Ridesharing in Africa is not a new phenomenon – Africans have moved around by sharing vehicles for decades. Traditional ridesharing was more about getting from one point to another than the technology that powered it. Today, though, real-time ridesharing is completely turning transportation on its head.

Real-time ridesharing involving the use of social networks, smartphones, and GPS navigation devices have made it possible to share rides with as little as a tap or click on a mobile phone.

Technology develops over time through a process of bundling and unbundling, and this is evident in the state of the transportation sector in Africa. For instance, traditional ridesharing evolved to individual mobility – as more people purchased cars – and it is currently moving back to ridesharing again with the introduction of ridesharing apps.

Real-time ridesharing is important because it is disrupting the transportation industry. Rapid urbanization is driving the need for transportation, and where public infrastructure is lacking, online ridesharing is filling the gap. It is estimated that almost 40% of Africans live in urban areas and this is projected to increase to 50% by 2030 and 60% by 2050.

As the urban population grows, the need for cost-efficient transportation in urban areas will grow as well. Ridesharing highly offsets the costs of owning a vehicle, reduces the impact of petrol shortages, drastically reduces the amount of CO2 emitted by cars, and helps professionals in big cities to beat traffic.

Additionally, competitiveness among e-ridesharing companies is building better customer service in the transport sector in the continent, as well as raising the service standards and expectations. Finally, ridesharing has economic benefits for both drivers and customers. The use of mobile apps is empowering individuals economically because they can generate money with the cars they already have in their possession. This strengthens their individual financial capabilities and the local economy as a result.

With ridesharing giants like Uber showing the way, numerous ridesharing apps have been popping up sporadically on the continent. This report sizes up ridesharing services in Africa to reveal the total number of ridesharing apps in the continent, the number of services per region, the region with the largest number apps, the timeline of ridesharing app launches, the cities with the highest number of apps and what this all signifies.

NB – Ridesharing in this article refers to real-time ride-hailing and carpooling services. This research is not exhaustive; it’s based on the data that was available to us at the time.

Highlights

- Africa has 56 e-ridesharing services

- Most of the homegrown apps launched between 2015 and 2016

- Uber operates in 15 African cities

- Lagos is the city with the most ridesharing services in Africa

- Uber has four major competitors

- Cash is still the most popular method of payment

- Funding is the decisive factor in the success of homegrown apps

The Distribution of Ridesharing Services in Africa

In total, there are about 56 e-ridesharing services in Africa. 21 countries utilise ridesharing apps, while the remaining 33 do not yet use them.

