A tech savvy look at how BNPL and omnichannel retail are reshaping Black Friday in Nigeria and why Credit Direct Checkout is powering this shift.

Black Friday in Nigeria has outgrown its origins as a simple discount event. It has evolved into a high velocity retail cycle driven by digital traffic, multi channel discovery, and increasingly sophisticated consumer behaviour. As the country’s ecommerce and fintech ecosystems continue to merge, Black Friday has become a proving ground for technologies that solve friction, expand access and accelerate conversion.

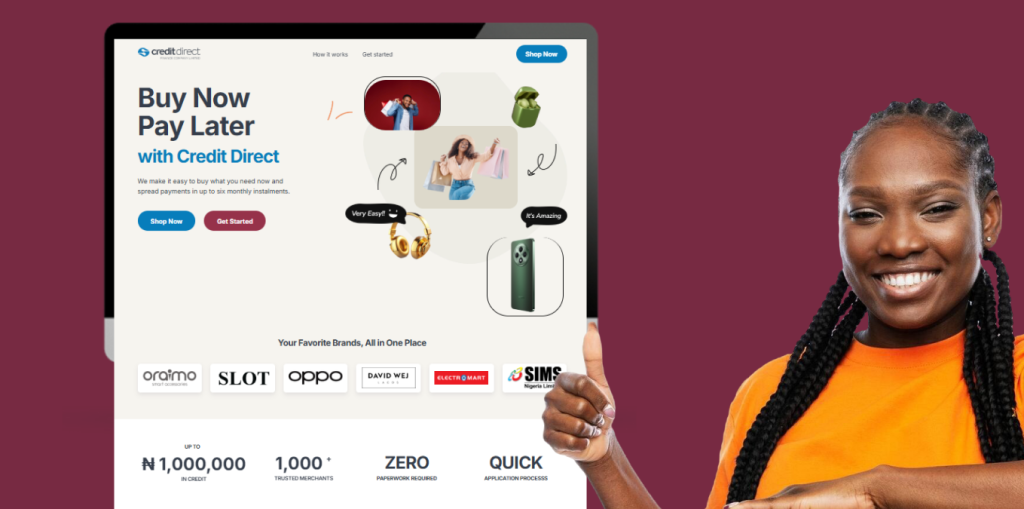

In 2025, one of the biggest drivers of this evolution is Buy Now Pay Later (BNPL). This year, Credit Direct is powering Black Friday across more than 600 merchants through Checkout, its BNPL solution that offers shoppers up to 1 million naira in credit with only 30 percent upfront and repayment spread across six months.

With major partners such as Konga, SLOT, Electromart, SIMS Nigeria, 3C Hub, Spectrum Phones, OgaBassey and Pointek, Checkout is positioned as a core infrastructure layer connecting affordability, digital commerce and customer experience at scale.

Black Friday and the New Digital Retail Stack

Nigeria’s retail environment is now a blend of offline stores, ecommerce platforms, social commerce channels and payment technologies. Customers frequently move across multiple touchpoints before completing a purchase.

A typical journey looks like this:

• discovery on Instagram

• price confirmation via WhatsApp

• comparison on a website

• purchase in store or online using a flexible payment method

This journey demands infrastructure that supports omnichannel retail. Fintech has stepped into this gap by offering payments, logistics integrations, credit scoring and automated onboarding.

BNPL is the latest layer in this stack. It democratises access by enabling customers to acquire products without waiting for full liquidity. For merchants, it boosts average order value, reduces abandoned carts and increases conversion speed.

Checkout: BNPL Designed for Nigeria’s Digital Commerce Behaviour

Checkout is built with an understanding of how Nigerians shop online and offline. It is designed to work across:

• in store purchases

• ecommerce websites

• Instagram storefronts

• WhatsApp sales

• independent retailer platforms

This flexibility is essential in a market where social commerce plays a major role and physical retail still drives significant volume.

Customers begin with Know Your Limit, a fast eligibility check that provides instant clarity on how much credit they can access. This single feature reduces hesitation, increases confidence and accelerates decision making.

With only a 30% upfront commitment, Checkout removes one of the biggest barriers to purchase: affordability at the point of sale.

Applying the 5 P’s Through a Fintech Lens

The traditional 5 P’s of marketing remain relevant, but fintech expands their possibilities.

1. Product: High Demand Meets High Access

Fintech enhances product strategy by enabling merchants to sell more high value items such as smartphones, large appliances, generators and electronics. BNPL makes these products attainable for a wider segment of shoppers.

Bundled offerings, limited edition drops and curated sets become more effective when customers know they can pay flexibly.

2. Price: Dynamic, Transparent and BNPL Powered

Price transparency has become a trust currency. Nigerian shoppers resist artificial discounts and expect real value.

BNPL strengthens pricing by:

• enabling tiered or time bound deals

• making premium products affordable

• increasing conversion of mid to high ticket items

By spreading repayment over six months, Checkout offsets upfront price sensitivity while keeping merchant margins intact.

3. Place: True Omnichannel Retail

Technology enables businesses to maintain uniform product information, synced inventory and seamless customer journeys across channels.

Checkout integrates easily into:

• website checkouts

• point of sale systems

• social commerce flows

This means customers can discover anywhere, decide anywhere and pay anywhere.

4. Promotion: Digital Reach Amplified by Payment Convenience

Black Friday promotions are more effective when aligned with frictionless payment options. Merchants can promote Checkout in their campaigns to strengthen customer interest.

Effective tools include:

• countdown content

• influencer led product demos

• flash sale reminders

• testimonials from BNPL users

Highlighting flexible payment options enhances perceived value and drives faster action.

5. People: Teams Powered by Fintech Knowledge

Customer facing staff must understand Checkout to guide buyers through onboarding, the 30 percent upfront process, monthly repayment expectations and credit eligibility.

For ecommerce teams, responsiveness in chat channels, quick product clarifications and consistent support increase customer trust and retention.

The Bigger Picture: BNPL as a Financial Access Driver

Beyond retail growth, Black Friday is becoming a gateway to broader financial inclusion. BNPL allows customers to access essential products without financial strain. It also supports merchants by increasing their addressable customer base and reducing friction in big ticket purchases.

Credit Direct Checkout plays a central role in building this new layer of Nigeria’s retail fintech infrastructure. It connects merchants, customers and credit tools into a unified experience that works across all the places Nigerians shop.This Black Friday will reward the merchants who embrace integrated fintech solutions and the customers who begin their journey with Know Your Limit. As the ecosystem evolves, BNPL will remain a key driver of accessible, convenient and efficient commerce in Nigeria.