The year has gotten off to a slow start. No thanks to all the economic flailing by Nigeria’s Central Bank. Since late 2015, it’s been one trade-stifling move after another, and the Naira has been suffering.

I’m no economist, so I can’t pretend to understand the arguments of those who say the apex bank should stop defending the Naira and let it float free to the level it wants, or those who insist that the pressure on the Naira is the fault of speculators and people who spend money abroad, and that the Central Bank should not give in. All I know is that all of the uncertainty is what is doing horrible things to local business. Horrible things. Like making it nigh impossible for them to pay for offshore software and services, or access their cash from foreign ATMs.

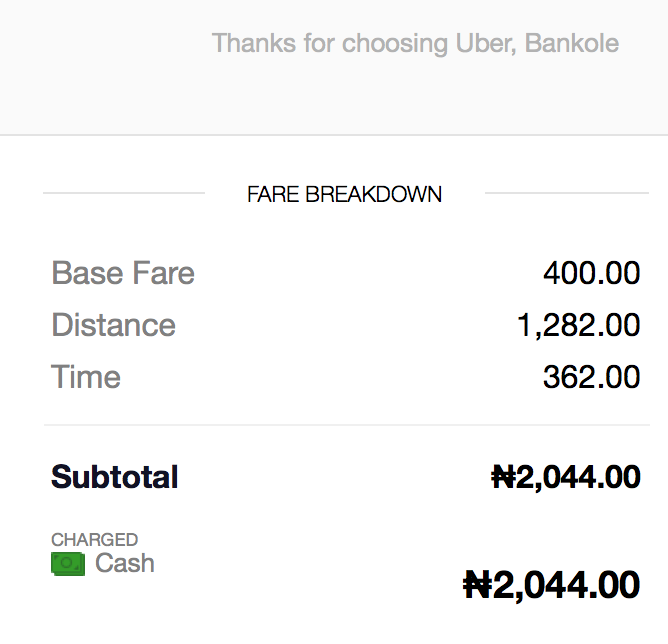

Uber in Lagos has been feeling the effects. Unexpected bank charges that do not match official Uber receipts have made riders livid. The banks have been using parallel forex rates to calculate the ride costs, and passing the difference off to the customer. After I hailed an Uber ride in December that saw the bank collect almost twice the amount on the Uber receipt, I suspended my use of the service till further notice. Because I’m a cheapskate who doesn’t like paying between 25 – 40 percent more than they are supposed to.

But then we got wind that Uber would commence cash tests this week. Naturally, I was going to test it.

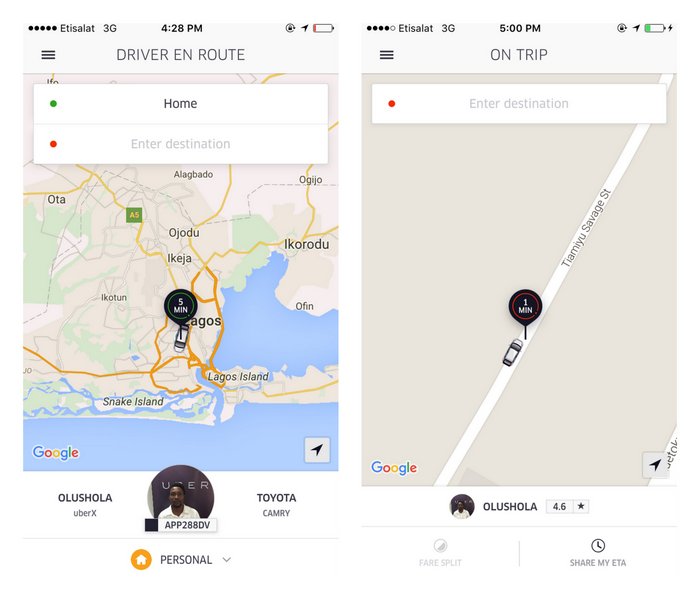

Important: Apparently, the cash feature is not live in Lagos yet, but I can confirm that the drivers are being briefed/trained because on both legs of my trip, my drivers were aware of the feature and didn’t weird out too much. As it turns out, I have the cash option because I have previously used Uber in a city where cash was enabled — Nairobi. Nonetheless, cash payment will be available to Lagos users any day now.

