Benjamin Schmerler’s path to being a Venture Capitalist (VC) has not been direct or traditional. It has been fueled by his constant curiosity about people and the different things that bind or separate us.

He grew up in the United States and early on had a sense that he wanted to go and explore what lay beyond the endless skies he stared at each day.

So since Schmerler left home at the age of 18, he’s lived and worked in nearly every corner of the globe. He started out doing supply chain consulting for global corporations like Starbucks, Whole Foods and Hershey throughout the Americas, East and West Africa and Southeast Asia.

Outside his professional work life, he’s played hockey for the Keyan Ice Lions, built a small coffee company in Boston, learned a few languages and even had a stint caddying for movie stars in Malibu.

Interestingly, he stumbled on the name for his firm — SUNU Capital — while in Senegal.

“I was in Senegal and had learned to speak a bit of Wolof language.” Over a call from his home in Nairobi, Schmerler recalls the day this happened.

“One day I heard the word Sunu in a song and had to ask what it meant. I found it meant ‘Our’ and it resonated with me. I used the name of my firm because it’s a simple word and more importantly because I believe in our collective effort; working together to build more wealth for everyone and leave this planet a better place for our children.”

Daniel Adeyemi: How has the transition to Venture Capital been?

Benjamin Schmerler: Directly before founding and running SUNU Capital, I worked for a reputable SME lender called Root Capital. I loved Root’s expansive geographic footprint, community, and clear purpose or mission. So I think it took me a little while to get my feet underneath me and start to have a vision and mission for SUNU and how we would operate, what we would invest in, and our role to play.

It’s easy to get mad at investors especially when we exhibit bad behaviours or our flaws rise to the surface. In my case, SUNU is in itself a startup, and I am a solo general partner (GP) with the weight of success, failure, and a bloated inbox on my shoulders alone. I have stakeholders, performance metrics, capital constraints, and my own ego and envy to contend with. This has led me to make mistakes in how I communicate, my pace, and missing opportunities to be forthright faster.

I love people and want to invest in everything, but at the end of the day I can’t and that took some time getting used to. As humans we are fallible and I am certainly working at being better at this part of my job.

DA: What’s the thesis behind your investments?

BS: We want to back exceptional teams early on in their journey. As a solo GP, I am really looking for a deep connection with founders and their teams. For as much as possible, I attempt to become part of that team; this helps me to stay focused and sane and hopefully, remain useful from time to time.

I spend a great deal of energy reflecting on how we build products and services that leave us and future generations in a better place than where we started. And, while I am certainly excited about all the gains we have made in the last two decades across many sectors – health, education, fintech, food, etc. and this informs where we allocate our time and resources. I am equally concerned about the threats facing plants and animal life. There’s some real tension here and I haven’t quite figured out what to do about it.

All this is to say, as a capital allocator, we reflect on and invest in things that align with a world that is more just, equitable, diversified and hospitable for all creatures (big and small). There’s such an immense opportunity in emerging markets and Africa specifically, we are keen to be supporters and allies of the next generation of leaders.

DA: Tell me about your ticket size?

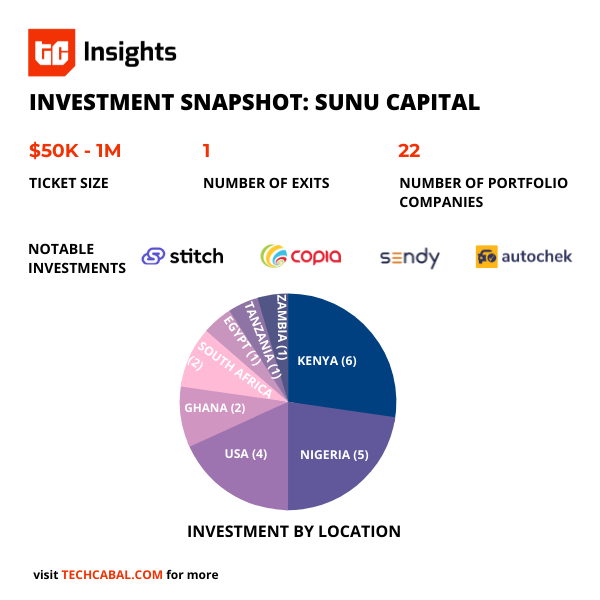

BS: If we find somebody that we really love with a laptop and dream, we’ll write them a $50,000 check and stay relatively close to see what happens. Our sweet spot is a $100-$250K initial check with the potential to follow on up to $1M. I have also been angel investing outside of SUNU and have invested in a handful of companies in Sub-Saharan Africa (SSA), the US, India and recently made my first investment in Pakistan. I participated as a Limited Partner in another Africa Fund.

SUNU has investments in the US and Africa and we use those networks to find opportunities that fit our mandate. I have found it invaluable to invest across the Atlantic and take learnings from Atlanta, New York and Los Angeles and try to apply it to what I am seeing in SSA.

DA: How long does it take to perform due diligence? How does that happen?

BS: It really is dependent on the situation. Typically, pre-covid it would take a few weeks on a smaller ticket and upwards of a month or more on a larger deal. With the world being condensed, smaller, and moving at lightning speed, we are making investment decisions as fast as on the spot to a few weeks regardless of the check size. I keep reading research that says entrepreneurs are most interested in speed, so we are trying to adapt and meet them where they are.

