Despite being the third-largest economy in sub-Saharan Africa and East Africa’s financial and commercial hub, Kenya has a savings rate of 12%, lowest in East Africa—way below Africa’s average of 17%.

There are many factors attributed to this low rate: high spending appetite among young Kenyans, high cost of living, especially in urban areas, and black tax. There’s also a problem of cumbersome saving options and lack of proper financial education that exposes people to the importance of savings.

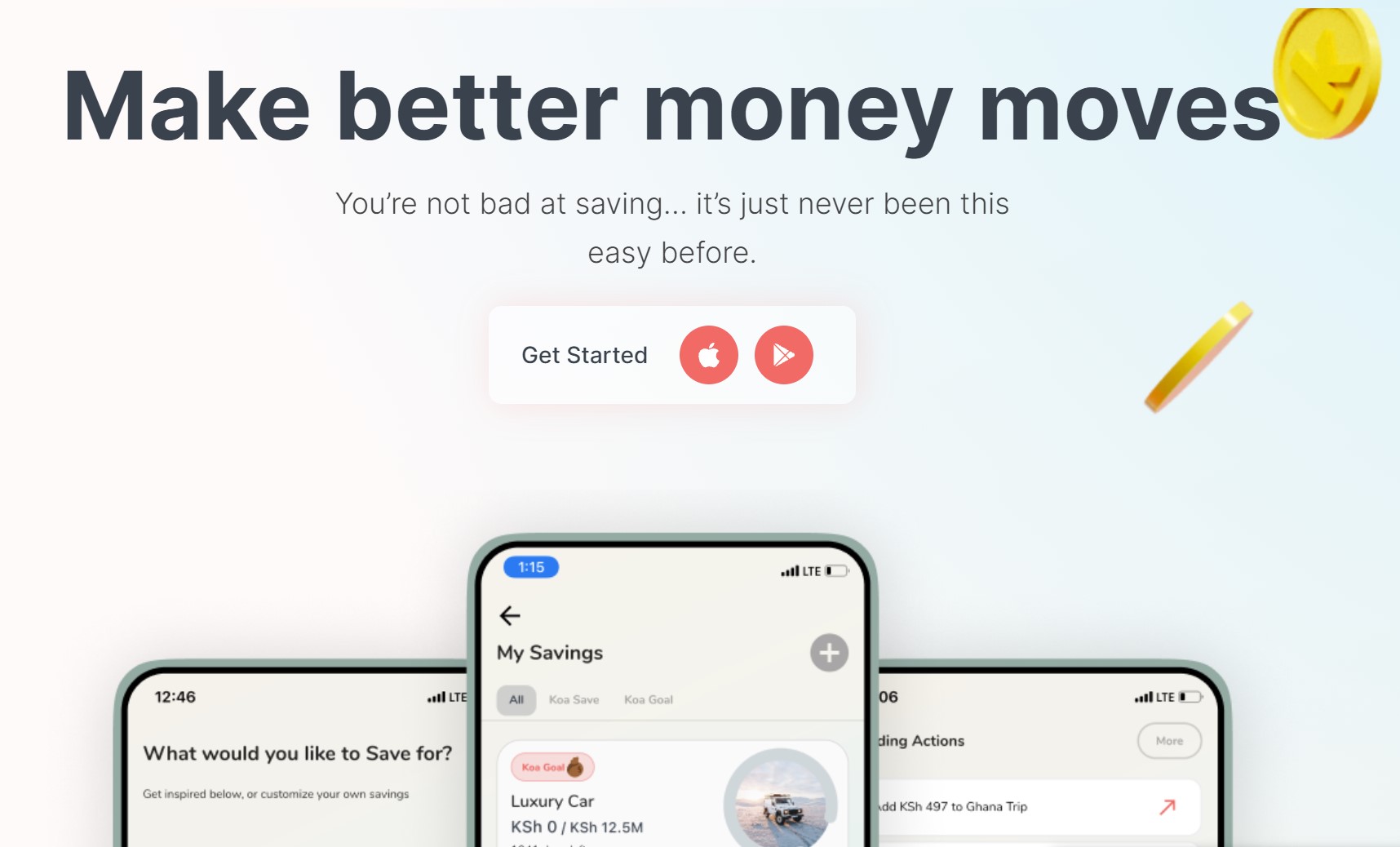

This is a big problem two pan-African tech operators Delila Kidanu and Alexis Roman are tackling through Koa, the digital saving platform they co-founded.