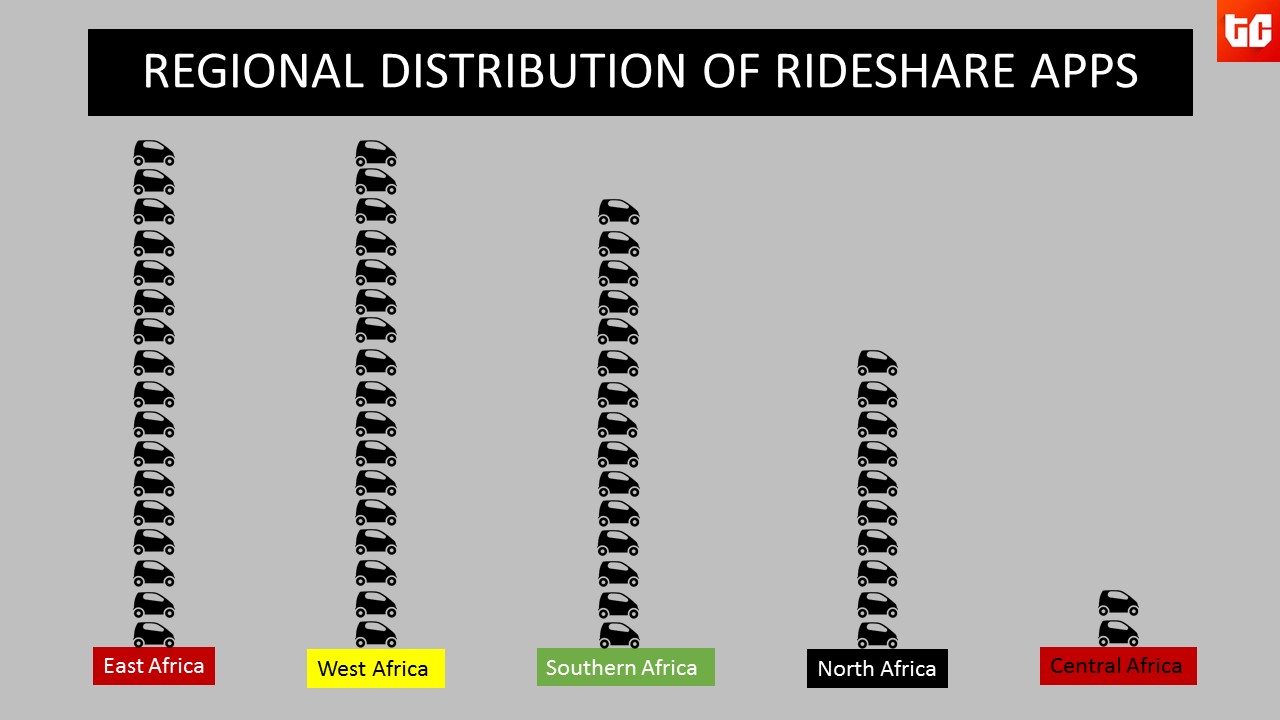

Coincidentally, East and West Africa each have 17 identifiable services, Southern Africa has 16, North Africa has 10, while Central Africa has the least with two.

Ridesharing in African Cities

With 14 identifiable ridesharing services, Lagos is the city with the most ridesharing services in Africa. The top five cities with the highest concentration of apps are:

- Lagos (14)

- Nairobi (11)

- Cape Town (7)

- Casablanca (5)

- Cairo (4)

The apps that are in the most cities are Uber, TaxiDiali, Ousta, Careem and Taxify. North African apps appear to be the most well-distributed homegrown apps locally, as well as regionally. TaxiDiali is available in over 30 cities in Algeria and Ousta is available in 11 cities in Egypt. Currently, all other homegrown apps are available in only one city, with the exception of Unicab, Little, Sendy Ride, GoMyWay, Fone Taxi and Jozibear.

