“I don suffer no be small, upon say I get sense,

Poverty no good at all ooo, Nayin make I join this business.

419 no be thief,

It’s just a game, everybody dey play am,

If anybody fall mugu, ah,

my brother, I go chop am.

National Airport, na me get am,

National Stadium, na me build am,

President na my sister brother,

You be the mugu; I be the master,

Oyibo man, I go chop your dollar.“

The above excerpt is from a popular song by legendary Nigerian comic actor, Nkem Owoh. He glorifies a life of fraud, claiming that fraudulent crimes are merely a game: “everybody dey play am.” But this joy ride carries serious problems for Nigerians in general.

Last month, United States authorities clamped down on online fraud perpetrated by a number of Nigerians. The number of indicted persons, the stolen amount and the victims are serious reminders of Nigeria’s problems with fraud. But most importantly the clampdown comes at a time when two companies, Interswitch and Flutterwave, have made notable efforts to connect Nigerians to international payment options.

A Short Tale of Two Crimes

This story began with the August arrest of 31-year-old Obinwanne Okeke, AKA “Invictus Obi”, who appeared on the 2016 Forbes 30 Under 30 list, by the Federal Bureau of Investigation (FBI). Invictus Obi was indicted in an $11 million business email compromise (BEC) scheme.

BEC involves fraudsters gaining access to a company’s computer system. The fraudster then poses as a company executive and convinces employees to make unauthorized wire transfers to bank accounts controlled by the fraudster.

Following Obi’s arrest, the FBI on August 22 arrested 14 people in the theft of over $6 million and an attempt to steal $40 million from unsuspecting victims. In an unsealed document, the FBI indicted over 80 persons, most of them based in Nigeria, with conspiracy to commit mail and bank fraud, as well as aggravated identity theft and money laundering.

The group was led by Valentine Iro and Chukwudi Christogunus Igbokwe who spearheaded the much of the operations. Serving as “brokers”, Iro and Igbokwe compromised victims’ emails, impersonated and helped launder the stolen money.

The use of BEC shows scammers have become sophisticated in both their approach and targets. Previously, romance scams, advance fee fraud and the “Nigerian Prince” scams had been the popular ways to defraud unsuspecting victims. But the use of BEC scams means fraudsters now compromise the security of companies and have found sophisticated ways to launder money through the Nigerian and global financial system undetected.

The geographical scope of victims is also widening. Formerly victims of fraudulent schemes were largely Americans and Europeans. But according to the recent indictment, a Japanese woman lost over $200,000 over a 10-month period. Identified as FK, the victim used Google Translate to chat with a Nigerian fraudster who posed as a US soldier stationed in Syria. The use of services like Google Translate allows scammers to target more victims in non-English speaking countries. In fact, the FBI disclosed that victims of the recently arrested scammers were located in Mexico, Lebanon, China, Ukraine, Germany and Indonesia.

These revelations could carry implications for companies like Flutterwave and Interswitch, who are helping to connect Nigerians to more international payment options.

This comes at a time when payment companies are trying to open Nigeria to international payment options

In July, Flutterwave, a fintech startup, secured a partnership with China’s Alibaba that allows it to integrate with Alipay. Alipay is the world’s biggest payments platform by transaction volume. The agreement integrates Flutterwave with Alipay, allowing African merchants access to the platform’s digital wallet and payment infrastructure.

Earlier this month, Verve, a payments card company owned by Interswitch, launched the Verve Global Card that gives Africans access to new international and cross border transaction capabilities.

Both initiatives by Flutterwave and Interswitch have been overshadowed by the news of the arrests in the US. With the reach of Nigerian online fraud now spreading to China and Japan, it could have implications for Flutterwave as it expands to Asia. Following its partnership with Alipay, Flutterwave subtly announced it was expanding its services into Asian countries like China and India.

Flutterwave declined to comment for this article. Interswitch didn’t respond to multiple requests for comments.

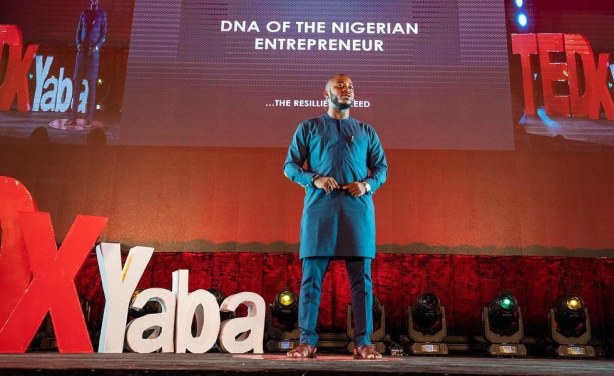

However speaking with TechCabal, Iyin Aboyeji, co-founder and former Flutterwave CEO agrees the indictment has hurt Nigeria’s reputation. But he explains that his company’s “superior technical knowledge” allows it to manage fraud better. There is a “global burden of education, and we have to show them how we are fighting the bad guys,” he added.

