The actual demos in the DEMO Africa event began yesterday. The excitement was palpable as founders and investors gathered to learn, pitch and collaborate with the aim of ushering in the next phase of innovation and disruptive technology on the continent.

These events are pretty intense as attendees are ushered from session to session. I was determined to make it a learning opportunity so I didn’t waste time heading over to the Knowledge Streams as soon as they opened. It was a choice between listening to Ben White of VC4Africa and Andrea Barrica of 500 Startups.

I started with Ben, the plan was to split my time in half – 20 minutes with Ben, 20 minutes with Andrea – but I ended up staying with Ben all through. The session was just so engaging.

Here are some of the things gleaned at the VC4Africa knowledge stream:

On approaching investors

1. Numbers are really important

A recurring comment by CEOs and Founders was that numbers were generally missing from most of the demos at the day’s event. If you’re planning on winning people over with your idea, you have to be ready to disclose numbers. It’s one half of the formula when you have limited time before an audience.

2. Tell Stories

The other half of the formula is storytelling. Nothing connects with people better than a story. Ideas are better conveyed in the framework of a story. Your story helps show how your product works in the real world as well as the kind of problem it solves.

3. Seize every opportunity to showcase the product

Investors love to see how scrappy you are. So, it’s preferable to have a product that is running along quite well. Ideally, you shouldn’t approach investors until you have gotten a product that is delivering numbers. You don’t have to be making profit but you must be able to show that you got the product ready by bootstrapping. It sends the message that you’ll manage funds well.

On financing your startup

1. At the seed stage, you have the option of approaching business angels, friends and family or just bootstrapping.

The African Angel networks are still trying to streamline their collaboration. It’s going to take them a while to figure things out so give them some time. Angels in diaspora are seeing all the activity and growth in Africa and they’re willing to put in their money and also collaborate. It’s a generally interesting time for angel networks in Africa.

2. Do your due diligence when approaching investors, don’t go in blind. Researching the investors also helps you to know how they get their money. Is it somewhere you’re okay with, morally? Who have they invested in already? What’s their motivation to invest with you? These are not questions to skim over. Entrepreneurs who are desperate to get funding sometimes get in bed with the wrong investor (usually the first one they sit down with). As a founder, you must be bold enough to say no to investors when they don’t pass your own personal checklist. It may be the hardest thing you’ll ever do as a founder, saying “Sorry, but no” to potential investors but you’ll be better for it.

Venture capitalists are nicknamed “vulture capitalists” for a reason. Get a lawyer in the same room if you can.

3. Family and friends as a source of funding may be a no-brainer for some people but you have to consider the relationship first. Money changes relationships. It’s turned cousins into enemies and some people drag their family members to court over debt issues. So, put that into consideration when looking to approach a family member. Also, do not borrow more than you actually need. You don’t want to get choked when the time comes to repay.

4. Get loud. Tell your story. After grinding away for months to get your product ready, there comes a time to start making some noise. You’ve been in the dark, it’s time to get some spotlight on you and your startup.

The session closed with Njeri Rionge, the serial entrepreneur and founder of Wananchi Online, one of the leading ISPs in Kenya. She shared her success story and gave super essential advice to entrepreneurs – invest in proper documentation especially financials, the road is hard so gather a solid team and last but not least, learn how to properly value your business.

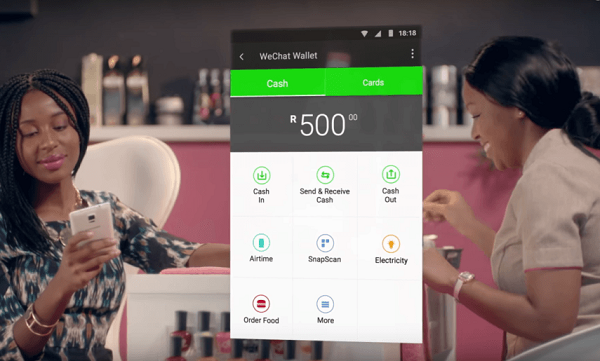

I got to listen to the some of the startups pitch to the 500 strong audience – TalkingBookz, RoadRules, Raye7, Carparts Nigeria, ogaVenue, Flippy Campus, mytoddlr, Insure Afrika, eProductivity, SimbaPay, ZeePay, Koomzo and Locname which blew me away with its simplicity and real world application. Expect detailed feature stories on them in the coming weeks.

Keep it locked for more info on the events of DEMO Africa 2015.