There’s a popular saying that “innovation moves faster than regulation.” But sometimes regulation moves fast, just not in the direction that innovators want.

This is what is playing out in the Nigerian fintech environment as a flurry of regulatory actions is about to unfold.

In addition to plans to roll out the new licence regime for payments companies, the Central Bank of Nigeria (CBN) is changing the licencing guidelines for microfinance banks (MFBs).

In an exposure draft [PDF] published on March 3, the regulator stipulated new minimum capital requirements for MFBs and has split the categories of licences into four. The new guideline will go into effect by April 1 and will have huge implications for fintech startups in the country.

Why is this an issue?

A microfinance bank licence is different from a regular commercial bank licence and fintechs are snapping up these MFB licenses

Microfinance banks are conceived as poverty reduction and financial inclusion mechanisms. They’re supposed to provide credit services to businesses in the informal sector. Basically, with an MFB licence, holders can offer banking services like accepting deposits, providing loans and making fund transfers.

But these licenses do not support international fund transfers and depending on the category, other restrictions also apply.

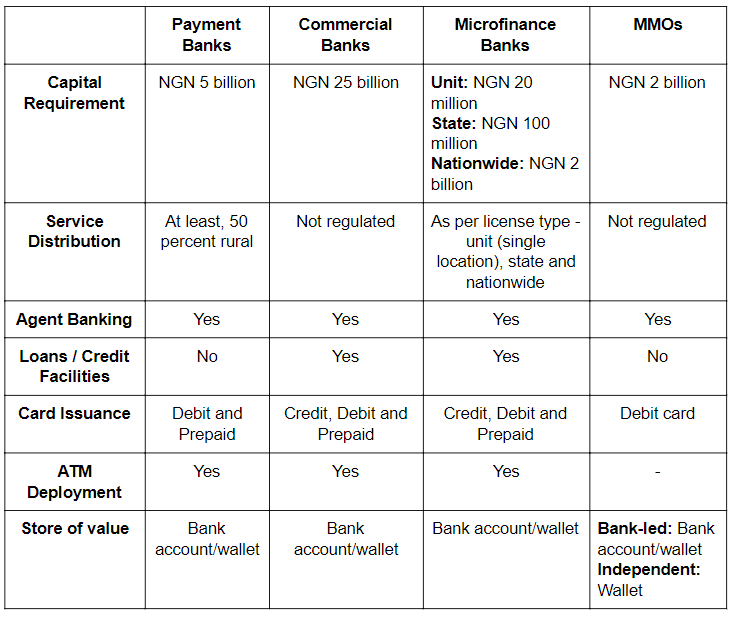

At the moment, MFBs are split into three categories by capital requirements and geographical scope.

The National MFBs can operate anywhere in the country with a licence fee ₦1 million ($2,715), but require a minimum capital of ₦2 billion ($5.43 million).

The State MFB license allows holders to operate with one state and even though there’s a ₦100 million ($271,455) capital requirement attached, the actual licence fee is ₦250,000 ($679).

The Unit MFB is third and the most limited. Holders can only operate out of one office, but it does come with a ₦20 million ($54,291) capital requirement.

For many fintechs, an MFB licence is important

Regulators have been slow to develop robust licence regimes suitable for fintechs. Unlike countries like Hong Kong and Singapore, Nigeria has no digital bank licences and there are seemingly no plans to develop one.

At a recent fintech roundtable organised by the law firm Banwo & Ighodalo, some industry players believe the definition of “fintechs” is still too ambiguous; it makes it challenging for regulators to develop regulation for the industry, they believe.

Some fintechs have found ways to work around this issue. Although they are pressing for new regulatory frameworks, these companies have chosen to operate within existing regulation.

For instance, lending services like FairMoney may require a finance licence to get in the business. A finance licence also supports asset management services like CowryWise.

Existing payments licences support startups that provide payment and wallet services, like OPay and Wallet.ng.

Some startups are more ambitious, however.

They want to roll out full digital banking services, including domestic and international payments. This is the vision of Carbon, Kuda Bank, Rubies and the recently launched V Bank by the VFD Group. But no single licence exists for this sort of thing.

Image source: Sustainable and Inclusive DFS

So these companies are thinking outside the box, somewhat.

They figured that a microfinance bank licence is an easy fix and quick way to get their products on the market. Last year, Kuda Bank secured a microfinance bank licence. V Bank operates under an MFB licence owned by VFD Microfinance Bank.

But the ₦2 billion ($5.43 million) requirement for a national licence is too high for many startups. One industry insider told me that fintechs are snapping up the Unit and the State MFB licences instead.

These two licences predate the fintech revolution of the last couple of years. In strict terms, the geographical restrictions on both licences mean neither is suitable for national scale fintechs want.

Yet these are what startups are going for.

