On Saturday, October 19, Funmi* received an Instagram direct message from David Kenneth. He made a tantalizing proposal: invest N5,000 ($14) and get it tripled in 45 minutes. She was intrigued. Kenneth requested her phone number to provide detailed explanations of how the investment worked. It seemed harmless.

Two days and six N5,000 transfers later, Funmi was understandably fuming when ‘Kenneth’ not only refused to pay her dividends but had hacked and taken control of her Instagram account. Her offence? Refusing to transfer more to facilitate the refund of her initial deposit. In 48 hours, she lost the equivalent of the new national minimum wage ($83); a dash to the bank spared her the disaster of losing savings to a faceless, rogue broker.

If you cannot relate to this story or feel Funmi was unduly naive, you could be right. But it has not been so long since thousands of Nigerians boarded the clearly questionable MMM rollercoaster. Many failed to arrive the financial independence utopias they were promised after months of expensive GH-ing and PH-ing.

With MMM dead, social media is awash with a new groove.

Like Funmi, Onyinyechi Okeke was followed on Instagram in November 2018 by a curiously-named account. “[He] said he worked with Flip cash which according to him, is a money doubling firm”. That should have been a red flag but “he also said their sole aim is to help youths that had productive thought for starting up a business but no capital. I guess those exact words enticed me”.

Sure enough, she would not be able to get through to the scammer on the phone once he received her N5,000 transfer.

‘Our name is legion’

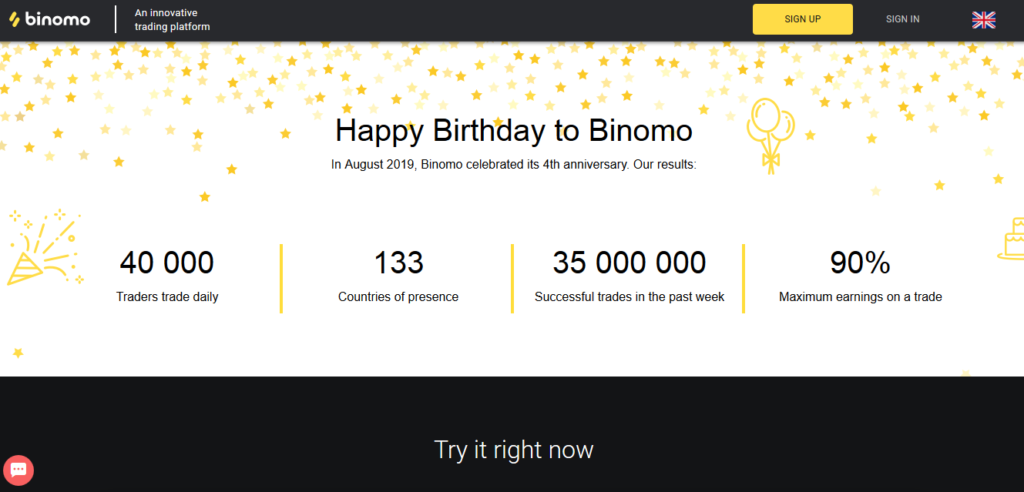

By every credible standard, “Flip cash” is not a real company. Unlike Binomo – a financial assets online trading platform – there is no official website or verified Facebook page for any entity claiming ownership of the Flip cash brand.

But even Binomo has become entangled in the web of online money scams such that the legitimacy of the platform is increasingly doubtful.

On Instagram, Facebook, Twitter and LinkedIn, hundreds if not thousands of accounts are named with a variant of “binomo investment” as a suffix. Timelines of such accounts are plastered with screenshots of supposed testimonies of multiplied deposits, ostensibly to persuade prospective preys of their legitimacy.

While they use male or female names – Mike, Faith, Mr Musa, Mrs Success – and use display pictures aimed at projecting wealth, they almost always make the same promise in the first few lines of their chat: to double or triple your money in less than an hour.

Legit or scam-ish

In September 2018, Binomo launched a Nigerian campaign featuring former national football team star Victor Moses as brand ambassador. At the time, they claimed to have been operating in Nigeria since the first quarter of the year; you probably got tired of their ads on YouTube at some point. ‘Binomo world’, a verified page on Facebook, is liked by over 36,000 accounts.

A bio on binomo.com says it was founded in 2014. Its address is in St Vincent and the Grenadines, an island country in the Carribean. You will find flattering testimonials from “Ayinde Abraham Lincoln” and “Adeyemi Iseoluwa Isaac” (tracking these persons for comment proved impossible). But a ‘binomo’ search across Facebook, Instagram and Twitter hardly turns up an account claiming to be trading assets on the platform.

