Ecoligo, a Berlin-based startup which provides solar systems to commercial and industrial businesses in emerging markets, has raised 2.5 million euros from Saxovent, a clean energy project developer and investor.

The startup says it will use the funds to scale up its operations in Ghana and Kenya. It will also use part of the money to expand its business in Costa Rica as well as expand to new markets in South Asia.

Founded in 2016, Ecoligo provides a complete digital platform for financing and delivering solar projects. In 2017, it closed seed financing with angel investors and InnoEnergy, a European company that promotes innovation and entrepreneurship.

“To date, we have successfully implemented more than 20 solar projects in East and West Africa, Central America and Southeast Asia and thus already have a relevant global influence,” Ecoligo CEO Martin Baart said.

Innovative financing options

Many Africans – about 600 million in the sub-Saharan region – continue to seek alternatives to unreliable power grids. They are increasingly turning to distributed energy systems but consumers often have trouble financing these expensive systems.

The average price for a 25KW solar panel system according to US solar power company, EnergySage is about $50,211, money that is simply out of reach for many Africans. Across the continent, solar power companies are providing financing solutions to address this problem. Some of the options include crowdfunding and pay-as-you-go.

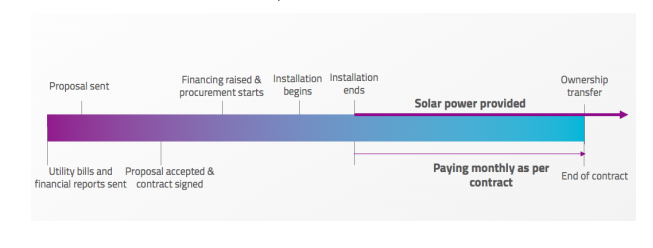

Ecoligo helps businesses finance their solar systems by crowdfunding from individual investors. It then collects the money over time by letting these businesses make a monthly payment for the energy they use. After the contract period ends and they complete their payments, the solar system becomes theirs. The individual investors are paid back from the monthly payments that businesses make.

Here’s how Ecoligo’s business model works

Source: Ecoligo

The business model takes away the financial burden of paying upfront for the solar systems. One of the beneficiaries of the model is Nyaho Medical Center, a hospital in Accra. The hospital raised 298,000 euros within 27 days for a 195 kWp solar system. The money was raised from crowd investors in Europe who will get repayments at 6% over the next five years.

“So far we have brokered a total of more than EUR 2.4 million on the crowd investing platform ecoligo.investments and won almost 800 committed private investors,” Baart said.

There are considerable risks

One of the concerns with crowdfunding and pay-as-you-go is that the solar companies who provide them essentially function like financial institutions. They have to take on the burden of debt collection and ensuring that crowd investors get paid. Solar companies typically study the credit profiles of the clients they engage and use credit scoring as well as risk analysis to ensure that payment defaults are very low.

Ecoligo, for example, warns its crowd investors, that their “investment involves considerable risks and can lead to the complete loss of the invested assets.” It also explicitly states that there is a risk that the economic failure of a different project by the company, which they’ve not invested in, could adversely affect their own investment.

The success of the model largely depends on the ability of organizations to forecast which customers will default and managing investment risks.

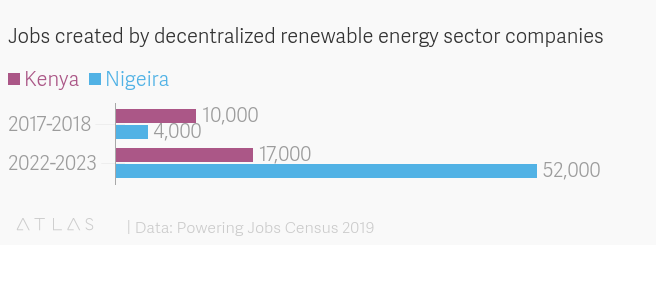

Decentralized renewable energy jobs are rising fast

Ecoligo handles the installation of the solar systems it provides to its clients from start to finish. It does so by working with local service providers thereby supporting direct and informal jobs. Its partners also provide maintenance services to its clients. While data on the jobs Ecoligo supports isn’t public, the company expects to grow its team and partner network on the back of the new investment.

A newly released jobs reports by Power for All reveals that the decentralized renewable energy sector has emerged as a significant employer in emerging markets. The sector has already grown a workforce comparative to traditional utility-scale power sectors and is expected to more than double by 2022–23.

In Kenya for example, the sector currently supports 10,000 direct jobs and 15,000 informal ones. The number for informal jobs is expected to double by 2023 while direct jobs are expected to rise by 70%. Kenya’s power utility, for contrast, currently accounts for 11,000 direct jobs.

Source: Quartz Africa

As more solar companies with innovative financing solutions and products continue to drive clean energy penetration, they’re expected to have a ripple effect from economic productivity to job creation.

Matthias Kittler, COO of Saxovent who are providing the funding, said of Ecoligo’s business model: “Everyone involved benefits financially from the solution: the local companies who reduce their electricity costs, the local service providers through the installation and maintenance of the solar systems.”