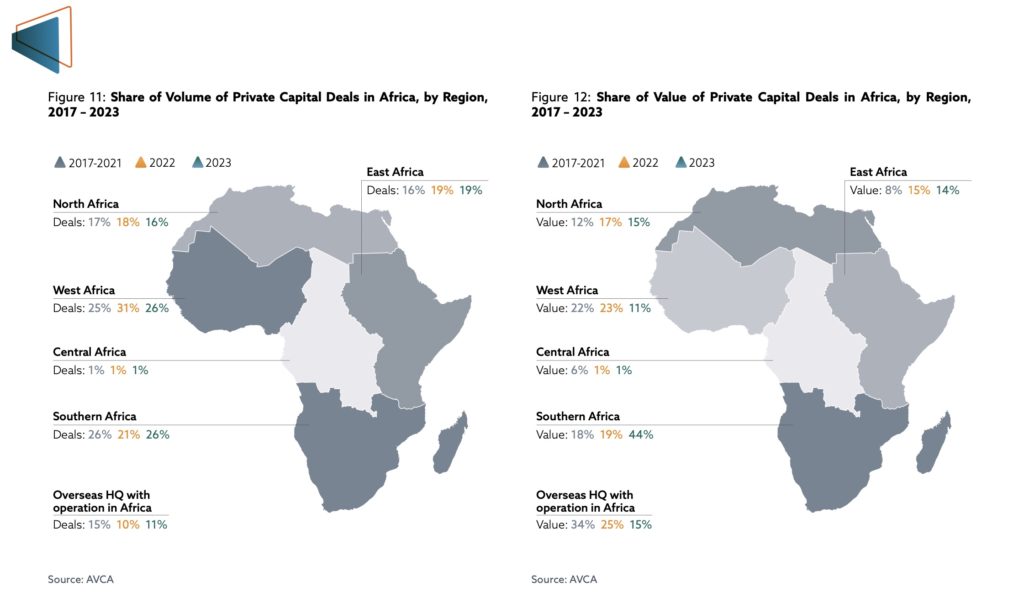

3. Southern Africa is now investors’ favourite investment destination

Southern Africa made a comeback in 2023, reclaiming its position as a top investment hub. The region attracted the highest volume (26%) and value of deals ($2.6 billion) with South Africa in front amidst growth in sectors like IT, software, logistics, and transportation. West Africa attracted only 11% of the total value of private capital deals on the continent, after Southern Africa and North Africa; a sizeable decline from 2022 where it got 23% of the total private capital value while Southern Africa drew 19%.

4. Investors are still interested in Africa

While final closed funds —funds ready for investment— declined slightly, the average value of capital raised for private debt and VC funds increased. Despite the global recession which was speculated to dampen investors’ spirits, there was some growth in interim fundraising activity (capital raised throughout the year) which suggests that investors are still interested in the continent. Africa experienced a 9% decrease in the total value of fundraising, while Asia experienced an alarming 39% decline. Europe’s decline was moderate at just 2%.

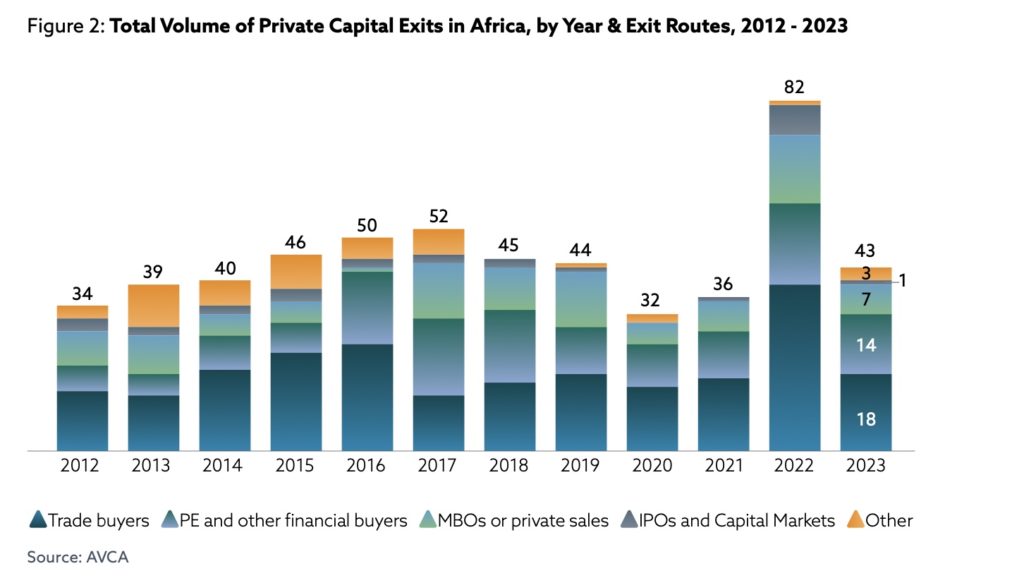

5. Exits are lower than in 2022, but still in line with the average

There were 43 exits in 2023, which is only about half of the 82 we saw in 2022; but this is still more than the 32 and 36 exits recorded in 2020 and 2021 respectively. South Africa remains the most active exit market, affirming to is status as the prime destination on the continent for mature investments.

While there was only one IPO exit, there were seven through management sales buyouts (MBOs)/private sales; 18 through trade buyers; and 14 through private equity and financial buyers. For the first time since 2015, there were no exits via the private equity routes within the financial services sector, which was one of the most popular routes in 2022.

To read the full report, click here.