A Launch Timeline of Ridesharing Apps in Africa

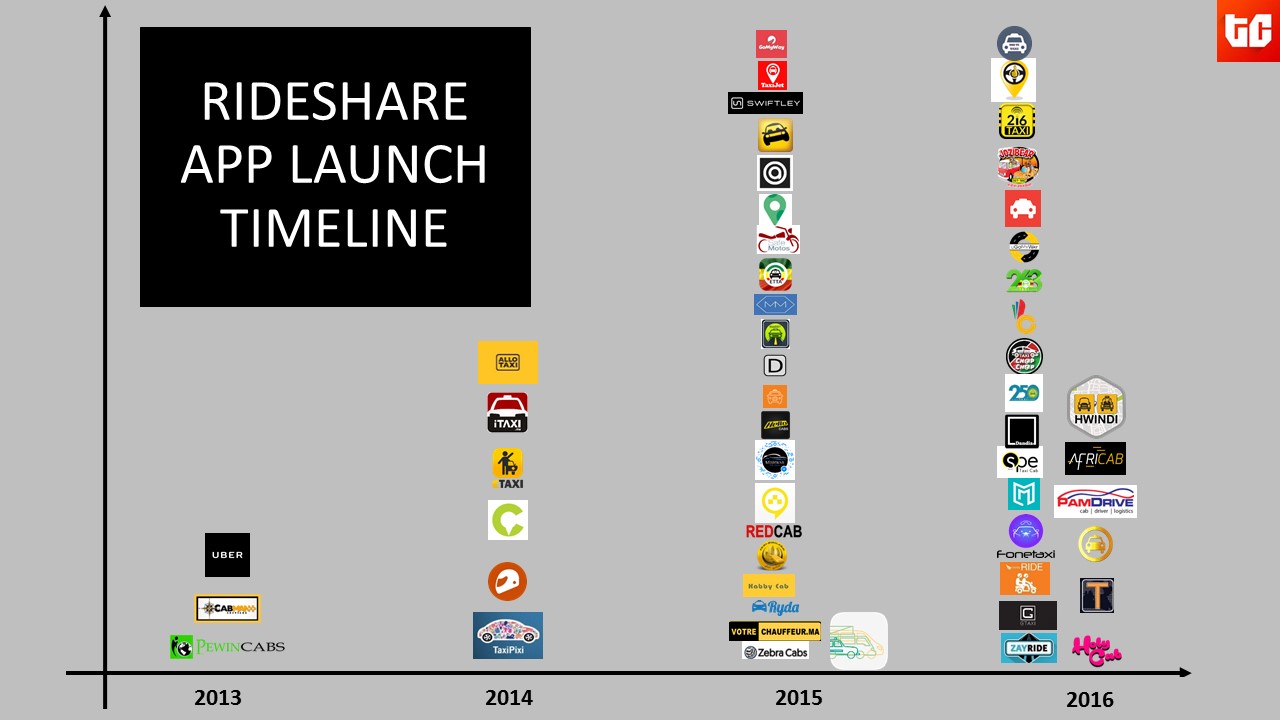

All the existing ridesharing services launched their apps between 2013 and this year. 3 apps launched in 2013, 6 launched in 2014, 22 launched in 2015 and 23 launched this year.

The graph above shows that 2015 and 2016 have so far been the most popular years in the growth of the ridesharing industry.

Homegrown Apps with the most installs

Among the homegrown apps, Mondo Ride and Ousta appear to have the highest average Android downloads with 300,000 installs each. While installs do not indicate usage, they show that these homegrown apps enjoy popularity in their countries (Kenya and Egypt) more than others.

Uber remains the most popular

According to Similarweb, Uber is leading in all the countries they are present in. They are also the most distributed across the continent, present in all regions except Central Africa. Uber is in Egypt, Morocco, South Africa, Kenya, Uganda, Tanzania, South Africa, Nigeria and Ghana and operates in 15 cities across the continent.

Regional Comparisons

In North Africa, Careem and Ousta are the strongest competitors with Uber, as they both have substantial funding. There is much more room for growth in countries like Sudan, as Mishwar is located only in Khartoum. Uber isn’t in Sudan yet and there aren’t other competitors, so Mishwar has a free range for now.

In West Africa, there is a high concentration of homegrown taxi-hailing apps. There are about 14 homegrown apps in West Africa alone. Taxify and Little are also looking for a share of the market in West Africa. The high number of apps is not an indication of the health of the rideshare industry because of Uber’s dominance in cities like Lagos and Abuja. Apps in Nigeria are concentrated in Lagos, with only Uber fully operating in more than one city in the entire region.

The same holds for East Africa. Homegrown apps are not only numerous in the region, they are also very innovative in ways to differentiate from competitors. For example, Safaricom’s Little offers a wide range of services. Customers can redeem Safaricom bonga points for cab rides and the app will soon be available for USSD (non-smartphone) users.

Little also offers a women-friendly ride service called Ladybug. The app has a live-fare feature that allows customers to monitor the fare rate throughout the trip, and a little coin feature that allows customers store unpaid change as credit for future rides. All these services differentiate Little’s services from others.

In Southern Africa, homegrown apps are thriving in Angola, Botswana, Zambia and Zimbabwe – Uber is not yet in any of these countries.

