Innovative early stage ventures that have the potential to yield high social impact, but require less than €1 million in capital, are the most difficult segment of the SME pipeline to reach. Often times they have a minimal track record and lack the collateral needed to secure capital from a local bank. Moreover, local banks and traditional financiers too often do not appreciate the dynamics of the entrepreneur’s specific business and therefore cannot add necessary value beyond capital. It is exactly through direct equity participation that entrepreneurs learn from angel investors, often experienced entrepreneurs themselves with domain specific expertise.

In July and August of 2015, ABAN, the African Business Angel Network organized a series of Angel Investor Boot Camps and Master classes in Lagos, Nairobi and Cape Town. Theme for the series was ‘Unlocking capital for early stage innovation’. The insights and lessons learned gained from these sessions was used as input for designing the program for the 2nd Annual ABAN Angel Investor Summit, an event that took place on the 23rd of September in Lagos, Nigeria preceding the 4th Annual DEMO Africa conference.

The four events brought together close to 250 African and international angel investors. ABAN partner VC4Africa was commissioned to survey the participants with the aim to identify issues African angel investors are facing today and to use this input as an important reference where the organization can focus its efforts moving forward. Below are the summarized Key Learnings.

Key Learnings

1) Angel Investing in Africa is Just Starting

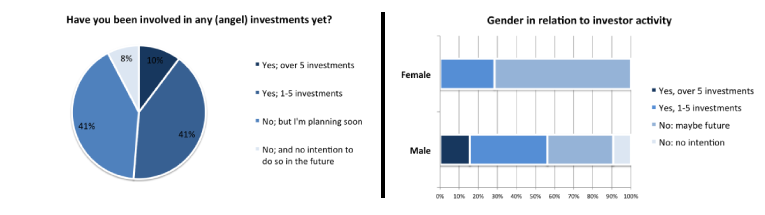

Angel investing across Africa is a new phenomenon and both individual investors as well as (newly formed) angel networks are looking for further education and guidance. Participants referenced the continent’s enormous wealth, but then the practical challenges faced in working to unlock this wealth as investment capital for a new generation of entrepreneurs building startups. 51% of the surveyed participants indicated they have already invested in African companies and 10% had already invested in more than 5 companies. Another 41% are planning to start investing. There was a clear shout out for further education on investing.

2) Investing is hard. Working together helps

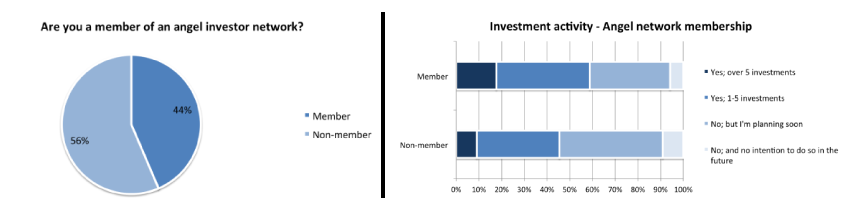

Investing alone is hard, and participants agreed at the different sessions that they could achieve more by working together. Vincent Kouwenhoven, the CEO of Amsterdam based eVentures Africa fund, stressed from his own experience, “A lot of work can be done remotely, via Skype and using other tools, but nothing can replace an in-depth understanding of the local market and having access to the right people locally”. eVentures Africa has invested in 12 African companies since launching in 2010 and recently concluded a deal in Zambia, co-investing with local Zambian VC firm Kukula Capital. He added that eVentures now considers having a local partner as a requirement for any new investments. A majority (56%) of the participants of the recent ABAN events are not part of an angel network. Further research is needed to understand why: networks do not exist yet? Or investors value their anonymity and therefore keep a low profile? Etc.

3) Need for a Platform to Connect and Exchange Best Practices

Most of the participants at the various local sessions knew of each other but had never met in person. Organizing these investor events (boot camps, master classes) was perceived as an effective mechanism for bringing together these active and/or prospective investors and to better link them as a network. The sessions also work to bring new investors to the table, given 41% of the surveyed participants were exploring Angel investing as an option and had not yet started investing.

When relating investor activity to angel network membership, data shows that investors that are part of an angel network are more active. Other research (University of Glasgow, 2014) has highlighted before that joining a network is usually the trigger to start investing. This input would suggest investing in the formation of networks helps to spur investment activity

4) Mentor Capital – more than money

Business angels bring three types of capital to a venture; financial capital (cash); social capital (a network of high-level contacts) and human capital (knowledge and experience). “Being a business angel is a fantastic thing to do. You’re able to enable entrepreneurs to follow and build their dreams”, said Selma Prodanovic, key note at the Cape Town Masterclass. Justin Stanford, a notable angel investor in South Africa, argued that one of the biggest errors you can make as an investor is to make decisions for the management team. “You can make suggestions,” he said. “But management must always own the outcomes. Make sure you’re giving advice and not instruction.”

5) Government Role Foreseen to Remain Marginal – Unfortunately

Governments only play a marginal role in supporting entrepreneurs and incentivizing investor’s today was the overriding opinion of the participants. Investors also do not have high expectations of role governments will play in the foreseeable future. Also clear, that where there are pan-European initiatives (EBAN, EU), there is relatively little that could be seen as really pan-African. These points also highlight the fact that the African countries are so diverse and that it does not necessarily make sense to copy a common set of training materials and/or research at this stage. It was argued that these materials would not be relevant across African markets. It is noted that both the materials and policy advocacy efforts would need to be home grown.

7) Balancing the Gender Balance

We need a diversity of business angels if we expect to enable diversity of start-ups. Globally, women are under-represented in the start-up space. Across the different sessions, there was a clear message that there is a desire to change this. One example is “The Rising Tide”, bringing together 99 women angel investors – both experienced and new – with the clear objective of increasing women’s participation in angel investing and educating a new wave of angel investors.

8) Long Term Perspective

Angel investing is not about overnight success. It can take up to ten years to build a sustainable and successful venture and it usually requires a lot more investment than initially planned for. Justin Stanford, a notable angel investor in South Africa, explained “Investors need to be aware that the first check is never the last check. When you make an investment, you buy the obligation to put more money in,” said Stanford.

Way Forward

Events like these are part of an ongoing effort to better connect Africa focused investors, improve knowledge of African investing, and to better mobilize the capital that is needed to support the continued growth of Africa’s innovation sectors. In this way, ABAN and its members seek to maximize the continent’s entrepreneurial potential.

The perception is that investors have all of the answers, or they wouldn’t be wealthy to begin with, when in fact investors are keen to learn and develop their knowledge and capacity in the same way as say a starting entrepreneur.

Through an ongoing series of regular blog posts, events, boot camps and master classes ABAN continues its efforts to capture best practices as they start to emerge in the ecosystem and to make these more widely available. Lets build a Network of Angel Investors in Africa.