Koa founding story

The story of Koa can be traced back to MEST Africa as it’s the first place the two co-founders met and worked. But the idea to start a company together hadn’t been born yet. They were only heavily involved in MEST’s mission, which is to incubate and help scale African entrepreneurs and startups, and were exposed to a lot of people and the process of building solutions for African problems.

Kidanu was born in Ethiopia, moved to Kenya as a child and lived there until she went to the UK to study international relations and business. She then moved to Sweden for a master’s degree in innovation management and entrepreneurship. She proceeded to work with an NGO in Belgium to drive policies around global education before she moved back to Kenya to consult for international companies looking to set up shops in East Africa. After doing that for a while, she joined MEST Africa.

Roman, on the other hand, was born in Paris but moved to Togo as a child where he stayed and schooled until he moved to Canada to study economics and finance. He started a business after school but later decided to go work in a traditional financial institution, which he called a mistake that came with lots of needed experience. He moved back to Africa to join MEST Africa in Ghana.

After leaving MEST Africa, the duo forayed into different businesses but kept in touch and would always meet up whenever they were in the same city. Early 2020, they became colleagues again and started working as startup scouts for an early-fund venture capital, Microtraction.

“We spent a lot of time in Ghana, Nigeria and Kenya. Both Delila and I saw the popularity of digital saving products in Nigeria, like PiggyVest and Cowrywise, and how they were serving a real need for customers. But when we looked beyond Nigeria, as a market, we felt like there was a significant gap in other countries,” Koa’s CEO Roman told TechCabal.

They went ahead to speak to thousands of people in Kenya and discovered that 60% of the people relied on inefficient Informal Saving Groups and Cooperatives to save and access financial products. It became more obvious that lack of seamless saving option is another big factor aiding the problem. So they started deliberating about solving the problem the same way PiggyVest and Cowrywise are doing in Nigeria.

In December 2020, they finally founded Koa with Bubunyo Nyavor, their old colleague from MEST. The platform went into beta in April and was launched to the public in June.

The platform makes it easy for users to set personal saving goals towards a particular expenses like paying school fee, buying a new phones, cars or even marriage. The app nudge users’ by sending them daily, weekly or monthly reminders to deposit into the goals they set. Koa also makes it easy for users to track their progress so that they won’t slack or help them back on track when they do.

Koa is playing in a tough market and so is investing heavily in educational content that exposes its users to the importance of savings, especially in creating generational wealth. So far, according to Kidanu, the platform has already passed a 12,000 users mark and has received a deposit of 11,105,315.30 KES ($100,000) since its launch.

A few weeks ago, the company pitched at the TechCrunch battlefield as one of the only two African startups that made the cut and was the only African startup that made it to top-five. Both co-founders said it was a great learning curve for them and another validation that their product is essential in solving this real-life problem.

Incentive: make more money while saving

It’s not only difficult for Kenyans to save; the lack of access to formal financial products also made it hard to invest. So, Koa is killing two birds with one stone by holding its users’ money in a money market through a partnership with Britam, an asset manager in the Kenyan market.

On Koa, users earn up to 10% interest on their money annually, depending on market conditions. They also earn interest daily, which is good because they see their money grow in real time. This strategy has helped to cement the gospel of building wealth through saving and passive investing.

“Our partner has different types of funds. For us, we needed to be able to tap into a lower risk investment so that we don’t lose our customer base that is a bit more risk-averse. So we opted to work with Britam to invest in their money market fund,” Kidanu said on why they choose such investment and the reality of their promised ROI.

In fintech, customer trust is key. Once you hack that, scaling becomes a lot less harder. It’s evident in the way savings platforms like PiggyVest transparently communicate with their users and how much loyalty their users have for them. So are Koa users aware that their money is being invested in a money market?

“Customer trust is very important to us, and we communicate with our customers in terms of where their money is, who our partner is, why we chose them, and how their fund flow works. We only make the investment passive because we want to ensure a seamless experience for our users who are new to this,” Kidanu added.

Making money for a company whose major mission is to first help people who, before now, wouldn’t even think of saving money and building wealth can be tricky because charging customers directly can end up driving them away. They don’t think of the money they could make but the little that’s being asked of them. So how does Koa make money as a business?

“We make money when we get a commission from our asset management partner on funds invested. So we didn’t want a situation where we’d have to charge our customers directly for the service. We want them to enjoy the service for free,” Roman said.

The founders said they’ve raised a pre-seed institutional investment. On the back of the raised funds and their seed round, which closes soon, Kidanu and Roman also plan to scale fast and expand to neighbouring countries like Tanzania and Uganda that have the same saving problem.