A Federal High Court order will allow Nigeria’s Economic and Financial Crimes Commission to block 1,146 accounts connected with an ongoing investigation into “offences of dealing in unauthorised dealing foreign exchange, money laundering and terrorism financing.”

“It has been confirmed that you trade cryptocurrency. We humbly request that you provide us with a valid court order for the release of your funds,” read an email from a financial institution to a customer whose funds were frozen.

The court order was granted on April 24, one day after Ola Olukoyede, the EFCC chairman, told journalists that the agency had blocked 300 bank accounts involved in “illegal” peer-to-peer FX trades.

The EFCC chairman said at Tuesday’s presser that “Over $15 billion passed through one of the platforms last year.” He claimed that the Naira would have crashed in a week if the EFCC had not blocked the accounts.

A spokesperson for the EFCC could not immediately provide comments.

Ninety percent of the account holders affected by Wednesday’s court order maintain accounts with some of Nigeria’s biggest traditional banks.

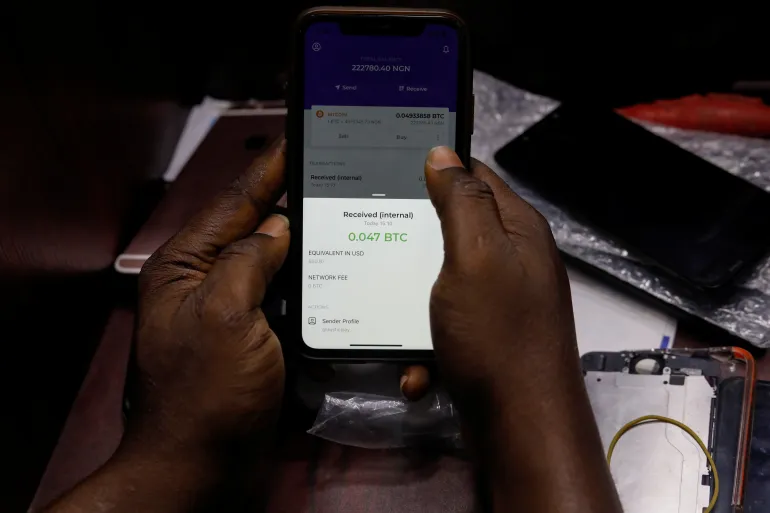

The EFCC’s investigation into these accounts is the latest move by Nigerian authorities to discourage currency speculation and naira volatility after two Binance executives were charged with money laundering and tax evasion.

In March, an analysis of peer-to-peer trading reportedly presented to Nigeria’s Central Bank identified a cluster of retail traders making large orders for USDT they didn’t eventually buy. The analysts claimed that some traders worked in teams to manipulate FX prices.

“The team uncovered users who have been using the platform for price discovery, confirmation, and market manipulation, which has caused tremendous distortions in the market, resulting in the Naira losing its value against other currencies,” Hakeem Bello, an EFCC operative, said in a March affidavit.