The digital revolution is reshaping financial services across Africa, offering unprecedented access and opportunities. Digital trading platforms, particularly mobile-based ones, are at the forefront of this transformation, enabling more people to participate in financial markets. As these platforms grow, they present both promising opportunities and formidable challenges.

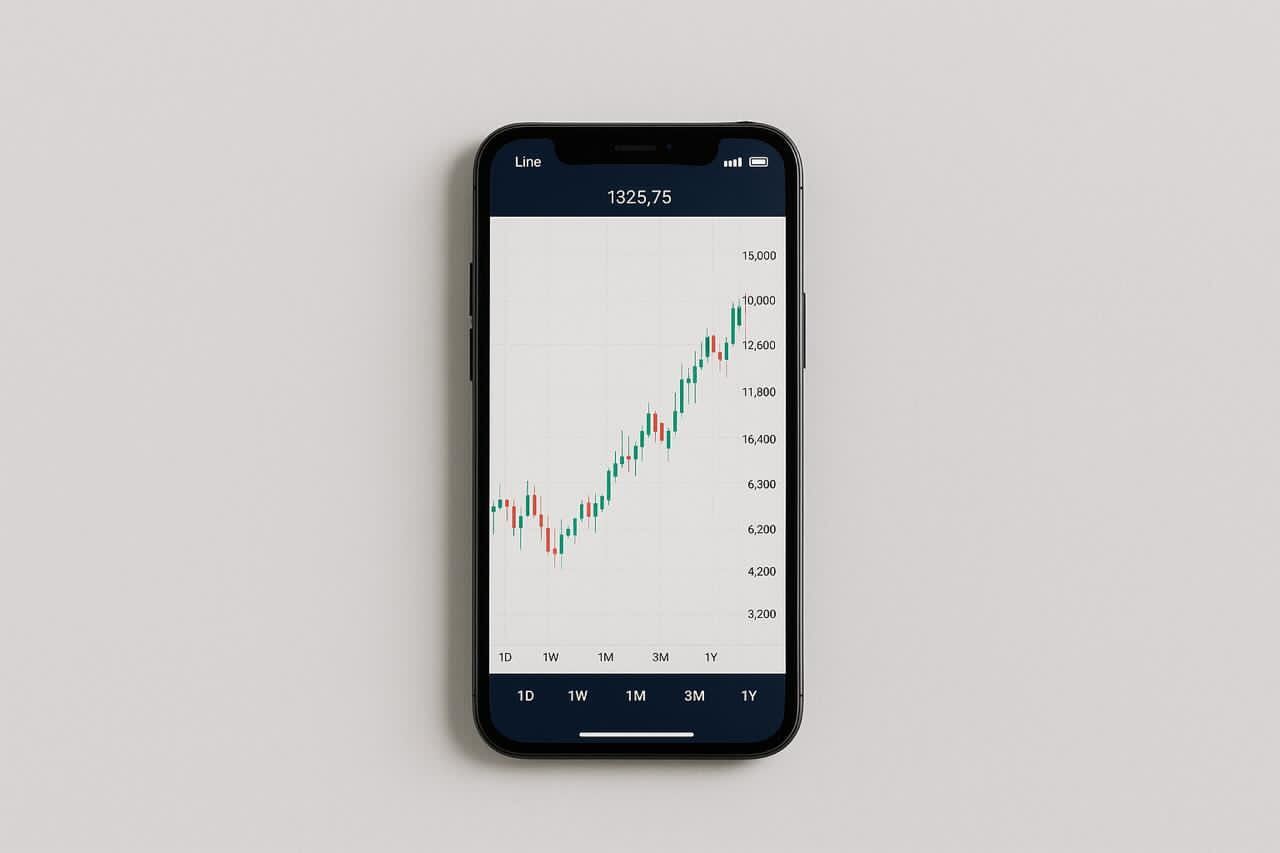

The rapid expansion of digital technology has opened new avenues for financial participation across Africa. Increasingly, mobile trading platforms are bridging gaps between traditional financial services and the unbanked population. These platforms provide a convenient and accessible way to engage with global markets. By leveraging mobile technology, individuals can trade shares, forex, and commodities directly from their smartphones, making financial markets more inclusive than ever before.

Factors driving the rise of digital trading

Several factors contribute to the rise of digital trading platforms in Africa. Chief among them is the proliferation of affordable smartphones, which has significantly increased internet accessibility across the continent. This technological leap allows users to connect to digital trading platforms with ease, facilitating a seamless trading experience from virtually anywhere. The availability of secure and reliable internet connections has further empowered users by ensuring consistent market access.

The growth of digital payment systems also plays a critical role in this trend. Mobile money services have created an ecosystem where transactions can be executed swiftly and securely, essential for real-time trading activities. Additionally, as more people recognize the potential of financial markets to enhance personal wealth, the demand for accessible trading platforms has surged. This shift reflects a broader desire for economic empowerment through direct engagement with global markets.

Furthermore, digital literacy initiatives have bolstered user confidence in navigating these platforms. By equipping traders with essential skills and knowledge, such programs enable informed decision-making and foster trust in digital trading technologies. As educational resources become more widely available, more individuals feel empowered to participate in these evolving financial landscapes.

Opportunities for African traders in digital platforms

Digital trading platforms offer myriad benefits to African traders by democratizing access to global financial markets. These platforms eliminate geographical barriers, allowing users from remote areas to engage with international markets. This accessibility not only opens up investment opportunities but also promotes economic diversification by broadening the range of available assets.

Moreover, the convenience offered by mobile-based platforms cannot be overstated. Traders can monitor market trends and execute transactions on-the-go, maximizing their responsiveness to market fluctuations. This level of flexibility is crucial for those who may not have access to traditional financial infrastructure or who lead busy lifestyles.

Digital platforms also provide traders with advanced tools and insights that enhance their trading experience. Features such as real-time data analysis, customizable alerts, and risk management tools empower traders to make informed decisions and optimize their strategies. These innovations ensure that even novice traders can effectively engage with complex market dynamics.

Challenges facing digital trading expansion

Despite these opportunities, several challenges hinder the full potential of digital trading platforms in Africa. Regulatory frameworks vary significantly across countries, creating uncertainty for platform operators and users alike. Harmonizing these regulations is crucial for fostering a stable environment that encourages innovation while protecting investors.

Technological barriers also persist in some regions where infrastructure development lags behind demand. Inadequate internet coverage and power supply disruptions can impede consistent platform access, discouraging potential users from engaging with digital trading solutions. Addressing these infrastructural issues is vital for sustaining growth in this sector.

A critical aspect that demands attention is the promotion of financial literacy among users. Without a solid understanding of financial concepts and risks associated with trading activities, individuals may face significant losses or fall victim to scams. Comprehensive education programs are essential for empowering traders to navigate these challenges responsibly and effectively.