Good morning ☀️

Here’s what one faithful subscriber had to say about the new TC Daily.

“Damn! Sorry to swear but the design is too good. Kudos to the graphics designer. The overall design interface has changed to reinforce the colours of TC Daily. Anyway, brilliant work!”

Do you agree? Share your thoughts in two quick minutes.

Economy

Zimbabwe inflation accelerates first time since currency change

Zimbabwe’s recent switch to the gold-backed ZiG currency in April marked its sixth currency change since 2008. This drastic measure was necessitated by rampant hyperinflation, which reached a staggering 57.4% in April before the transition.

While the ZiG initially seemed to quell inflation, a severe drought has exacerbated food shortages, driving up prices and reigniting inflationary pressures. As a result, Zimbabwe recorded its first increase in inflation since the ZiG’s introduction in August, primarily due to soaring food costs.

Analysts predict that inflation will continue to rise until the country’s next harvest in March 2025, forcing the government and private millers to import grain to address food shortages.

Read Moniepoint’s 2024 Informal Economy Report

Did you know that 57.7% of the business owners in Nigeria’s informal economy are under 34 years old? Click here to find out more about the demographics of Nigeria’s informal economy.

Internet

Starlink cuts off South Africans

They say the third time’s the charm, but South African “illegal” Starlink users will be reeling from this news. After three warnings, these users have now been cut off from the Elon Musk-owned satellite internet service provider (ISP).

To get licensed, the country’s telecoms regulator, the Independent Communications Authority of South Africa (ICASA), mandates that 30% of all foreign companies, like Starlink, must be owned by historically disadvantaged groups. However, the satellite ISP couldn’t meet this requirement.

So, South Africans got creative. They started using roaming services. They bought Starlink kits, registered in other African countries where Starlink legally operated, from third-party resellers.

ICASA has since chased down these resellers to little success. Fearing regulation trouble, Starlink threatened to cut off more than 12,700 users that violated the usage terms. After warnings in February and April 2024, these users only got a slap on the wrist. This time, they’ve been cut off from the satellite service.

Getting operational clearance in African countries still eludes Starlink. Regulators want to control the content shared over Starlink. Since Starlink’s satellites don’t have a physical presence in the countries, it’s not possible to hold Starlink responsible for content transmitted over the signals.

This is what Kenya’s biggest telco, Safaricom, is pitching after it recently requested that regulators ban Starlink in Kenya. Critics have argued that it is anti-competitive.

But for these blocked users in South Africa, only two options exist: they either move to the countries they’ve been tapping roaming access from or pray ICASA moves faster with its plan to fix the Starlink mess in Kenya; though it is demanding that foreign ISPs must provide access to updated data on its network.

Collect payments anytime anywhere with Fincra

Are you dealing with the complexities of collecting payments from your customers? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. What’s more? You get to save money on fees when you use Fincra. Get started now.

Economy

Kenya’s credit rating gets downgraded again

Kenya’s debt woes are being thrown into full-view again after another credit rating downgrade.

After Fitch and Moody’s downgrade in July and August 2024 respectively, S & P Global Ratings has downgraded Kenya’s credit rating from “B to B-”, meaning that Kenya has now been deemed credit-risky by all three of the biggest credit rating agencies. If it wasn’t convincing before now, perhaps this rating seals Kenya’s fate.

These sovereign credit ratings play an important role in determining a nation’s ability to meet its debt obligations. Due to being credit-risky, raising money from debt instruments will become problematic for Kenya because the borrowing cost becomes expensive.

The ratings tell investors that Kenya is not a debt-sustainable country. So, they will be wary now of providing Kenya with loans. To hedge against that risk, they will provide loans to Kenya at high interest rates.

After Kenya’s president, William Ruto withdrew the Finance Bill in June, he mentioned that the country will look at alternatives to raise money. Borrowing more money at high interest rates to meet its debt obligations remains one bleak option for Kenya. The other, one that is not well received by Kenyans, is to implement taxes.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

Mobility

Dutch regulator fines Uber

How big of a deal is data protection? Planet-sized big.

In 2021, over 170 French Uber drivers made data privacy complaints to a French human rights group Ligue des droits de l’Homme. The French activist group transferred those complaints to the Dutch Data Protection Authority.

