Zimbabwe is working on its first-ever crypto regulation, a significant policy turnaround after the Reserve Bank of Zimbabwe (RBZ) barred banks from processing cryptocurrency transactions in 2018.

In May 2024, the government-appointed National Risk Assessment Coordination Committee (NRACC) began consultations with crypto stakeholders to develop a regulatory framework. That consultation ended in June.

For crypto stakeholders, this regulation—which may include issuing licences for crypto exchanges—will legitimise the industry.

NRACC did not respond to a request for comments.

The government has asked crypto players to form lobby groups, people familiar with the matter said.

“Being able to speak directly with regulators presents a simpler gateway to building scalable products instead of having to try to bypass existing regulations because there are no enabling regulations,” said Vusa Chimanikire, founder of fintech startup Entry.

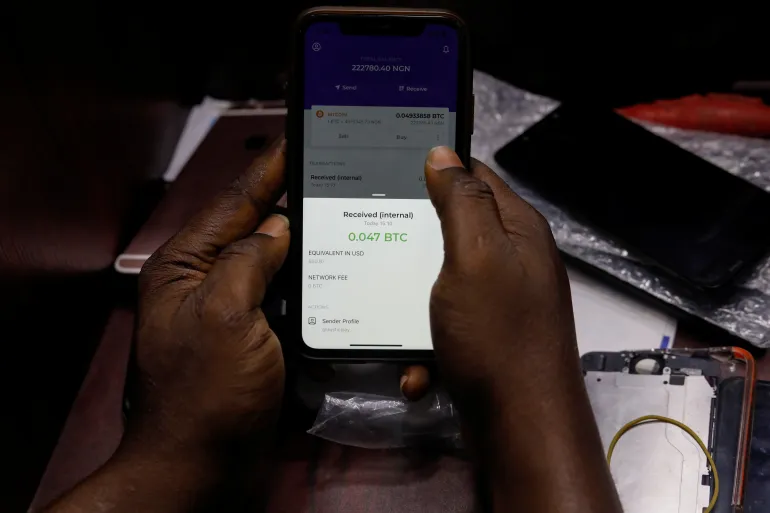

Zimbabwe’s history of currency volatility forced citizens to find alternatives in crypto exchanges like Binance, Coinbase, and home-grown Golix. With the regulatory framework, the government hopes to reverse the mistake of allowing crypto exchanges to operate unregulated before the 2018 ban, which led to financial losses for citizens.

Crypto stakeholders say issuing licences for crypto asset service providers (CASPs) is important. However, for this to happen, crypto should be recognised as a financial asset.

Since the ban, crypto-related businesses have been unable to open bank accounts. Instead, they rely on payment providers such as PayPal and Payoneer to store and move funds.

“If you are a business and cannot even open a bank account, you might as well not exist,” one founder who runs a Telegram-based crypto trading platform said.

Since the ban, crypto trading moved to underground speculative trading which led to crypto pyramid schemes. In May 2024, Dr. Solomon Guramatunhu, a popular Zimbabwean ophthalmologist, reportedly lost over $100,000 in a crypto scam.

“The Golix fiasco and other scams painted crypto in a bad light because the victims never got back their coins or any justice,” one crypto stakeholder who asked not to be named said. “So maybe with the backing of a framework, trust in crypto will come back.”

For users, licensing would help them deal with verifiable middlemen and help combat the high number of crypto scams in the country.

“Crypto will allow more competition in the peer-to-peer transaction space dominated by mobile money, physical cash transactions, and bank transfers,” said Valentine Muhampa, a market research and analyst.

For crypto players in Zimbabwe, a regulatory framework will change the perception of what was previously a Wild West industry. Until then, they will hold their breath.