VFD Microfinance Bank operates with a Unit licence. Rubies Bank is powered by High Street MFB, which holds a Unit licence. PiggyTech, which operates PiggyVest, acquired Gold Microfinance Bank a few years ago. Gold MFB operates with a Unit licence.

Renmoney, one of the earliest fintechs of the last decade, started with a Unit MFB licence before upgrading to a State licence. The online lending company currently operates five offices in Lagos.

Fintechs are exploiting the location limitations in these licences thanks to their branchless digital nature. While they have met the physical office requirements, their distribution over the internet makes it challenging for existing rules to restrict them.

This is not to say regulators aren’t aware. “There is nothing that happens in the market that the regulators are not aware of,” a source at the CBN told me. But regulators react differently than many would expect, he said.

MFB guideline revision

With the fintech revolution in Nigeria, the CBN has beamed its attention on microfinance banks. In 2018, it announced that it was going to increase the minimum capital requirements for MFB licences.

In the original 2018 document [PDF], the regulator wanted to increase the Unit MFB requirement from ₦20 million ($54,291) to ₦200 million ($542,910). State MFB was pegged at ₦1 billion ($2.7 million), up from ₦100 million ($271,455). And lastly, the National MFB required a ₦5 billion ($13.6 million) minimum capital.

The new guidelines are slated to become active by April 2020.

On March 3, the CBN released the latest MFB exposure draft. “The need to reposition and strengthen MFB towards improved performance has become apparent as revealed from the report of a recent review of the subsector,” the regulator wrote without mentioning the name of the report.

In the new draft, the CBN changed the requirements for Unit MFB. It divided it into two tiers that had strict location limitations and carefully worded-descriptions.

Tier 1 Unit MFBs “shall operate in the banked and high-density [urban] areas”, the CBN wrote. It can only operate a maximum of five offices within six local governments. The Tier 1 Unit MFB has a ₦200 million ($542,910) capital requirement.

The Tier 2 Unit MFB is on the low-end. It carries a ₦50 million ($135,727) capital requirement. “[it] shall operate only in the rural, unbanked or underbanked areas”. Holders can only operate a maximum of two offices which must be in the same local government.

Once the new guidelines kick in by April, startups operating under the Unit MFB will have to tweak their operations.

Importantly, the new regulation puts significant funding constraint on startups. While fintechs have received the largest share of funding to Nigeria, not many of them have enough to cover capital requirements beyond ₦200 million ($542,910).

In September 2019, Kuda Bank raised $1.6 million (₦586.4 million). PiggyTech’s last fundraise was $1.1 million (₦403.2 million) in 2018. These are not “large fundraises”. The operational cost of running a startup is already high, increased regulatory funding requirements will put a strain on their finances.

Startups could also use a loan, rather than capital, to meet the revised regulatory measures. But they can’t borrow from a Nigerian lender. “Where the source of funding the equity contribution is a loan,” the CBN wrote in the exposure draft, “such shall be a long-term facility of at least 7-year tenor and shall not be taken from the Nigerian banking system.”

Will the revised requirements force fintechs to consider mergers to stay competitive? We’ll see.

The regulator is giving companies 12 months to reach the new capital thresholds once the guideline becomes active. Tier 2 holders need to raise their minimums to ₦35 million ($95,009) by April 2020, and ₦50 million ($135,727) by 2021. While Tier 1 holders must raise theirs to ₦100 million ($271,455) by April 2020 and ₦200 million ($542,910) by 2021.

The “rural” location requirement of the Tier 1 licence is unclear. Many fintechs operate in Lagos from locations like Yaba, Ikeja, Lagos Island and Ikoyi. These are not “rural” areas. To remain compliant, these fintechs may either have to secure the Tier 1 Unit licence or relocate their offices to get the less costly Tier 2 licence.

There is no indication, however, that the revised MFB guidelines would tackle MFB holders that are exploiting the grey area caused by tech-adoption.

We requested for comments from PiggyVest, Kuda, VFD and Rubies about the new policy but as at press time they are yet to respond.

One bank, however, VFD Microfinance Bank called it a “good move.”

“If you want to do this business, if you want to hold peoples’ deposit, you must have the capacity,” Azubike Emodi, Managing Director at VFD was quoted saying. “I can’t take people’s deposits perhaps ₦500 million, ₦1 billion and ₦2 billion in deposit with a recapitalisation of N20million; it doesn’t augur well,” he added.

But VFD is based in Lagos Island, a relatively urban area and operates with a Unit licence. Talking tough, Emodi told Guardian Newspapers his bank has already recapitalised without saying what tier it secured.

Regardless, its digital bank, V Bank, technically shouldn’t operate nationally under the Unit licence. That is a grey area, but Emodi said nothing about it.

This regulatory hole and capital requirements are issues fintechs and their investors would like to see fixed.

Join our Fintech 3.0 townhall on investment and digital banking. The event holds in July 2020. Fill in this form so we can let you know when ticket sales go live.