IN PARTNERSHIP WITH

Good morning ☀️ ️

The gospel we’re pushing this week is, “Join the Cabal!”

Big Cabal Media is hiring some superstars to come supercharge their careers.

We’re looking for a Software Developer, a Senior Sales Manager, and a Talent Operations Analyst. If you love reading what Zikoko and TechCabal cook up, then you’ll love working with us.

If you know anyone who might be interested, share these opportunities with them. Remember, those who grow together, glow together. 🌟

In today’s edition

- US & UK restrict travels to southern Africa

- Trouble in Entebbe?

- Battery production in the DRC

- TC Insights: Egypt’s fintech boom

THE US & UK RESTRICTS TRAVELS FROM EIGHT SOUTHERN AFRICAN COUNTRIES

From Monday, the US will be restricting travel for non-US citizens from eight African countries including South Africa, Botswana, Zimbabwe, Namibia, Lesotho, Eswatini, Mozambique, and Malawi.

And it’s all thanks to COVID.

This sounds familiar

Well, if it does, it’s because a travel restriction of non-US citizens in South Africa—and 29 other countries—was just lifted three weeks ago.

After 18 months, the US opened up its borders to foreigners on the condition that they were fully vaccinated against COVID.

What changed?

COVID played the X-Men card and mutated. And South African scientists were first to report the mutation.

The World Health Organization has noted that the latest variant, Omicron—no known relation to Voltron or Ultron; maybe Megatron, though, because he’s evil—may be vaccine-resistant, has a possible growth advantage, and looks more contagious than the Delta variant.

Tulio de Oliveira, the director of South Africa’s Centre for Epidemic Response and Innovation, reported that the variant is “spreading very fast, and we expect to see pressure in the health system in the next few days and weeks”.

It’s going south from here

South Africans, justifiably, aren’t happy with the US’ announcement, especially as it came hours after the UK placed their own restrictions on travels from South Africa.

Many are also wondering if the decisions to restrict were made hastily without a full understanding of the (source of the) variant as it has since been identified in Israel, Hong Kong, and Belgium, and none of these countries have been placed on travel restriction lists.

The South African government has expressed concern on what this means for its tourist economy, with some reports stating that South Africa loses R26 million (about $1.5 million) for every day of restricted travel to the UK.

Since the announcement last week, the rand has dropped by 2.4% against the dollar, and South African hospitality stocks have plummeted.

Zoom out: As of November 2021, Africa holds about 3.35% of total COVID infections around the world. The US contributes 18%. Africa is still, however, the least vaccinated continent with only 4.4% vaccinated, compared to the US’ 55%. In South Africa, however, about 35% of the population is vaccinated with over 6 million doses available for public use.

TROUBLE IN ENTEBBE?

Since the weekend, news has been circling about trouble brewing over Uganda’s only international airport.

The news highlighted that Uganda may someday lose control of the Entebbe International Airport.

Break it down for me

- In March 2015, the Ugandan government signed an agreement with the Export-Import Bank of China (Exim Bank) to borrow $325 million with a maturity period of 20 years, including a seven-year grace period.

- The loan was to be used to expand the upgrade of the airport as part of Uganda’s 20-year civil aviation master plan.

- Only after the loan had been disbursed and construction commenced on the airport did the Uganda Civil Aviation Authority (UCAA) realise that the loan agreement came with what has now been termed “toxic clauses”.

- The UCAA identified 13 toxic clauses, one of which gives Exim Bank the sole authority to approve the withdrawal of funds from the UCAA accounts. Another clause gives Exim Bank power to approve annual and monthly operating budgets.

- In 2019, Uganda sent envoys to China to renegotiate the contract and rescind the toxic clauses, but China refused.

Big picture: The loan doesn’t mature for another 15 years, so Uganda’s got a lot of time on its hands to repay it. Government personnel are also confident that other solutions abound in the event of a default. Uganda’s Finance Minister, Matia Kasaija, mentioned that in the case of a loan default, the “central government” would intervene.

In Ep. 3 of Artwork, learn how to build a passionate community around your content.

👉🏾 Watch now.

This is partner content.

BATTERY PRODUCTION IN THE DRC

The Democratic Republic of Congo (DRC) wants to build its own domestic battery manufacturing industry.

Last week, at a two-day conference in the country’s capital, Kinshasa, Prime Minister Sama Lukonde laid out a series of initiatives aimed at increasing capabilities in the country’s battery manufacturing sector, including the creation of a Battery Council and a “policy to develop a regional value chain around the electric battery industry”.

