How many times have you had to replace your debit card because you left it in your back pocket along with your bulging wallet, forgot about it and sunk into the snug swivel chair at work, after which you hear a gentle, almost imperceptible “crrrk” sound?

That’s your debit card failing an impact test. It’s also the sound of another N1,500 ($7) you will fork over to your bank to regain the joy of cash on-demand and smooth cashless payment.

But again, a debit card broken in two is a more benign problem to have as far as problems involving debit cards go.

For one, you could reach into your wallet after an expensive dinner at one of the many upscale restaurants on the Island and realize your debit card had snuck out while you weren’t looking.

Maybe you left it at your desk, or you forgot it at the gym after the evening session. None of those look pretty and the second is worse. If a resourceful gymster gets a hold of it, that’s an early and possibly teary-eyed goodbye to your savings.

Or even worse; probable litigation, if our gymster had deals with those within the grey dimensions of the law.

Even when you are not snapping your debit card in half, or having it picked up by the resourceful fitness buff, there is no knowing the sketchy crew waiting to tap your card details from the ATM plaza you just used. It’s ugly. Makes one wonder if we won’t we all be better off if our debit/credit cards were locked away in some safe house.

It’s why the mobile payment infrastructure from Access Bank – PayWithCapture – is a great idea.

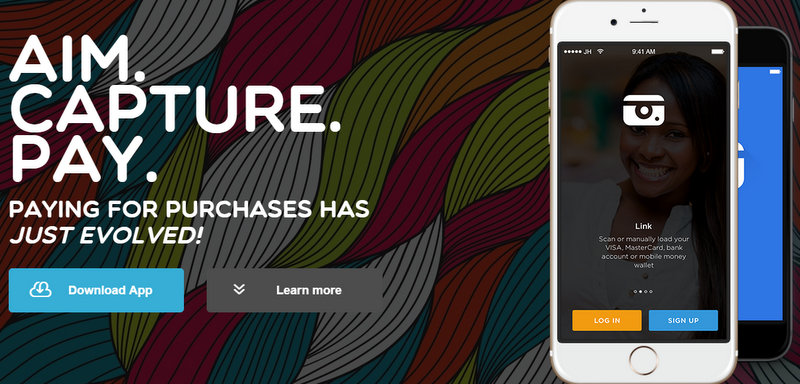

With Access Bank’s PayWithCapture, a user can store her card details on one central infrastructure and make payments from within the app by capturing pre-generated QR code at POS terminals with her phone. No cards, no swipes.

With PayWithCapture, all you ever really need is your phone. The user can save as many card details – from as many financial institutions – as desired on PayWithCapture, and the different cards can be selectively or collectively charged, depending on the user’s disposition.

PayWithCapture is not merely a shiny new toy, it’s a true innovation. It removes the risk of losing your card or gifting the price of a decent Shawarma to your bank because your behind and the conference seat did an impact test on your debit card, or if any of the other things that could go wrong, went off.

To get started:

- Download the PayWithCapture app

- Sign up and link your accounts. You can link as many – credit/debit card, bank, mobile money – accounts as possible.

At the store:

- Open PayWithCapture

- Add payment method

- Scan a QR code

- Make payment

- Be fruitful and multiply

Go here for the FAQ’s and more information.