A strong diaspora and the opportunity to penetrate north Africa’s undigitised industry are two advantages that tech and tech-adjacent startups north of the Sahara are failing to fully leverage.

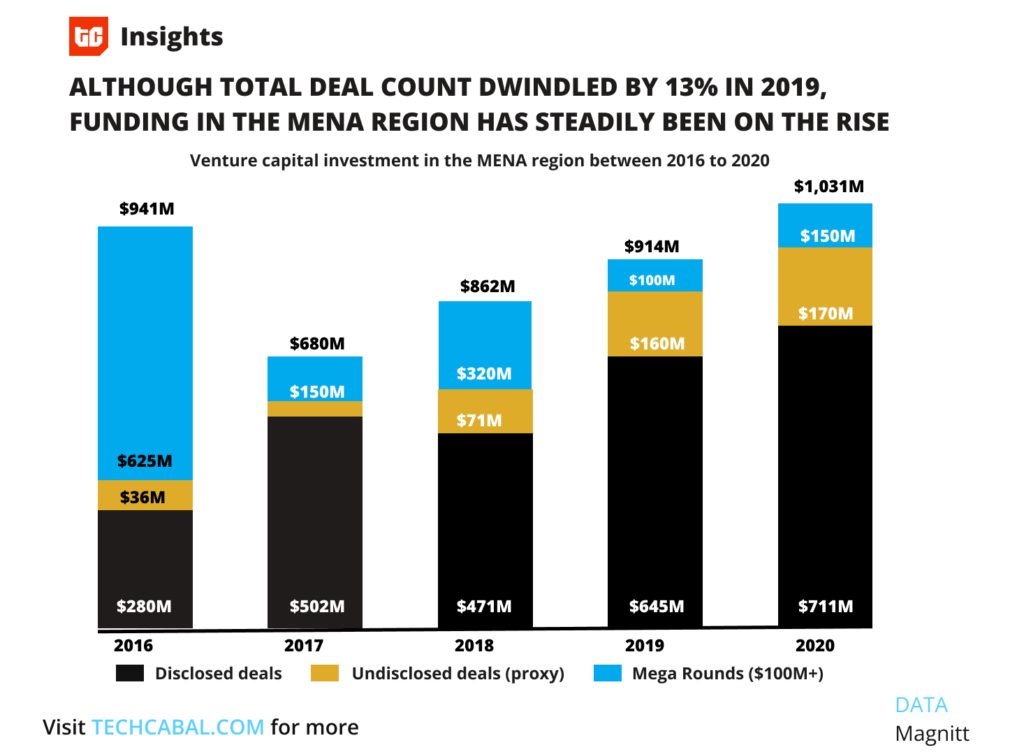

In the past year, North African startups have attracted investor attention and cash on the back of the favourable narrative comprising a large and relatively young population, increasing digital consumption, economic tailwinds, and a deep pool of tech talent—especially in Egypt. Across the Middle East and North Africa (MENA), the use of digital technologies has picked up too. According to MAGNiTT, startups in the MENA region raised a record $1 billion in 2020. Further narrowing our scope to only northern Africa, per Briter Intelligence, the number of deals in the region more than doubled from 2019 to 2021, and the total amount being invested more than quadrupled.