DA: I just checked your website and it doesn’t even have a contact address. Are you intentionally keeping a low profile?

BS: Laughs, initially it was intentional and now it has just fallen to the bottom of my to-do list. I want to be better at online networking, but I haven’t quite figured it out. There are only so many hours in the day, and between work, family, staying healthy and energized – I need to let some things go. It means that I should probably hire some great talent to build the platform so SUNU is out there engaging more with the ecosystem.

I’ve already started taking steps by hiring someone who has increased my capacity immensely. So here’s the plug: if you are an early-stage entrepreneur and want to have a chat, slide into my Twitter DMs. And, if you are interested in VC and are great at building a community, do the same. I am open to chatting!

DA: Okay, that’s a nice way to put it. How do people find you? How’s that working out for you?

What I’ve been doing is networking with other investors and asking founders in my portfolio who I should be talking to. I have gotten better at poring through Twitter and messaging founders directly. As it is right now, I’m getting most things from referrals. I’m open to meeting folks, talking to them and taking cold calls. I’m generally very open and excited to have conversations.

I’m also part of a Whatsapp group with like-minded investors who have a similar solo-ish GP structure to what we run at SUNU Capital. We talk about pipeline, due diligence, crypto tips, recipes, and pictures of our kids.

DA: What’s a question that’s been on your mind for a long time?

BS: What I’m really interested in is how to break the borders between countries so we can get a larger aggregated market that can be efficiently served. I believe if we can do this, we would see exits at the scale beyond anything we have seen to date.

I talk to entrepreneurs all the time and they show me the total addressable market (TAM) of Africa, a map of 54 countries. They hint at the possibility of expansion and I’m thinking how do we unlock Gabon? What does it take to be a part of Cameroon as well? There is so much untapped potential all over the continent that I am absolutely excited by infrastructure that turns the 4 or 5 markets where all the activity is happening into 10, 20, 30 countries over the next handful of years.

Further, I am so enthused by what I am seeing from young entrepreneurs who continue to remind me that this ecosystem is just getting started. I think about what Web 3.0 will look like in the African context; how does the creator economy evolve, grow and monetize; are there climate tech plays that will be born from this soil.

Just this morning I met with an incredible young crypto entrepreneur here in Kenya and he was explaining that despite much of the fintech and opportunities we are seeing as TradFi (traditional fintech), right around the corner there’s another wave of Decentralized Finance (DeFi) entrepreneurs disrupting what was just recently considered innovative. I am here for that and eager to see what these dreamers do.

Lastly, our markets are shifting rapidly and a number of the highest quality global funds are now here and playing an active role. I am stoked that this is happening for entrepreneurs and our ecosystem at large. All the ecosystem builders that have been doing this for a long while deserve their flowers. It’s also making me re-evaluate where SUNU can / should participate. I think the answer is early, early on in a company’s journey. I aspire for us to be a pre-seed and seed specialist that moves fast, is entrepreneur-friendly, and helps companies execute and raise their next round.

DA: That’s a good point because most of these activities are happening in Nigeria, Kenya, South Africa and Egypt. Which is just about 10% of the countries on the continent.

BS: This afternoon I spoke to an entrepreneur who is looking to expand from Nairobi into “alternative markets” where new leadership is opening up interesting spaces to get involved in countries like Zambia, DRC, Tanzania, Angola, and others.

A fantastic outcome of global investors focusing more time and resources in Sub-Saharan Africa will hopefully lead to increased Mergers and Acquisition (M&A) activity thereby decreasing the time to scale and new market expansion.

DA: What key trends are you seeing?

BS: First and foremost, this is a super time to be an entrepreneur as there’s an abundance of capital chasing the start-up story from all over the place. Capital is in high supply so entrepreneurs can / should be discerning about who they are taking money from and why. Despite the high valuations at the early stage, it’s also a great time to be an investor as there are more and more exceptional people building incredible ideas.

In terms of deal flow, I am continuing to see a ton of opportunities in fintech (payments, remittances, lending); logistics, distribution, warehousing; and a few things in education and healthcare.

I’m excited about early-stage crypto entrepreneurs because there are killer opportunities to learn and get smart about this potentially transformative space for African consumers and businesses. The things I would love to see more of are new media and the creator economy, agtech, climate tech, innovations in healthcare, and food. I would also love to invest in more female CEOs.

DA: Interesting to hear you mention food. Do you think it must have been influenced by your background?

BS: Well if you look at the agricultural tech market in the US, it has skyrocketed over the last 10 – 15 years because there’s an increased demand for resources, a premium on efficiency, and lifestyle trends that are reshaping food. Everything from precision agriculture to innovations to decreasing spoilage and even the things we eat and consume – think Oatly and Impossible Burgers.

At the end of day, you can’t eat fintech. There is low hanging fruit everywhere to create tons of value up and down the supply chain and for investors.

The food systems aren’t functioning efficiently. If you can find some space there, to build new products or supply chains to serve the rapidly expanding urban market more efficiently, with higher margins, I think there’s an immense opportunity there.