A 3-way partnership between Planet Payment, a leading provider of international and multi-currency payment processing services, Absa, one of South Africa’s largest financial groups and CyberSource, a global payment gateway and merchant provider has given birth to a multi currency pricing solution in South Africa called Shop in your Currency.

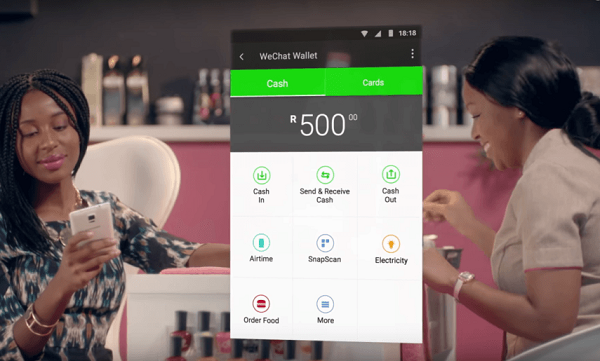

The solution allows retailers to localise their ecommerce offering and simplify the shopping experience for international customers who view pricing and pay in their home currencies, while the merchant receives settlement in South African Rand as they would do normally.

“It will furthermore allow international Customers to enjoy the convenience of shopping and paying in the currency they know best – their own,” adds Cowyk Fox, Managing Executive, Absa Card.

“When we initially partnered with Planet Payment in 2010, Absa became the first local bank to implement Pay in Your Currency, also known as Dynamic Currency Conversion, and we look forward to further expand this relationship as we launch it in South Africa. The introduction of Shop in Your Currency provides our customers with a powerful tool that will assist them to succeed in the new global marketplace and will allow merchants to implement their international e-Commerce strategies without overseas expansion.”

“We are delighted that Absa has chosen to include our Shop in Your Currency product in the bank’s suite of products for the South African market,” said Carl Williams, President and CEO at Planet Payment. “As global ecommerce sales continue to rise, we continue to believe that localized pricing is a key component to a merchant’s international e-commerce strategy.”

Photo Credit: SimonQ錫濛譙 via Compfight cc