Cash is the most popular method of payment in Africa, due to the fact that countries like Egypt, for example, still have very low banking and credit card penetration. Uber launched a cash payment option in Egypt and Morocco as a result of the low usage that occurred when cash was not a payment option.

Countries with more payment options, like Kenya might favour mobile money to cash. All the ridesharing apps in Kenya offer mobile money payment options, indicating that it is favourable. Cash is still the most popular option across the continent, as big players like Uber, Taxify, Little and Careem all offer cash payment options.

Uber in Africa: Lessons to Learn

Is Uber calling the shots in Africa? To a certain extent, yes. Uber’s top competitors are Careem, Ousta, Little and Taxify, but it is dominant in all the countries it is present in. Is it a good thing? Yes and no. It is a good thing because it is changing ridesharing on the continent and improving customer service in the industry. It has also inspired the rise of numerous homegrown ridesharing apps, suddenly offering Africans a variety of choices, which is an indication that the transport sector is becoming healthier.

Nevertheless, Uber’s domination arouses mixed feelings because of there is often no room for other taxi companies to thrive. Uber’s domination in different parts of the continent is already having an impact on local transportation. For example in Egypt and Morocco, Uber faces a myriad of challenges fitting into the local space because of friction with local taxis as well as taxi drivers who use the Uber platform.

Careem took advantage of Uber’s clash with local taxi drivers in Egypt by adopting 42,000 local “white” taxis as part of their service this year, giving Careem an advantage over Uber. There are speculations that other “white taxis” are teaming up to form their own white taxi-hailing app, which will try to compete with Uber and Careem on a level-playing field in Egypt.

In Morocco, however, Uber has adopted local taxis to meet demand as well as to reduce the friction between Uber drivers and local taxis. Also, in December 2015, Uber enabled cash payments in Egypt. This was a significant move, because even though Cairo is a densely populated city, banking and credit card penetration is low. Cash payments have enabled a larger number of customers to access Uber’s service.

The same regulation disputes have been experienced in Kenya, South Africa, etc. In Lagos, Uber has already begun to face license problems as well and the local government is beginning to regulate Uber’s service. Uber’s policy of cutting tariffs has also been met with stiff opposition from Uber drivers, encouraging competitors like Taxify to woo drivers with better working conditions. This is playing out in a similar pattern as Paris and other cities where Uber has disrupted local transportation. These trends show that as online ride-sharing grows, African governments will increasingly regulate practices in the sector.

Uber will continue to spread across the continent. More homegrown ridesharing apps will launch but their lifespan and competitiveness will be determined by how much funds they have. Careem and Ousta are able to stay competitive because they have significant funding. Outside Africa, China’s Didi Chuxing was able to overtake its biggest competitor with a ridiculous amount of funding. While service differentiation and local expertise help competitiveness, money seems to be the decisive factor.

Apps like Maramoja, Mondo Ride and Sendy use local expertise and an understanding of local habits as their selling point. For example, Sendy and Mondo Ride utilize boda bodas (motorcycle taxis), in addition to cars as a part of their services, while Fone Taxi and ZayRide offer three-wheeler ride options to customers.

While these services are strategic, nothing stops their greatest competitor on the continent from deploying similar services. When combined with substantial funding and pricing manipulations, steep discounts and driver subsidies that Uber is known for, homegrown apps will be driven out of the market (Zappacab and Snappcab come to mind). African ridesharing businesses have to become just as shrewd and manipulating in how they operate. They must also have a massive balance sheet to counter Uber’s subsidy model.

We see a future in which the consolidation of many homegrown apps or ridesharing companies will become a means of competing with Uber – it’s already happening in Egypt and may replicate in other parts of the continent. On the other hand, competitors may buy out local brands in order to stand toe-to-toe with Uber. This is what Careem has done in Morocco already. Taxify and Little are inching their way into West Africa so we are about to witness major competition.

We will have to see what will happen in the next few years. The changes that will take place should be very interesting to watch.