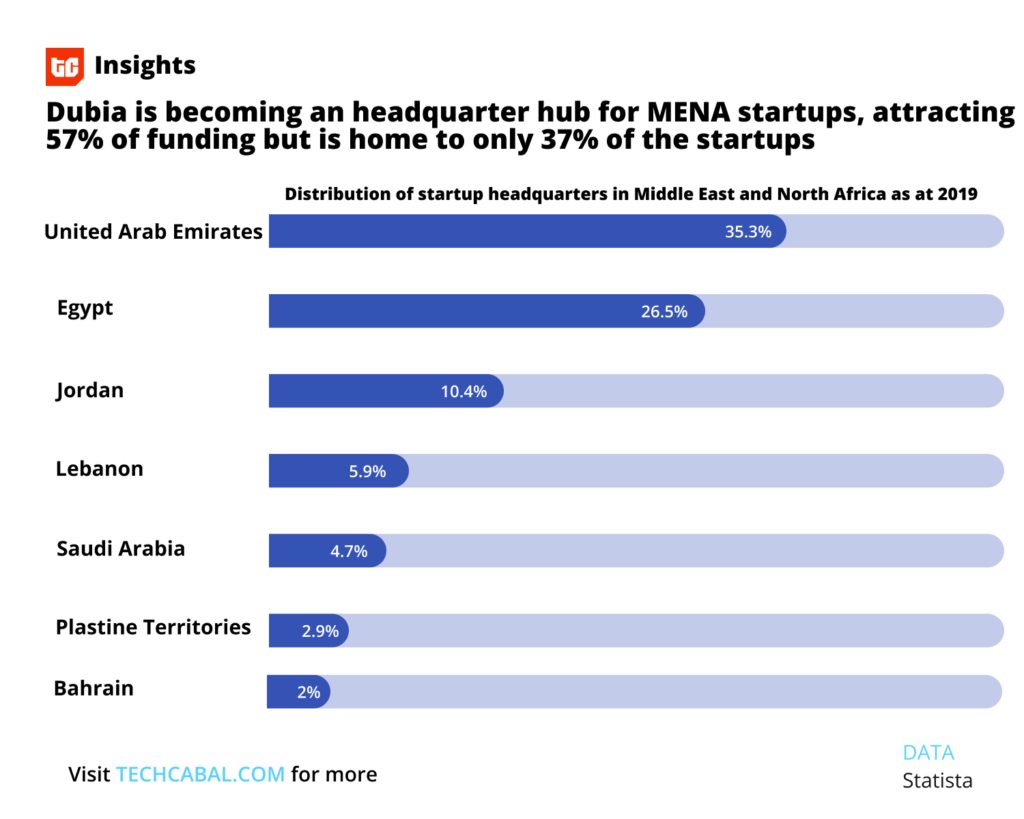

In this space, Egypt is the clear leader, even rivalling tech ecosystems in the Gulf Cooperation Council (GCC). Between 2020 and 2021, for example, UAE startups led the venture investing table, closing 44 deals. That was only two more than deals closed by startups based in Egypt and Saudi Arabia. In north Africa, tech firms in Egypt alone capture more than three-quarters of the total investment into the region. It is the region’s most developed startup ecosystem, and while it is not the perfect method, Egypt’s startup world shares much of the potential and challenges of its peers in neighbouring countries.

This remarkable growth has also been severely jolted by the venture funding slowdown, the broad sell-off in tech stocks, and the slow macroeconomic burn of inflation and sovereign debt chaos. Swvl, for example, one of the region’s breakout stories, which earlier this year, listed on the NASDAQ via a SPAC is down almost 88% from its $10 listing price.

Given this abrupt wake-up call, and how small and nascent the space is, it is conceivable that stakeholders in North Africa’s venture and tech firms will begin to reassess the opportunity while they brace for further impact. The thing is, North Africa has a lot going for it. Some are subtle, while others, like relatively better urban infrastructure and a large population, are obvious. One of the subtler advantages is the region’s large diaspora linkages.

A diaspora beyond remittances

The conversation about North Africa’s diaspora very often devolves to remittances. It is not unreasonable too. Remittances accounted for around 6% of North Africa’s GDP in 2020, according to the German market research firm, Statista. Even governments have come to depend on the annual inflow to shore up foreign exchange. “There are more than 20 million people from the Middle East and North Africa living abroad, but we fail to think of them beyond remittances,” said Hafez Ghanem, World Bank vice president for the Middle East and North Africa.

Remittances are a passive way to engage North Africa’s diaspora. Instead of thinking of the diaspora only as the source of annual dollars—a perfectly legitimate perspective as remittance payments in the MENA are relatively untouched by digitisation—North Africa’s diaspora can function more deeply as a source of trade, investment, and technology transfer to and within the region.

This is already happening at a level. Some of the region’s tech founders had built thriving careers in the GCC, Western Europe, and the US before setting up a venture locally. The tech ecosystem also employs operators with experience from other work outside north Africa. What is needed, however, is to recognise the diaspora—not just returnees—as strategic assets to deepen two assets the ecosystem has not fully developed: a deeper pool of local capital and a buying market that is relatively impervious to local economic downturns.

To better leverage its diaspora, North Africa’s ecosystem will need to be better at selling its success potential to north Africans residing outside north Africa.

Deeper connection to industry

Like most of Africa, startups north of the Sahara have yet to penetrate what industrial spaces exist in their markets. It is probably easier to build and sell a consumer app to your first 1,000 users than to penetrate industry networks with all the baggage that typically accompanies B2B markets.

In addition, B2B tech demands a more technical kind of VC. The sort of investor that is willing to invest in research to look beneath a diverse selection of industry hoods. Hasan Haider, managing partner at +VC agrees: “Another area for improvement is not with the founders but the lack of experience many newer VCs and investors have,” he told me.

The good news is that the region has a significantly more developed industry sector. I use “industry” broadly to include any aspect of the economy that is non-tech and relatively undigitised. As Eslam Darwish, founding general partner at Nclude, a Cairo-based venture firm, wrote recently on LinkedIn, “Startups don’t operate in a vacuum nor are they an independent sector. They are a natural extension of existing industries.” Embracing this perspective means building an ecosystem that looks beyond directly reaching consumers, to building the technology and systems that power industrial value chains. I’ll admit that this is significantly more difficult compared to building consumer apps.

To reach the full potential of this perspective, North African startups will eventually need to lean into their geographic advantage, not just to expand their market coverage but to build cardinal linkages with the GCC’s robust industry players and the different industries recording growth in sub-Saharan Africa. This may not be a consumer market move, but it helps North African tech talent find a quick outlet for deeptech solutions that may struggle to find a market locally.

Indeed the failure of Gulf countries to provide digital economy leadership is one of the biggest opportunities for North African startups, especially Egyptian companies, to strategically become a digital hub that can rival trade and real-estate obsessed Dubai.

Deepening north Africa’s tech penetration into indsutries may also confer startups from the region with a stronger path into sub-Saharan Africa. One area where we see this dynamic showing signs of life is in Amazon’s Egyptian play. Cairo Angel’s CEO, Aly El Shalakany believes that African startups, in general, can do better if they successful expand into more African markets.

“We are starting to see the convergence of the MENA, African, and South Asian economies. North Africa is starting to orient itself more towards sub-Saharan Africa, Egypt is beginning to see its sub-Saharan trade and investment ties as more important, and the Gulf Cooperation Council countries are increasingly leveraging diplomacy to position themselves for Africa’s future growth,” Wesley Schwalje, COO at Tahseen Consulting, a Dubai-based consulting firm told me.

Startups in north Africa only have to recognise these trade winds and sail along.

Partner Content

We’d love to hear from you

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.