In June 2020, Paystack launched Paystack commerce and became the latest company in the fintech space to roll out a social commerce product in the last six months. Flutterwave joined the party in May.

Both companies caught the headlines. But a smaller player in the e-commerce space, Seller has not registered a blip on the radar. Seller is an e-commerce product created by a little known marketing technology company, Mercurie.

Their proposition sounds the same as what the other players offer: a virtual store for small and medium businesses (SMBs) that has payment integration and shipping tacked on.

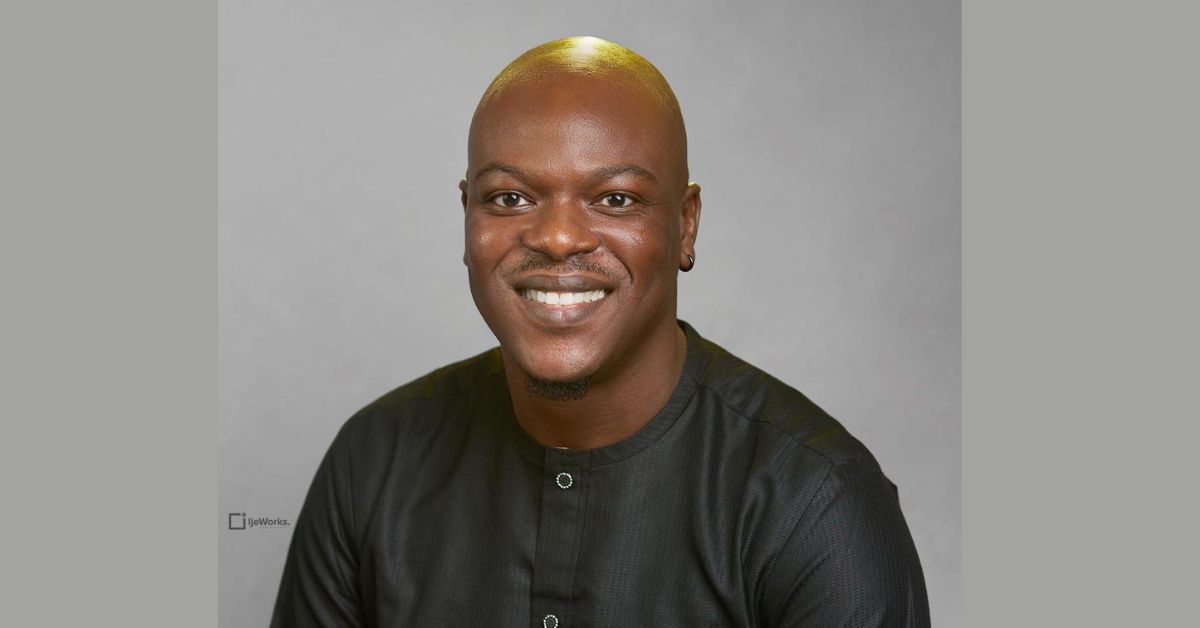

But Seller’s engineering team, led by Damola Bamgboye say they are different from all the other offerings in the market. Regardless of their differences, these companies are sparking an interest in powering social commerce.

Online commerce is not new in Nigeria. For years, Konga and Jumia have put their money where their mouth is in trying to show that there’s a viable market online. But for many SMBs, getting listed on Jumia and Konga has not always been the way to go. Despite Jumia’s utility, for small retailers, getting listed would need a registration and vetting process.

It is a complex process that Jumia or Konga must insist on. This is because trusted third party merchants are important to ecommerce companies. Instead of going the Jumia route, the same small retailer can set up a Twitter and Instagram account in minutes, list their products and reach a mass of people.

If getting online is the first step, then organising payments is the second necessary step.

But payments is a problem which has been solved. We have come a long way from when Interswitch owned the market for payment gateways online. Today, adding payment integration to your website is easy and cheap. It’s in part thanks to the newer entrants like Paystack and Flutterwave.

There’s also the fact that instant transfers are popular in Nigeria, so it is worth asking, what will these platforms do for SMBs and why can’t they get it on classifieds?

The problem with classifieds in Nigeria is that, although they are useful, they have a harder time sifting through shady listings or merchants. By the time classifieds in Nigeria had come up with the idea of verifying merchants, many of them already had the uphill task of distrust to deal with.

When verification happens, disclaimers from classifieds such as telling users not to make transfer money to merchants they have never met hardly eases the trust problem.

But social commerce scales this problem. First they provide a virtual storefront for SMBs that allows them to collect payments and handle shipping all in one place.

It helps that many of the businesses they provide virtual storefronts for already have social proof and are trusted on one or two social platforms. In this interview, Omowumi Kolawole told SLA that most of her sales come from Twitter, where she is a trusted authority.

Apart from trust and convenience, many of the social commerce platforms fintechs are building are free for SMBs, collecting only a commission on sales.

It shows that for many of these players, payments is the real play. How will Seller hope to compete with the more established players that already have these payment platforms?

