First Published 08 September, 2024

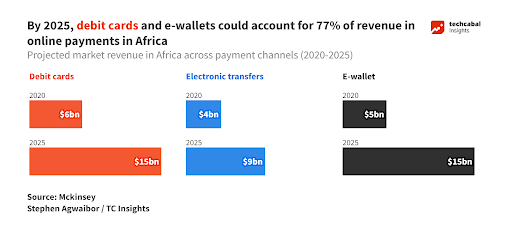

While digital payments have gained traction in Africa, low-value, high-volume transactions, often prevalent in informal markets, still rely heavily on cash. Payment experts estimate e-payments to grow by at least 30% per year through 2025, with Nigeria leading the pack.

This presents a few challenges for consumers and businesses. Contactless payments offer a potential solution to these issues with speed, convenience, and security, and are emerging as frontrunners in this evolution. In Africa, where cash remains king, contactless payments can improve the payments ecosystem and boost economic growth.

Contactless payments require customers to tap NFC-enabled cards (the most prominent contactless payment mode) on the reader or a wearable device to complete transactions. It takes 15 seconds to complete a transaction and has the potential to reduce the time spent at checkout and minimise the risk of fraud. Businesses can improve operational efficiency and attract a wider customer base.

Additionally, it can contribute to financial inclusion by providing access to formal financial services for underserved populations. Startups in sub-saharan Africa, where financial inclusion is 64% can use this opportunity to accelerate inclusion.

Overcoming Obstacles

Despite their benefits, the widespread adoption of contactless payments in Africa faces several hurdles. One major challenge is the cost of issuing and managing cards.

Innovative solutions like mobile wallets and wearable devices can be explored to address this. Well-known examples in this regard are smart watches linked to digital wallets like Apple Pay and Samsung Pay. If one cannot afford cards, the wearable option can be both fashionable and a payment system.

Debit cards and e-wallets would account for 77% of online payments revenue. Chart by Stephen Agwaibor, TC Insights.

Security concerns, such as the potential for fraudulent transactions, must also be carefully considered. Implementing robust security measures and educating consumers about best practices can mitigate these risks. In Nigeria, the Central Bank introduced a policy in June 2023 pegging transaction limits of ₦15,000 and a daily cumulative limit of ₦50,000. In essence, customers can only make contactless payments of up to ₦15,000 per transaction and up to ₦50,000 per day without entering a PIN or biometric verification. They can also pay with their smartphones if they do not have debit cards at hand. These limits on transactions can help to check cases like theft or fraud.

A growing market opportunity

The potential market for contactless payments in Africa is significant. The informal retail sector, which accounts for a substantial portion of consumer spending, presents a vast opportunity for growth. In Nigeria, consumer purchases form part of the $1.4 trillion African retail market. Similarly, a majority of the shopping involves informal traders. By enabling these businesses to accept contactless payments, we can drive financial inclusion and stimulate economic development. Using the Total Available Market (TAM) Serviceable Addressable Market (SAM) and Serviceable Obtainable Market (SOM) model, there is the possibility of a market generating opportunity that can realise outsized value from here.

Government support and case studies

Governments in emerging markets, such as India, have played a crucial role in promoting the adoption of contactless payments through supportive policies and infrastructure investments. Sectors like quick service restaurants, pharmacies, food, grocery have seen the highest adoption, growing transactions from 2.5% in December 2018 to 16% in December 2021. In Australia, 92% of Visa card transactions are tap-to-pay. Small retail outlets are at the centre of this mass adoption.

In Africa, similar initiatives can accelerate the transition away from cash-based transactions. Case studies from countries like Nigeria demonstrate the potential of contactless payments in specific use cases. The success of initiatives like Cowry Cards and Jump and Pass highlights the benefits of these technologies in transportation and retail sectors.

Contactless payments offer a promising solution to the challenges posed by cash-based microtransactions in Africa. By addressing the underlying obstacles and leveraging the potential of this technology, we can create a more efficient, inclusive, and secure payments ecosystem. As Africa continues its digital journey, contactless payments are poised to play a pivotal role in shaping the future of commerce.

Next Wave ends after this ad.

Joseph Olaoluwa

Senior Reporter, TechCabal

Thank you for reading this far. Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.