Good morning ☀️

Moonshot is giving out tickets to students at ₦5,000 only. As a student, you will get access to all Entering Tech sessions, all workshop sessions, and brand merch.

Here is your chance to save a seat at Moonshot 2024. Get tickets here.

Layoffs

Meta ex-content moderators seek $1.6 million in compensation

On Friday, Kenya’s Court of Appeal upheld a ruling by a labour court filed in April 2023. The ruling meant Meta could face trial over the mass layoff of content moderators in the country.

About 185 ex-content moderators filed a lawsuit against Sama, a third-party company hired by Meta to moderate Facebook content. These workers, who had the challenging task of filtering out hours of disturbing material from social media, sued Sama for poor working conditions and unjust layoffs.

A case in 2022, filed by ex-Sama worker Daniel Motaung, sued Sama for being wrongfully dismissed for trying to form a union to lobby the company for better pay. Motaung’s case was previously dismissed for lack of jurisdiction. Meta had also argued that it was not a direct employer and couldn’t be sued in Kenya.

However, the new ruling by the Court of Appeal lumps the two cases and rules that both Meta and Sama could be responsible for paying $1.6 billion in compensation to these ex-workers.

Mercy Mutemi, a representative counsel for the ex-Sama workers said of the ruling, “Meta being sued in Kenya is a wake-up call for all Big Tech companies to pay attention to the human rights violations taking place along their value chains.”

Read Moniepoint’s Case Study on Funding Women

After losing their mother, Azeezat and her siblings struggled to keep Olaiya Foods afloat. Now, with Moniepoint, they’re transforming Nigeria’s local buka scene. Click here for a deep dive into how Moniepoint is helping her and other women entrepreneurs overcome their funding challenges.

Economy

Analysts expect a pause in interest rates

To rein in inflation, the central bank’s Monetary Policy Committee has raised interest rates four times since the start of the year. The MPC raised interest rates to 26.75% in July.

Inflation slowed for the second consecutive month in August with 32.2%, down from 33.4% recorded in July. The decreasing impact of the currency devaluation, the temporary removal of fuel subsidies, and a drop in food prices driven by the harvest season played a role in the inflation slowdown.

Although analysts anticipate a potential pause in interest rate hikes, the central bank will likely remain cautious and assess inflationary pressures through November, considering the recent fuel price increase, before determining whether to ease or maintain its monetary tightening stance.

The MPC will also make other decisions around short-term interbank interest rates. In July, it widened its asymmetric corridor, allowing commercial banks to borrow from the CBN at 31.75% (up from 27.25%) and deposit at 25.75% (up from 23.25%).

Issue USD and Euro accounts with Fincra

Whether you run an online marketplace, a remittance fintech, a payroll, a freelance platform or a cross-border payment app, Fincra’s multicurrency account API allows you to instantly create accounts in USD and EUR for customers without the stress of setting up a local account. Get started today.

Banking

Access Bank records $257,000 as “unrealised” FX gains

Access Holding, the parent company of Nigeria’s largest bank by customer base, has posted its second-quarter financial statement.

The company reported a pre-tax profit of ₦348.9 billion ($218.1 million) for the first half, driven by a surge in interest income from loans and investments. Access Bank earned about ₦646.34 billion ($404.0 million), aided by ₦412.8 billion ($258.0 million) unrealised foreign currency translation gain.

The bank’s personnel expenses surged to ₦415.8 billion ($260.0 million) from ₦65.1 billion ($40.8 million). This may have been driven partly by a surge in hiring due to the Access Bank’s recent expansion. In June, Access Bank acquired ABCT Bank in Tanzania to deepen its East African presence. Access Bank’s staff headcount increased from 7,567 to 8,009. The number of high-earning employees—staff earning ₦14.9 million ($9,312) monthly and above—increased by 689 in just six months.

Aside from Access Bank South Africa and Kenya, all other foreign subsidiaries reported pre-tax profits. Access Bank South Africa and Kenya posted pre-tax losses of ₦10.6 billion ($6.5 million) collectively.

Hydrogen Payment Services, Access Holdings’ FinTech subsidiary, reported a pre-tax profit of ₦238 million ($148,750). Access Pension and ARM Pension, its newly acquired PFA, were both profitable, reporting revenue of ₦15.1 billion ($9.4375 million).

Introducing Pay with Pocket on Paystack Checkout

Paystack merchants in Nigeria can now accept payments from PocketApp’s 2 million+ customers. Learn more →

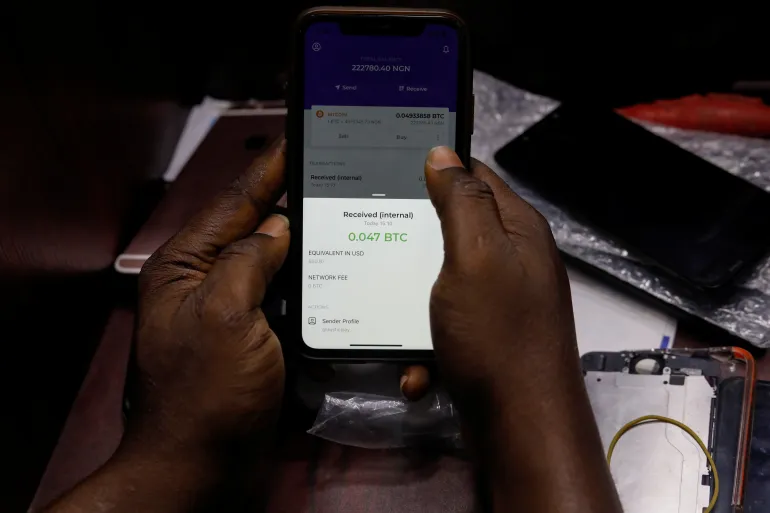

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $63,909 |

+ 1.37% |

– 0.29% |

|

| $2,661 |

+ 2.38% |

– 3.11% |

|

|

$1.62 |

+ 12.17% |

+ 63.11% |

|

| $1487.04 |

– 0.99% |

– 4.64% |

* Data as of 06:10 AM WAT, September 23, 2024.

Events

- Earnipay – Digital Marketing Specialist – Hybrid (Lagos, Nigeria)

- Paystack – Finance and Strategy Specialist – Lagos, Nigeria

- KrediBank – Head of Liability Generation – Lagos, Nigeria

- Mono – Technical Product Specialist – Lagos, Nigeria

- Cowrywise – Backend Engineer (Infrastructure, API Engineer, DevOps) – Hybrid (Lagos, Nigeria)

- When – Sales and Marketing Operations Specialist – EMEA, Remote

- Spacefinish – Associate Designer – Lagos, Nigeria

- LemFi – Customer Support Representative (Chinese Speaking) – Remote (Any Location)

- Kuda – Senior Product Designer (3+ years of experience) – Lagos, Nigeria

- Apex Web Network – Marketing Specialist – Hybrid (Lagos, Nigeria)

Issue virtual USD cards for you and your customers

Do you want to issue virtual USD cards for your customers and business expenses? Use Kora’s APIs to issue cards, customise your card program, and set your customers’ funding limit to your risk level. Get started here.

Written by:Faith Omoniyi and Emmanuel Nwosu

Edited by: Olumuyiwa Olowogboyega & Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.