Africa is trading more with the world than at any point in its history. As ports are busier and warehouses are fuller, demand from global supply chains seeking alternatives to Asia and Europe is also shifting southward.

Yet behind the optimism lies a quieter crisis: for many African businesses, the hardest part of global trade is not finding suppliers, raising capital, or even navigating customs, but it is paying – credibly, transparently, and on time.

Delayed foreign exchange access, opaque intermediary banks, rejected transfers, and “third-party” payment workarounds have turned something as basic as settling an invoice into a structural disadvantage.

As a result, goods sit at ports, suppliers grow wary, margins erode, and growth stalls. It is this gap between Africa’s growing participation in global commerce and the outdated systems meant to support it that Rojifi is stepping into.

A system designed for a different Africa

Sub-Saharan Africa remains the most expensive region in the world to move money. These costs are not abstract, as the African Development Bank estimates that settlement delays and FX charges alone can reduce SME operating margins by up to 15 percent.

For manufacturers, importers, pharmaceutical distributors, and airlines operating on tight timelines and thinner margins, those numbers can mean the difference between scaling and stagnation.

Yet, despite a global shift toward real-time commerce, much of Africa’s payment infrastructure still reflects a pre-digital era which is fragmented, slow, and built around risk avoidance rather than trade enablement.

“Global commerce has become real-time, but African payments infrastructure hasn’t,” said Moses Onyekaonwu, founder and CEO of Rojifi. “You can have the capital, the demand, and the supplier but without the ability to move money instantly and credibly, the entire system breaks down.”

How a founder’s frustration turned infrastructure play

Rojifi did not begin as a whiteboard thesis but emerged from lived friction.

Before founding the company, Onyekaonwu operated multiple businesses with supply chains across Asia. He experienced firsthand how rejected payments, delayed FX approvals, and unreliable intermediaries strained supplier relationships which sometimes led to withheld goods and cancelled orders.

“In Africa, you could have the money, but not the ability to move it instantly,” he said. “And the longer you wait, the more you lose.”

That experience shaped a simple but ambitious idea: African businesses should be able to pay international suppliers directly, transparently, and in their own name without offshore entities, informal brokers, or credibility-eroding workarounds.

Why ‘In-Name’ payments matter

One of the least visible but most consequential barriers to African trade is ‘trust’.

FXC Intelligence notes that a lack of transparency in intermediary banking often creates tension with suppliers and increases operational risk. Many global suppliers hesitate to transact with African firms not because of the businesses themselves, but because payments often arrive from unidentified third parties.

This idea feeds into a broader global trend of ‘de-risking,’ where international banks reduce exposure to regions perceived as opaque or high-risk.

Rojifi tackles this head-on, as every transaction is sent in the client’s registered business name and clearly reflected on the MT103 SWIFT message.

“Your supplier sees your company name and not an unknown intermediary, and that credibility changes the relationship,” Onyekaonwu said.

This implies fewer disputes, smoother audits, and stronger long-term supplier partnerships.

Built at the Intersection of speed and trust

Rojifi positions itself deliberately between fintech agility and banking discipline.

The platform uses AI-driven systems for fraud detection, transaction monitoring, and onboarding, which is an increasingly critical advantage in a world where, according to IBM and J.P. Morgan (2025), 88 percent of financial institutions have experienced payment fraud.

AI-based behavioral analytics help reduce false positives, a common frustration for African businesses whose legitimate transactions are often flagged or delayed.

Onboarding, which can take anywhere from 12 to 36 hours across Africa, is streamlined to as little as 24 hours with Rojifi without compromising compliance.

“We are combining the speed of fintech with the discipline of traditional banking,” Onyekaonwu said. “That balance is what serious businesses need to compete globally.”

Caleb Nnamani, expert African storyteller and Chief Executive at Blacktrigger, added, “An ever-increasing demand for imported goods on the continent has carved out global payments for African businesses to be an intensely competitive sport with a handful of winners and many graveyard relics.”

“Rojifi’s play is ambitious and interesting, and it will be exciting to see the team make good on their AI-first promise,” he said.