But Aboyeji questioned the willingness of regulators to tackle the issue. “We are excited to work with them [regulators], but are they willing to work with us?” he asked rhetorically.

Odunayo Eweniyi, Chief Operating Officer (COO) at PiggyVest, said the latest round of indictment is very damaging for the country.

“A lot of financial services options are unavailable to us precisely because of the risk of fraud,” she told TechCabal. “International payment options, merchants and services don’t see our market as rich enough, or even worth it to take the risk,” she added.

Meanwhile, Nigeria’s efforts to control the situation are complicated by political realities.

In 2017, the Nigerian Financial Intelligence Unit (NFIU) was suspended from the Egmont Group, an international organisation that helps Financial Intelligence Units (FIUs) in member-nations to share information confidentially. The Group accused Nigeria of failing to make the NFIU an independent body outside of the EFCC. In addition, the group cited that the EFCC was leaking confidential information to the media and blackmailing individuals with this information. However, Nigeria’s membership was restored last year after the National Assembly passed an Act that separated the NFIU from the EFCC.

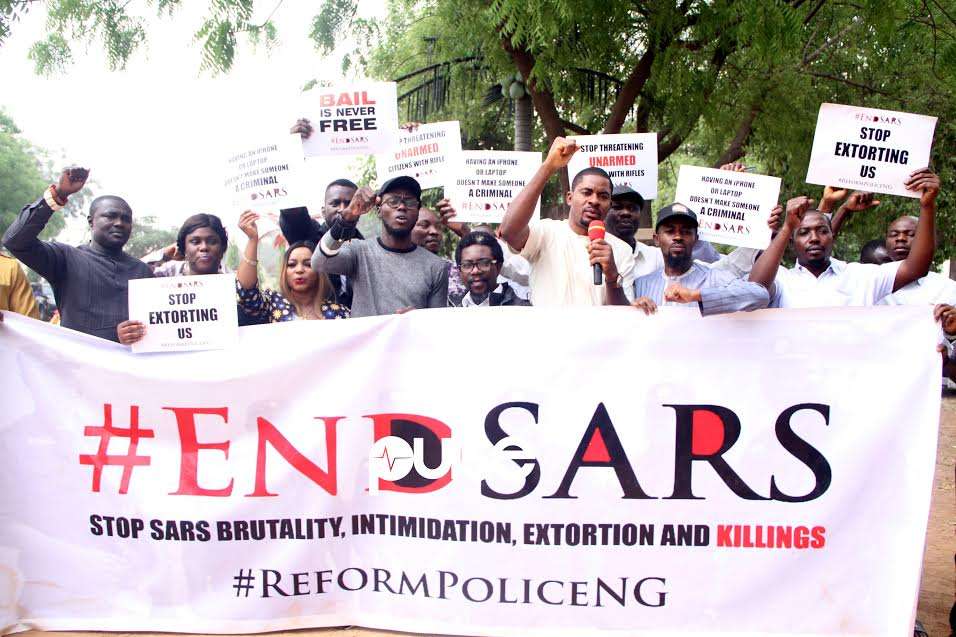

Efforts to control cyber-fraud are also hampered by cases of extortion by some Nigerian police officers. The Special Anti-Robbery Squad (SARS) of the Nigerian Police Force have been at the forefront of the security agency’s online fraud investigations. But SARS officials have been accused of arbitrarily arresting people and labelling them fraudsters, in order to extort money from the victims.

The brash manner with which SARS officials and harassment of innocent people prompted the #ENDSARS campaign calling for the end of the unit and reforms in the police.

This issue exposes the challenges in the country’s police force and makes it easy for real fraudsters to escape punishment by simply paying off some police officers.

Am I A Yahoo Boy?

Nevertheless, the country is not completely incompetent in the fight against cybercrime. Since the early part of 2019 the country’s anti-graft agency, the EFCC has stepped up its anti-fraud activities.

In May, the EFCC arrested fast-rising musicians Naira Marley, Zlatan and three others for alleged internet fraud and money laundering. Naira Marley has since been arraigned in court and the case continues, although he was granted bail.

Since his arrest, the EFCC has made over 60 fraud-related arrests. For instance, on August 30, it caught around 20 suspects in Imo state in a single swoop, and on August 7, 29 suspected fraudsters were arrested in Ibadan, Oyo State. Another 27 suspects were caught in Osun State in June. Meanwhile, the agency has also disclosed that it is working with the FBI to investigate suspected cyber-criminals.

However, these efforts won’t matter, according to Aboyeji, until industry players including regulators cooperate to address how illicit finances flow through the Nigerian system.