Lipisha is a Kenyan company that uses various platforms to automate mobile payments, allowing businesses to collect, automate and integrate payments from customers and clients using mobile money. One of these platforms was Safaricom’s M-Pesa, at least until November 12th, when access was cut off for BitPesa, for whom Safaricom explicitly asked Lipisha not to continue serving.

The termination was carried out without notice, with Lipisha notified via SMS after the fact. This prompted Lipisha to take Safaricom to court. Certifying the matter as urgent, High Court Judge Joseph Onguto added that Safaricom would have to provide grounds for this termination.

BitPesa is one of Lipisha’s largest clients, and so they were joined as a co-plaintiff in the suit. The two firms blamed Safaricom for using its monopoly on the mobile money industry to intimidate Lipisha into cutting off access to M-Pesa services for BitPesa, which is a bitcoin trading platform. On BitPesa, users can convert bitcoin into Kenya Shillings and use the M-Pesa platform to send this money to any user with an account.

Safaricom has been sued for allegedly using intimidation to suspend the two firms’ services. Speaking to the Daily Nation, Mr Kiragu Kimani, lawyer for the firms, said that cutting BitPesa off is not only illegal, but is also creating grave strain on their business. According to Kimani, if Safaricom does not restore BitPesa’s access privileges, thousands of customers will be inconvenienced.

“The suspension of BitPesa’s access to M-Pesa services, and the demand that Lipisha stops transacting with BitPesa. is unlawful and infringes on the firms’ rights to acquire and own property, fair administration as well as their economic interests,” Mr Kimani said.

Lipisha alleges that Safaricom suspended its services and demanded that the firm produces its licence from Central Bank on the assumption that it trades in Bitcoin. The cryptocurrency is not illegal in Kenya, but it is also not recognized either.

Lipisha was established in 2011, two years before Safaricom’s Lipa Na M-Pesa service. It uses a variety of platforms to process payments, including Visa, Mastercard, M-Pesa and Airtel Money, enabling customers to pay for goods and services internationally. It also allows business owners to quickly receive and process mobile payments through simplified mobile and tablet applications.

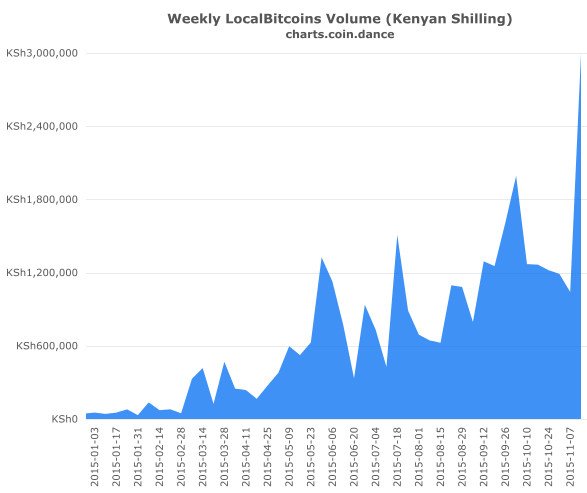

There appears to be at least one party to the proceedings who isn’t complaining though. Since the Lipisha/Safaricom dispute began, LocalBitcoins, a local currency to bitcoin trader has doubled its Kenya Shilling transaction volumes, suggesting that BitPesa’s loss is their gain, with daily amounts traded approaching 3 million shillings.

The spike started on 12 November, when BitPesa was cut off. (Via LocalBitcoins)

The Lipisha Consortium application against Safaricom’s action to terminate their access to the M-Pesa platform is currently in court. The first public hearing was on the 24th of November at Nairobi’s Milimani Law Courts, with the second scheduled for the 14th of December 2015.

Photo via Flickr