Infrastructure for businesses that move real volume

Rojifi is a fully licensed Money Service Business in Canada and is pursuing an International Money Transfer Operator license in Nigeria, a dual regulatory strategy designed to signal credibility across global corridors.

The platform supports payments to over 200 countries, handling major currencies including USD, EUR, GBP, and CNY. Businesses can execute payments through direct deposits and FX swaps, access an OTC desk for large or bespoke trades, and rely on high-liquidity rails built to withstand FX volatility. SWIFT-enabled payments offer T+1 settlement, with delivery within 24 hours in selected corridors.

African businesses can onboard using their existing local entities, as no offshore LLC is required.

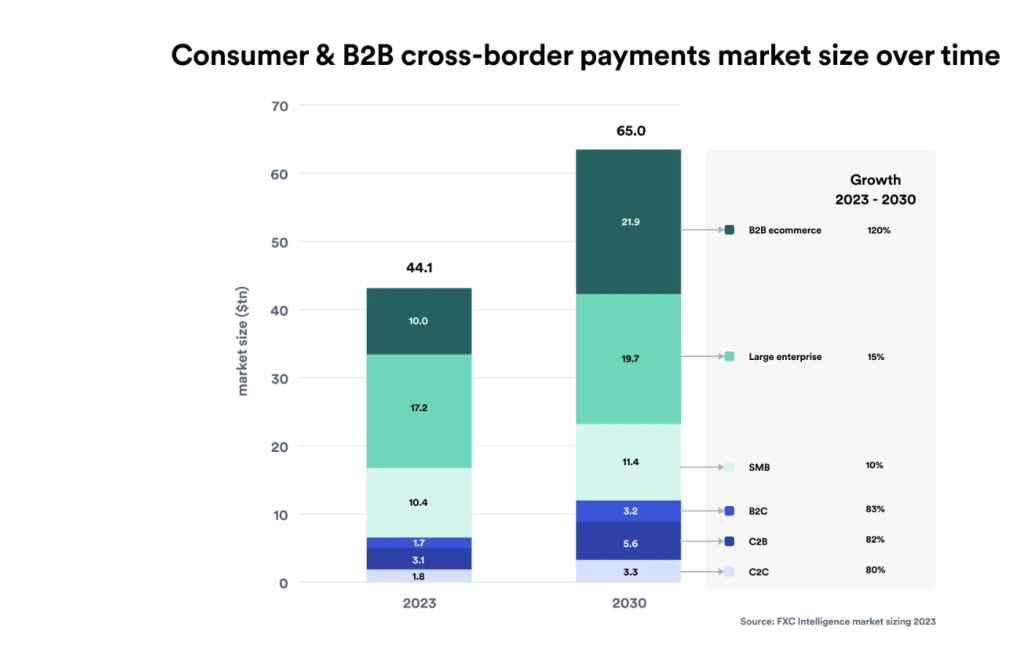

This focus on B2B infrastructure reflects a broader market shift. While consumer remittances once dominated the narrative, the African cross-border payments market is now valued at approximately $329 billion in 2025 and projected to reach $1 trillion by 2035, according to Oui Capital and Fintech News Africa.

The politics of infrastructure

There is an unspoken political dimension to payment infrastructure, which is who gets access to global rails, and under what conditions, which shapes who participates meaningfully in global trade.

By removing opaque intermediaries and embedding compliance by design, Rojifi is positioning African businesses not as exceptions to global rules, but as first-class participants in them.

“When African businesses can pay suppliers instantly, transparently, and in their own name, trade becomes easier, trust increases, and growth accelerates,” Onyekaonwu stated.

Powering the next phase of African trade

With clients already living on the platform, the company plans to expand licensing across key corridors and deepen its footprint across Africa.

In doing so, it is betting on a simple premise: Africa’s trade challenge is not ambition or capability but infrastructure.

African businesses looking for efficient, competitive FX rates to settle global partners can create user accounts on Rojifi, complete KYB, and instantly move high volumes at breakneck speeds (T+0)

By dismantling decades-old barriers to cross-border payments, Rojifi is not just moving money but helping to redefine how African businesses show up in the global economy, which is visible, credible, and ready to compete on equal terms.