Telcos are a very important part of the startup ecosystem, for one many startups deliver their products and services via mobile networks and the internet which are mainly run by them. Additionally, some startups need the customer base that telcos have in order to gain traction. For example in 2016, solar startup M-KOPA signed a deal with Safaricom in Kenya which entailed the telco stocking the startup’s solar TV sets at its outlets. On the other hand, telcos also need startups in order to stay innovative and competitive.

In West Africa, telcos are supporting startups in different ways some of which include partnerships, trainings and funding. Although funding activity is relatively low, we take a look at some of the telcos investing in and supporting West African startups.

Orange Group

French telecoms company Orange Group launched a $56 million fund focused on African startups in 2017. The fund is being managed by the Orange Digital Ventures team which was launched in 2015. The Africa fund is targeted at early stage startups in the areas of new connectivities, fintech, internet of things (IoT), energy and e-health. A dedicated Orange Digital Ventures Africa team was also set-up in Dakar, Senegal. Here’s what Marième Diop, VC Investor at Orange Digital Ventures Africa said about setting up in Senegal: “We opened our offices in West Africa because we know that there are amazing potential in this region, and we certainly want to tap into francophone West Africa.” So far, the Africa fund has only invested in Kenya’s Africa’s Talking. Before it launched the Africa fund, Orange Digital Ventures acquired a $88 million equity interest in the Jumia Group in 2016.

Before the Africa fund, Orange already had an accelerator and hub initiative called Orange Fab in Ivory Coast, Cameroon and Senegal. Orange is also one of the partners supporting the first incubator/hub in Senegal, CTIC Dakar. Furthermore, Orange Niger helped set-up the CIPMEN incubator in the country.

MTN Group

In 2016, MTN participated in a $351 million funding round in Nigerian e-commerce group Jumia. MTN Group’s Chief Digital Officer, Herman Singh said at the time that Jumia would help reinforce its digital offering and pledged to support the company with its knowledge of the market. In partnership with the Federal Government, MTN also launched the Student Innovation Challenge in Nigeria targeted at startups founded by students from tertiary institutions. The group’s goal is to give fifty finalists from the challenge 1 million naira ($2,780) each in seed funding. MTN also has a pan-African Venture Incubation Programme in partnership with UCT’s Graduate School of Business (GSB).

Asides the above, there’s also the Africa-wide MTN Entrepreneurship Challenge which was launched and driven by Jumia in 2016. The winner in 2016 was Ghanian health startup MedRx which beat two other finalists Nigeria’s Pass.ng and Tanzania’s Vicoba to walk away with the $25,000 prize money.

Vodafone Ghana

Globally, Vodafone’s Institute launched the F-LANE accelerator which focuses on women-led or focused tech-startups in partnership with Impact Hub Berlin and Social Entrepreneurship Akademie. The accelerator is open to Africans founders and winners would receive about $14,000 in seed funding. Although it has an investment arm, Vodafone Ventures, it doesn’t appear to have a fund focused on Africa.

Asides funding, Vodafone also has partnerships with hubs and startups in Ghana. In 2015, IrokoTV announced a content partnership deal with Vodafone Ghana which saw it provide content to Vodafone’s subscribers for a small fee (US$6 per month for more than 4,000 movies). Vodafone Ghana is also a partner with MEST Ghana holding developer events, providing access to market and fund development opportunities to startups.

Airtel Nigeria

In 2015, Airtel announced the Singtel/Airtel Accelerator Challenge a competition for app developers in Africa and Asia. The goal was to identify consumer-focused mobile apps in the region. In the same year, it also held the Catapult-a-Startup challenge which saw seven startups win 1 million naira each. The winning startups were Chopup Games, Yuzah, Sonbim Games, Matchup, Blubird, Pass.ng and PushCV. Airtel doesn’t appear to have continued any of these initiatives since 2015.

Additionally, Airtel struck a partnership with Ghanaian fintech startup, Zeepay and the Ashanti Regional Agricultural District in 2015 to use Airtel Money to increase financial inclusion among smallholder farmers. The District will use Zeepay’s platform and Airtel Money to register about 100,000 Farmers in order to support the dissemination of information under its digital agriculture project.

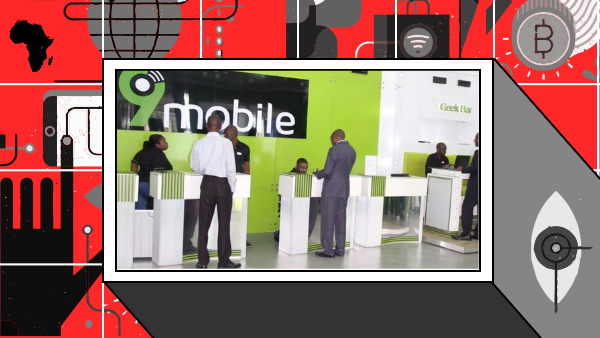

Moov/Etisalat

Before it exited the Nigerian market, Etisalat Nigeria held an annual prize for innovation called the Etisalat Prize for Innovation which was founded in 2012. There were two award categories with different prizes as follows: (i) Most Innovative Product/Service ($25,000) and (ii) Most Innovative Idea ($10,000). Past winners include Helium Healthcare (previously One Medical), Genii Games and Dresses by Aloli. The last known Etisalat Prize for Innovation event was in 2016 but the new entity 9Mobile has since called for new entries for 2018.

Through its EasyBusiness Millionaires Hunt, Etisalat trained entrepreneurs in Nigeria and gave out 40 million naira (approx. $111,000) in grants as at 2016.

Tigo/Millicom

In 2014, Tigo’s Think Incubator invested in four startups including Nigerian building materials marketplace, CribPark (seems to be currently inactive). The startups were each offered $15,000 each for a 10% equity. The telco also launched a $10 million fund in 2014 targeted towards digital innovators in emerging markets including Africa which will be managed by the Millicom Foundation. Not much appears to have happened afterwards.

Millicom is also of the investors in Jumia, it invested $45 million in 2013 to increase its stake in the company to 35%.

Globacom

While Globacom doesn’t have a specific initiative targeted at tech entrepreneurs, in 2015 it announced a five-year partnership with the the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) to support 17 million small and medium business owners in the country. Through the partnership, Glo will provide SMEs access to grants, soft loans and capacity training programmes. Globacom’s fibre optic network has also been a major boost to ICT infrastructure in the country.

Conclusion

The Orange Group and MTN Group happen to be the biggest and most active backers for tech entrepreneurs in West Africa as at now. The other telcos have little or no activity or have become inactive in funding technology entrepreneurs in the region. As Aubrey Hruby pointed out in this article, “African corporates need the most up to date technology to be competitive across global markets and local startups can help with that.” She stated further, “In order to compete successfully on a global stage, African conglomerates must harness these startups’ innovation, technology, and country knowledge through investment.” It will be interesting to see more telcos set up venture funds like the Orange Group as it not only benefits startups but the organizations themselves.