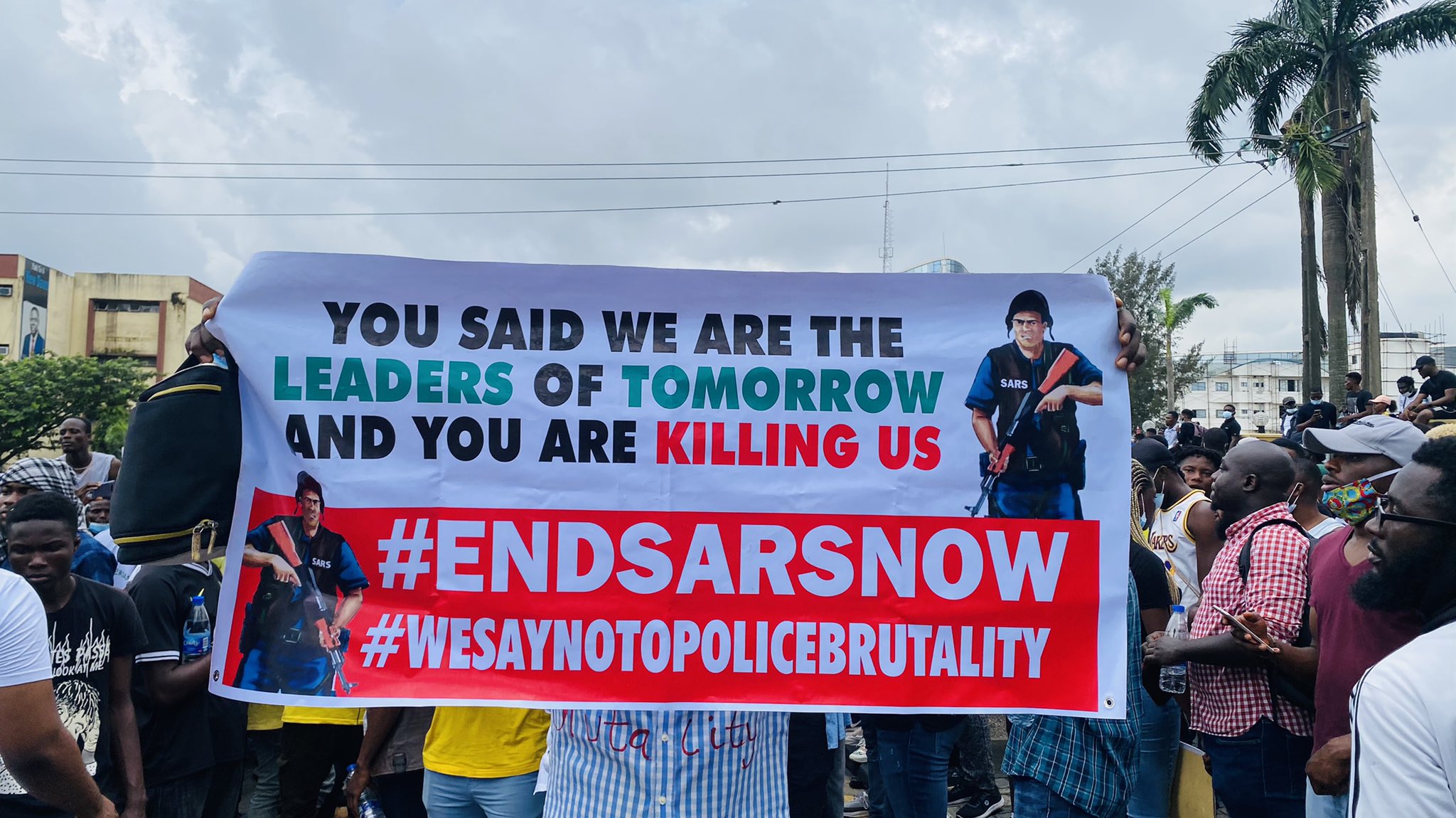

“It’s high time,” African Investment Advisor, Aubrey Hruby tweeted supporting calls for an end to police brutality in Nigeria.