Yesterday, the regulator fined Uber about $324 million after it found it guilty of transferring sensitive driver information to its server in the US without adhering to global data protection standards (GDPR). The regulator claimed that Uber collected driver information including taxi licenses, location data, and in some cases criminal and medical data and sent them to its servers in the US without using data transfer tools aimed at protecting privacy.

One of the lead drivers behind the complaint argues that the Dutch ruling could set a precedent for legal action against other tech companies.

This $324 million fine is Uber’s largest fine yet and the third from the Dutch data protection authority. The DPA worked with other European bodies to decide Uber’s fine. The DPA earlier fined Uber $670,000 and $11 million in 2018 and 2023 respectively.

Join the FSDH Deal Room

Join FSDH Merchant Bank, UNIDO, and ITPO for the annual Deal Room on Friday, 6th September 2024, at 3PM WAT on Zoom. Founders with businesses operating for at least two years in Nigeria can connect with financiers and investors. Register here.

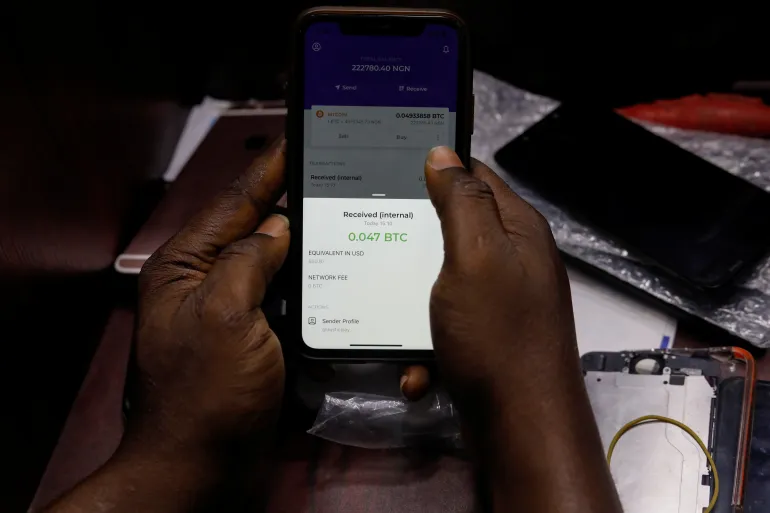

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $63,0082 |

– 2.09% |

– 8.52% |

|

| $2,682 |

– 3.48% |

– 18.50% |

|

|

$5.13 |

– 13.27% |

– 23.01% |

|

| $157.49 |

– 2.17% |

– 15.54% |

* Data as of 22:50 PM WAT, August 26, 2024.

Events

- The Central Bank of Nigeria is conducting a survey to gather insights from fintech operators on their scope of activities, key issues, and challenges facing the industry. Your perspective as an operator is important to this study. Please take a moment to complete this survey.

- We’re excited to announce our partnership with Wimbart the second edition of their pioneering pan-African research publication, “Startup Performance Reporting in Africa”. This report will shed light on the intricacies of investor relations within the African tech ecosystem. If you’re a founder, take a couple of minutes to share some key insights with us by filling out this survey.

- The Africa Prize for Engineering Innovation is open to African innovators creating engineering solutions to local challenges. Innovators from sub-Saharan Africa should pitch viable engineering products or services that will have social or environmental benefits to the continent. Apply for the chance to get up to $25,000 in funding.

- The Future of Capitalism Tech Startup Competition is offering $1 million to one lucky tech startup that can transform how businesses today operate. If your tech can save costs, boost efficiency, increase productivity or customer satisfaction, then apply by September 30 for a chance to win.

- Fintech company, Netapps launches reliable and secure suite of products

- Investment bankers, lawyers could make $82million from bank recapitalisation as competition pressures fees

- Nigerian fintech lost ₦146 Million initially recovered from fraudsters

- The Next Wave: How investor activity changed after 2022

- Nigeria’s Chowdeck hopes to prove food delivery doubters wrong

- Young men have invented a new way to defeat themselves

Written by: Faith Omoniyi, Stephen Agwaibor & Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.