Building on existing platforms vs building from scratch

Damola Bamgboye, Seller’s team lead thinks their chances of success are good. He tells TechCabal: “one of the obvious parts of fintechs coming into the e-commerce space is that they are putting an add-on to what they already have. They are leveraging their payments game.”

Seller, for its own part, has no fintech platform to leverage on. Instead, it is “built from ground up and runs on our own proprietary code, not some template like most others.”

Despite their pride in pointing this out, it’s doubtful that building a platform from the ground up will matter to customers at the end of the day.

What will likely make a difference is which of the players will commit to playing the long game.

One of the sub-sector’s pioneers is GTB. In 2015, it launched an SME market hub. In 2018, the bank also launched an e-commerce platform, GTHabari which has a two-year head start on all the other players. Despite their early starts, both platforms are far from being household names.

This inability to make something out of a head start may validate Damola’s argument that there are a lot of moving parts to ecommerce and if ecommerce is not at the core of a company’s business, progress may be slow.

But it also says something about what the expectations of these fintechs are. While social commerce is a low-risk move for them, they will be counting on increasing their core offering, payments, by leaning on Twitter and Instagram.

They will also be counting on creating network effects as the race to sign up some of the most influential SMBs on social media is on. While it is too early to judge adoption, it is hard to argue against using these virtual stores if most of the online businesses you patronise are signed up.

These online retailers are experiencing a boom, with Google’s latest COVID-19 community mobility report showing that the percentage of people going out for retail and recreation is down by 18%.

In a sense, the timing for a social commerce play could not be better as people look for smoother online shopping experiences. Cindy, a Kenyan national who lives in Lagos is disappointed at the existing online shopping experience.

She points out that most of the online shopping she tries to do is routed through Whatsapp instead of payment platforms.

Sentiments like Cindy’s are great for established fintech players who are making a low-risk social commerce play that will hinge on achieving a network effect to grow. Seller, on the other hand, will be banking on their long-term view.

“For us, this is our core and we have a long-term view and what we’ve built is more of a technology solution than a payment solution,” Damola tells me. But it is not yet uhuru for the company that is using some of its competitors’ products to power payments.

What is Seller trying to do differently?

While the Mercurie team speaks about its competitors, they still use the payment integration of two of these competitors, Flutterwave and Paystack.

But they say it is part of their strategy to give merchants the power to choose. “Most of these platforms will only have their payment gateway as options. Seller will use Paystack and Flutterwave and allow the merchants to choose,” Damola tells me.

The choice will extend to delivery partners as well, as merchants will be able to choose between options. But right now, there’s only one option: Sendbox.

Logistics is the final unsolved piece of the commerce puzzle in Nigeria and solving the logistics problem will be a game-changer. Seller’s attempt to solve the logistics puzzle is by creating options to choose from, despite having only one logistics company signed on for now.

In spite of this paradox of choice even with only one logistics service signed on, Seller will take hope from the fact that online shopping is seeing more first timers. In June, a survey by VISA showed that 71% of the consumers they spoke to (amongst the banked population) in Nigeria, shopped online for the first time as a result of the pandemic.

Yet, the real story is that it is less about customer willingness to try online shopping for the first time than about their experience with logistics. According to Technext: “38% of shoppers will never shop with a retailer again if they had a poor delivery experience.”

Without a robust logistics backbone, these social commerce platforms are unlikely to be game changers. Yet the reality is that Nigeria is some way off from solving the logistics problem because without a functional government backed postal service, many players are building from scratch.

It’s a view echoed by Stears, who say that “although adequate logistics improve delivery time and increases the likelihood of retaining customers, the cost of building stronger logistics networks —akin to the 1-day delivery services offered by the likes of Amazon Prime, can be prohibitive for new players.”

Is Seller’s decision to market choice enough to persuade merchants to use the platform? Or will it prove to be a pesky detail for retailers who want things served to them on a plate?

That is still up in the air. What will matter almost as much as logistics is visibility. Will these platforms be visible enough to become reliable avenues for sales?

Right now, there are no easy answers, save to say that it’s a multi-step process. The first step is creating the platforms, but the crucial next step will be for the platforms to be worth a seller’s while. SMBs will gravitate towards channels that deliver the most value.

As SMBs look out for themselves, platforms will also be looking at covering their costs. The bigger players may have the pockets to cover the cost of operations until business becomes viable, but Seller can hardly do this.

It is why the company says it is not pursuing the “commission on sales” model the other players use. It will instead have two subscription tiers; a free, basic subscription, as well as a paid subscription that will cost ₦5,500 ($14.20) monthly.

Mercurie’s hope is that people will do the math and see that with a flat fee, they may save more money than if they paid commission on a large volume of sales.

For now, the company says it has a hundred users. It is easy to make the jump that a good number of these users are its digital marketing clients which it has onboarded. Yet, onboarding existing clients will not be their marker of success. Footing the cost of their operations will come down to finding subscribers who are willing to pay.

In the end, despite their optimism on subscriptions, it will fall to merchants to decide if Seller’s approach and “built from scratch” engineering brag will prove important enough to pay for.