“I brought VC investors to Nigeria from Egypt last year and they were completely shaken down and robbed by the police as they were leaving the country after an amazing week of meeting with stellar Nigerian entrepreneurs #EndSARS,” Hruby concluded narrating her experience with the rogue police unit, Special Anti-Robbery Squad (SARS).

Many of the responses to her story were from people worried that the incident could cut investment into Nigeria’s technology sector. The technology sub-sector has been driving the growth of the services industry which is the bedrock of the Nigerian economy.

Imagine if more investors who provide the money required to fund growth in the sector experienced similar harassment from SARS?

Police harassment could chase foreign investors

The EndSARS crisis and recent policy missteps could make investors cautious about Nigeria . Foreign investors contributed $75 million in 2019, to the technology industry. That’s a 703% jump from the $9 million investors provided in 2018, according to data from the Central Bank of Nigeria.

Perhaps, the deal that saw global payment giant, Stripe acquire Nigerian payments company, Paystack will probably not have happened if Patrick Collison, CEO at Stripe, experienced police brutality in Nigeria. Maybe it would have. But the security risk creates uncertainty that limits the immense talent of the Nigerian youth. Nigerian technology workers have quite a number of SARS horror stories.

Following the announcement of the Paystack acquisition deal, Paul Graham, co-founder at US-based startup accelerator, Y Combinator said, “Investors, who ignore Nigeria now have to ask themselves: What do I know that Patrick Collison doesn’t?”.

In the comments, people shared the belief that Nigeria could be Africa’s center of foreign investment in the absence of bad governance.

Currently ranking 131 in ease of doing business in a list of 190 countries, Nigeria needs to take actionable steps that’ll make it more pleasant for investors.

Policymakers should be concerned

It’s surprising that regulators, policymakers, and political leaders aren’t doing all it takes to protect this fast growing industry.

The technology sector was the second-fastest-growing sector from Q1 2018 to Q4 2019, trailing only behind transportation and storage. It contributed about 13% to the economy. This is about 10x the input of the transportation and storage sub-sector.

The real GDP of Nigeria’s technology sector has been growing over the last ten years. It dropped slightly in 2017 after Nigeria entered a recession in 2016.

It also contributes more to the GDP than the oil and gas sector; the major source of revenue for the country. Favorable government policies could result in an increase in GDP for the technology sector.

The technology sector could lose over $1 billion

The COVID-19 pandemic dealt a blow to the Nigerian economy that could slow down the growth of the technology sector.

The Q2 2020 national economic output fell by 6.1%. A financial services group, Cordros Capital, revised its GDP growth forecast, after the recent social unrest clouded Nigeria’s economy. It stated that the economy could shed about 6.91% and 4.15% in Q4 2020 and full year 2020 respectively.

As much as that percentage might look insignificant, in real value, it means Nigeria could lose ~ $12.9 billion (6.91% of its 2019’s GDP). The country would technically be in a recession (if Q3 2020 national economic output growth is also negative).

There’s a high positive relationship of ~93%, from 2010 to 2019, between the real GDP of the technology industry and the economy at large. Simply put, they move in the same direction. The GDP of the technology industry could drop to $24.6 billion this year from $25.6 billion in 2019. But the pandemic isn’t the only problem the technology sector in Nigeria faces.

Unfavorable policy decisions such as the ban on bike-hailing in Lagos and similar anti-innovation announcements are a threat to the technology industry which is largely driven by Nigeria’s youth population. The security risk posed by rogue policemen is also an emerging threat. These factors will further shrink the pie for the sector and consequently, the Nigerian economy.

Editor’s note: This is a TC Insights data article. TC Insights clarifies the business and human impact of technology and innovation in Africa with research and data. Find out more about our work here. Got a request for us, let us know here.