Instead, an army of malicious actors fronting as company agents are on the prowl, promising near-instant returns to unsuspecting targets. On bad reviews posted to the Binomo Facebook page accusing it of being a scam, Binomo’s replies are that it has no agents trading on its behalf, everyone should be vigilant and reach out to them via email with questions.

The company is yet to provide answers to a list of questions regarding its Nigerian presence; whether it is aware of these scams and its relationship with financial services regulators, among other things. Alina Shulgina, whose email signature describes her as Binomo’s “Global SMM & Community Team Lead,” failed to get back with answers before handing me over to a second representative, Kseniya Potapova, who says: “I will try to figure out and let you know.”

The proprietors of mytopexchange.com, a website run by Nigerians, claim to facilitate trades in bitcoin, binary options and Olymp Trade (another trading platform whose authenticity has come under scrutiny, though their Twitter account is verified). The website has a post explaining how you could fund your Binomo account through a complex mechanism of online transfers where they act as a “third party e-currency exchanger”.

On a call with one of their authors (who says he is a financial assets trader), he acknowledged the prevalence of money-doubling scams by purported Binomo agents. But when pressed on his company’s status as a Binomo third party agent, he said they stopped facilitating Binomo trades two months ago (the above-mentioned blog post is dated 24th October 2018, a month or so after Binomo’s branding partnership with Moses). He would not clarify why they stopped, though he insists Binomo remains legitimate.

On their websites, Binomo and Olymp Trade say they are ‘category A members of the Financial Commission‘, a so-called “independent self-regulatory organization and external dispute resolution (EDR) body”. It is unclear that this body has any ties to any national government or rules-based financial regulator.

This September, the Cyprus Securities and Exchange Commission (CySec) warned its citizens that binomo “does not belong to an entity which has been granted an authorization for the provision of investment services and/or the performance of investment activities”.

Why would anyone fall for this?

Aduke Yemisi Williams is an active social media user and has got her share of attention from scammers. She has not been a victim of an online money scam but has had sufficient contact with them in her DMs to curate a list of some of the more notorious accounts.

Sometimes she chooses to ignore the DMs and may play along at other times. “The bottom line is I am very careful because I wouldn’t want to fall victim.”

Playing along could be costly though, as Lucy* found out in the last week of October. ‘Otega Dennis’ promised he wasn’t dealing in MMM or Loom and “sounded so convincing we moved from twitter to WhatsApp”.

But after “he swore with his life and the lives of his family that it wasn’t a scam and [that] after this I’ll be the one telling people about this investment”, nothing came from the N7,000 ($19) – including N500 borrowed from a friend – she transferred. “I came online on Twitter and realized he blocked me. He blocked me on WhatsApp too.”

Naiveté, greed or ignorance, there are varying reasons why anyone would fall for these.

“You can’t tell me that if I invest N10,000 you’ll give me N30,000 in the next 45 minutes”, Aanu Sebiomo, a graphic designer, told me in a conversation about his money scam experience. Contacted on Twitter by ‘Mr Frank Binomo investment ltd’, Sebiomo took him to task to verify authenticity.

“I asked him what he was investing in, he didn’t give any concrete response. I went to Google and did a reverse image search of the pictures on his timeline and they belong to someone who is a CEO of [another] company. I asked him if he was the owner of the pictures and he said yes”.

Sebiomo got blocked by his scammer after this confrontation. He says he would understand if he learns someone has been scammed by similar means. But anyone investing in anything should ask key questions: What is the broker or fund manager investing in? What’s the nature of his/her social media handle? Why should I deposit into a personal account number?

Keep calm with giveaways

Sebiomo’s sister had shared her account number in the comments of an Instagram post promising a giveaway. She did not know the account wasn’t Tunde Ednut’s (as she imagined) but an account aping the influencer’s username. A hacker would not do much with an account number alone but the ease with which social media users volunteer personal information certainly emboldens would-be scammers.

In addition to her account number, Funmi had sent her scammer ‘David Kenneth’ her date of birth.

It comes down to individuals being more circumspect in conversations online. While they have policies against malicious actors and misinformation trolls, social media companies insist they are not in the business of policing content round-the-clock. As more of the world comes online – many, especially of a pre-internet generation, not very discerning about technology’s harms – the risks of online money scams will increase.

Many of those in this story say they will now stay vigilant online. Onyinyechi just graduated from a university in south-east Nigeria. Her experience has made her more careful on social media. Lucy will not countenance any online investment offers going forward, no matter how legitimate. That would be a shame as genuine investment opportunities can be found on the web. But if that’s the price to pay for being once bitten, they have no problem being twice shy.

*Names changed to protect identity.