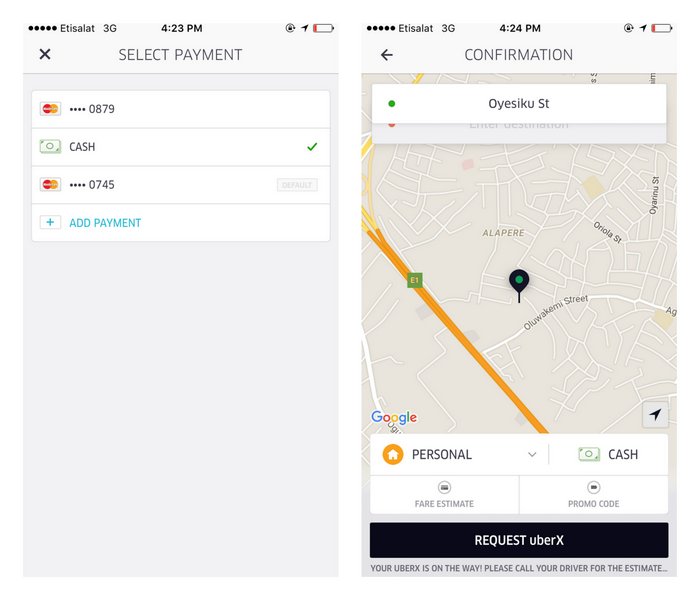

I hailed an Uber, the usual way. Except this time, I was sure to change the payment method at the bottom left from card to cash.

The trip proceeded normally.

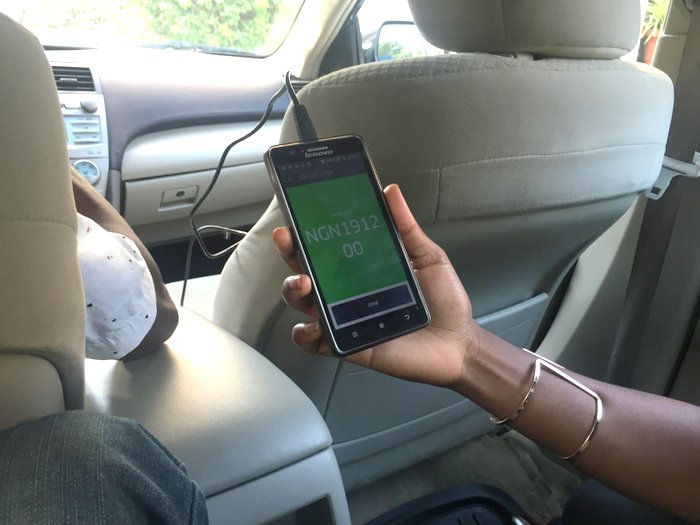

The fun began when I reached my destination. The driver was prompted to click the “cash collected” button to confirm that they had indeed received cash from the passenger

Making change was obviously going to be a problem, but I simply gave the driver N2,000 for the N1912 fare and went on my way.

If you are thinking that the fares should be round numbers to make the business of change less messy, you would be on the money.

But when the cash payment option becomes fully live in Lagos, Uber will round the fares down to the closest, er, round number.

On the bright side for Uber Lagos’ handlers, cash payments might open the service up to people who don’t trust card online payments, or do not have cards in the first place. Please, don’t ask me how likely it is for someone who doesn’t have a bank card to download apps. On the dark side, the cash transactions will probably earn Uber scrutiny from the Lagos tax man.

Talking to the drivers was interesting. It seems that they prefer not having to deal with cash or the hassle of making change like regular taxis. One of them was concerned about how receiving cash would destroy his ability to save his earnings. I can see how that could be a problem.

For my part as well, I must admit that what was typically a silky-smooth experience for me is now fundamentally broken. On the return leg, I caught myself leaving the car before handing the cash over. Curbing that reflex is going to be a pain. That, and keeping hundred and thousand Naira notes around, considering that my lifestyle is almost cashless. But the current alternative is taking a forex haircut in my bank debits. The choice is not hard.