Juicing up the industry

Congo produces around two-thirds of the world’s cobalt and is also Africa’s leading copper producer. The minerals are in high demand for use in electric vehicles and electronic devices.

Despite the resource-rich country’s high levels of mineral exports, Congo is still ranked among the world’s least developed countries.

Most of the minerals Congo exports are sold at a fraction of the final cost of the batteries, which are produced in countries like China, which maintains a 77% share of the global lithium-ion production market.

The African Development Bank as well as several other banks have already signed on to help develop Congo’s battery production industry.

Join the Future Africa Collective—an exclusive community of investors who invest in startups building the future. With a $300 quarterly fee, you get access to invest a minimum of $2,500 in up to 5 high-growth African startups.

This is partner content.

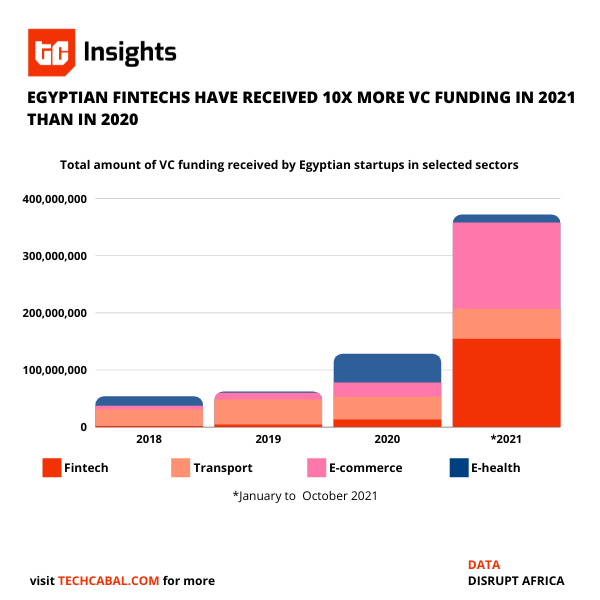

TC INSIGHTS: EGYPT’S FINTECH BOOM

Egypt’s startup scene is presently the darling of investors.

The country has received over $300 million in VC funding within this year alone. Between 2017 and 2019, startups within the e-commerce and transport sectors took a large chunk of these funds. But fintech startups are changing that. They’ve received more funding in 2021 alone than in the previous three years combined.

Compared to countries like South Africa, Kenya, and Nigeria where fintech startups have always dominated the startup scene, Egypt had a slow start. For many years, the banking regulations that enabled the fintech boom in those countries were largely absent. Also, inflation rates rose as high as 29% in 2017 as the country tried to manage the political instability that resulted from the Arab Spring.

All that is in the past now. Earlier this year, fintech startups were granted banking licenses which allowed them to extend their offerings. The government also passed an e-money law that requires companies to accept and disburse money electronically.

These shifts in regulations and policies have spurred innovation within the space and imbued investors with confidence, culminating in the huge wave of funding the sector has already received this year.

Beyond the new regulations, the country’s informal sector presents a market opportunity. According to the International Labour Organisation (ILO) in 2018, almost two-thirds of jobs in Egypt were in the informal sector. Only 14% of adults in the country have bank accounts, excluding at least 50 million people from the financial system.

Across Africa, fintechs have preached the gospel of banking the unbanked and fostering financial inclusion. Egyptian fintechs are the newest evangelists on the block. With the increase in VC investment for fintechs in the country, they now have more firepower to chase this mission.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Save 50% on transaction costs with instant, linked-account payments. Ideal for wallet funding, loan repayments, collections, and e-commerce checkouts.

This is partner content.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- British Council – Administration & Finance Manager – Nigeria/Senegal/Ghana

- Unilever – Projects and Engineering Service Manager – Tema, Greater Accra Region, Ghana

- Farmerline – Senior Mobile Engineer, Senior Software Engineer – Kumasi, Ghana

- TeamApt – Backend Engineer, Growth Associate, UX Product Designer – Lagos, Nigeria

- GIZ – Technical Advisor – Dakar, Senegal

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Sabi targets South Africa and Kenya with its new $6 million investment.

- Scammers are leaning into Davido’s $400,000 fundraising appeal.

- Italy fines Apple and Google €10 million each for ‘aggressive’ data practices.